How do I change an EPS after it's already been sent to HMRC?

2:35

"How do I change an EPS after it's already been sent to HMRC?"

Sometimes you may want to send changes or updates to an EPS that's already been sent to HMRC.

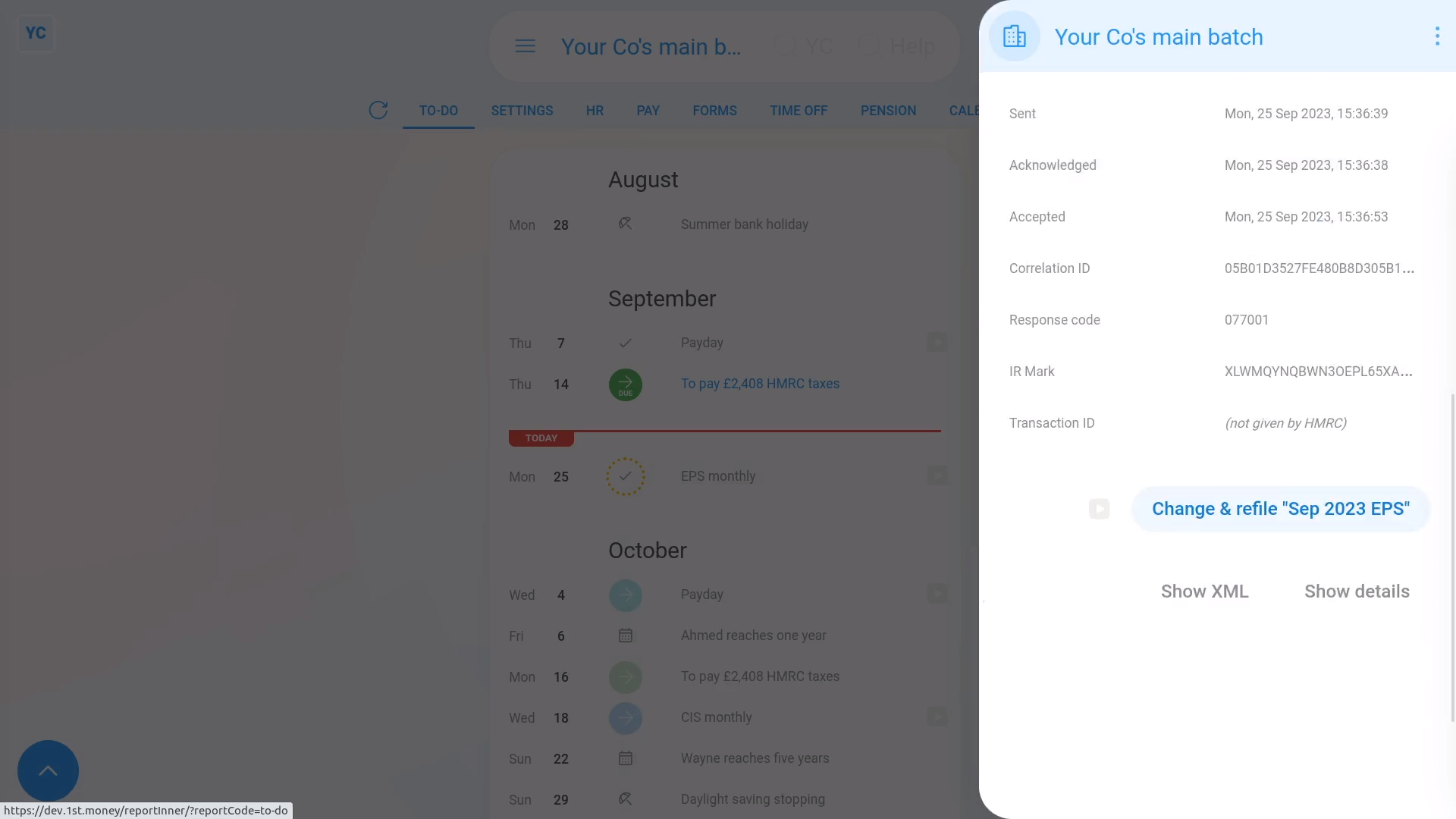

To change or update an EPS that's already been sent to HMRC:

- First, select the pay batch on: MenuPay batches

- Once it's open, check you're on the To-do tab.

- Then tap the tick by the submitted EPS that you'd like to change.

- Once it slides out on the right, scroll down and tap: Change & refile EPS

- It takes you to the EPS monthly page where you can set your additional changes.

- Then once you're all ready to send it to HMRC, tap: File with HMRC (at the bottom)

- As usual, it takes 15 to 20 seconds for HMRC to finish processing your EPS and send back a confirmation receipt.

- Once it's finished, you'll see your confirmation receipt.

- Then back on your To-do list, you'll also see an additional "EPS monthly" row with a tick.

- And finally, the additional row confirms that the EPS was again sent successfully.

Keep in mind that:

- You don't have to re-enter every section.

- Suppose you originally sent both banking and other changes. Then say, you later wanted to further update only the banking. In which case, resend the banking section only. The other changes are still kept by HMRC, and not overwritten.

- Also, you can't change an EPS after the 19th of the month. In other words, an EPS for the tax month ending on the 5th, has a 14-day change window.

- You're free to resend as many EPS changes as you want during the 14 day change window. Once it's the 19th of the month, however, the EPS is locked by HMRC.

- Also keep in mind, some changes, like changing bank account details, can instead be sent in next month's EPS.

For advanced usage:

- The exception to the 14-day change window is the "March EPS", which is the last EPS of the tax year.

- The "March EPS" doesn't get locked for 12 months, so you can make more changes during those months.

And that's it! That's everything you need to know about changing an EPS that's already been sent to HMRC!

Was this page helpful?