5. How do I tell HMRC that I'm turning on the Apprenticeship Levy?

3:16

"How do I tell HMRC that I'm turning on the Apprenticeship Levy?"

The Apprenticeship Levy setting is something you need to turn on once your "annual wage bill" reaches £3 million per year for all your pay batches, or connected companies.

To tell HMRC that you've turned on a pay batch's Apprenticeship Levy:

- First, select the pay batch on: MenuPay batches

- Then tap: FormsEPS monthly

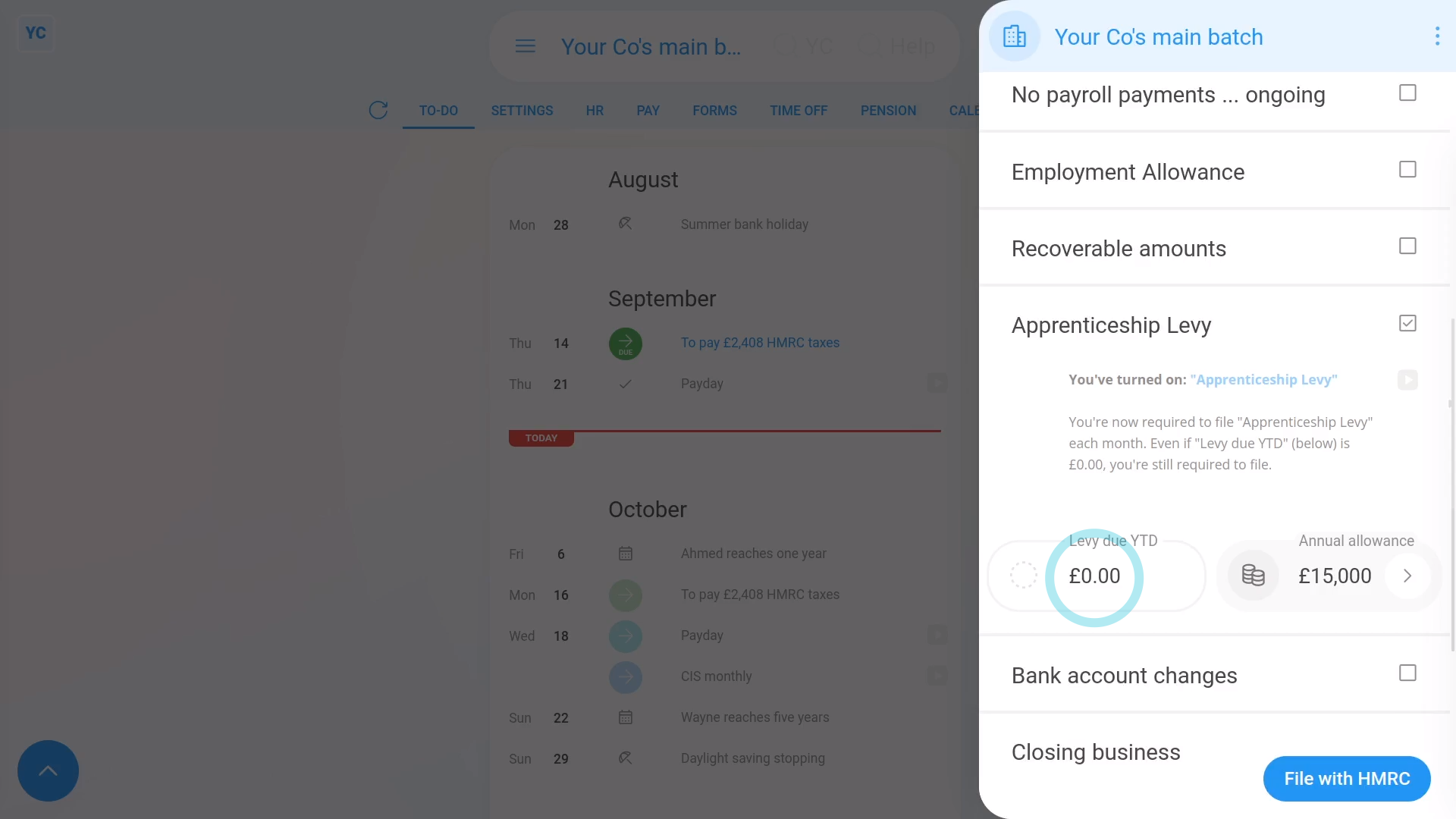

- Once the EPS monthly is open, tick Apprenticeship Levy.

- If it says that it's "currently turned off", tap the blue Apprenticeship Levy settings link.

- And set Apprenticeship Levy to: "Yes ... paying Apprenticeship Levy"

- You only need to turn it on if your "annual wage bill" is more than £3 million per year for all your pay batches, or connected companies.

- From now on 1st Money automatically calculates your: "Levy due YTD"

- Also, if you want to change the default £15,000 "Annual allowance" tap the "Edit" button:

- Then drag the slider, and tap: Save

- And finally, if you're all ready to send it to HMRC, tap: File with HMRC (at the bottom)

For advanced usage:

- Apprenticeship Levies are a tax that employers pay direct to HMRC once their "annual wage bill" reaches £3 million per year.

- The amount of levy you pay is half a percent of the part of your company's "annual wage bill" that's over £3 million per year.

- Which means that the half a percent of the part that's under £3 million per year, is the allowance.

- In other words, you get a maximum allowance of £15,000, which you can decide to split between your pay batches, or connected companies.

- HMRC's definition of a connected company includes any entity that's using the same: Employer PAYE reference

- In most cases, if it's your only pay batch, apply the full £15,000 Apprenticeship Levy allowance to the current pay batch.

- Then each month when your Apprenticeship Levy amount is calculated, the following happens.

- First, half a percent of the value of the month's "wage bill" is calculated.

- Then one month's worth (1/12th) of your "Apprenticeship Levy allowance" to is taken off.

- The remaining amount becomes that month's Apprenticeship Levy, to be paid to HMRC.

Keep in mind that:

- Once you turn on Apprenticeship Levy, you'll have to file Apprenticeship Levy every month, even if the "Levy due YTD" is £0.00.

- Also, if you're using the entire Apprenticeship Levy allowance of £15,000 in one of your other pay batches, or connected companies, drag the slider to set it to £0.

- If you overpay, or underpay, when you reach the end of the tax year, HMRC balances out your final calculation with a refund or payment request.

And that's it! That's everything you need to know about telling HMRC that you've turned on a pay batch's Apprenticeship Levy!

Was this page helpful?

4. How do I tell HMRC I've got recoverable amounts6. How do I tell HMRC about changes to my company's bank account