P45. How does a person's P45 get sent when the person leaves?

3:44

"P45. How does a person's P45 get sent when the person leaves?"

The P45 is the form a leaving person uses to hand their tax info to their next employer. A person's P45 is automatically emailed out to each leaving person when their final payslip's filed.

To pay a person's final payslip and send them their P45:

- First, select the person who's leaving on: "Menu", then "People"

- Now, go to: "HR"

- And tap "Dismiss" or "Resign", whichever best matches why the person's leaving.

- Then select the "dismiss" or "resign" reason which best matches why the person's leaving.

- Carefully go through all the steps until you reach the end, where their end employment doc is sent.

- Next, go to the Person tab (at the top), and to reload the page, tap the "Reload tab" button: (at the top)

- Then tap: Final payslip

- Once it slides out on the right, to pay the person's final pay, scroll down and tap: Go to "Pay now" report

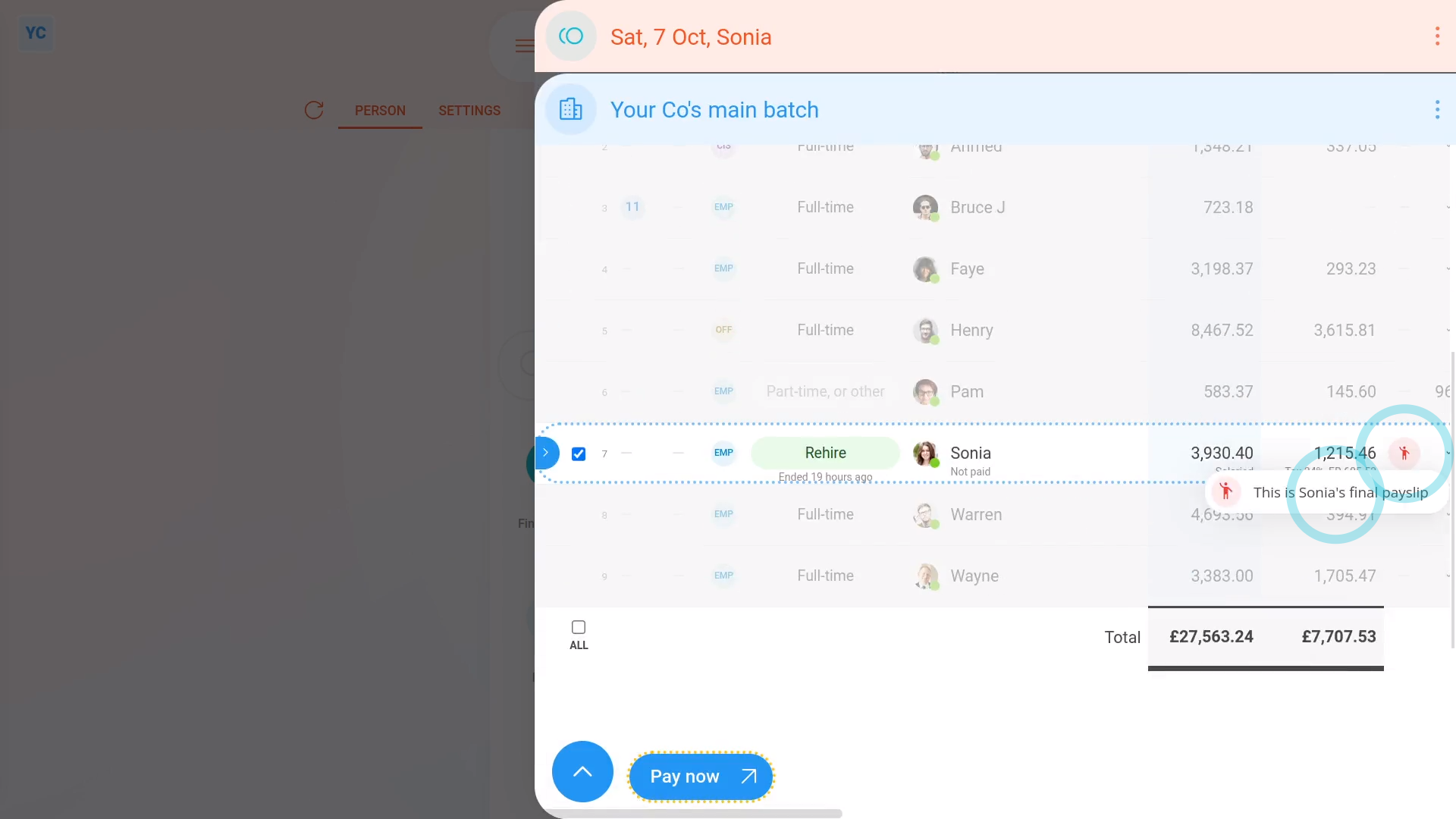

- On the same row as the leaving person's name, you'll see a red circle showing that it's their final payslip.

- Then once everything's checked, tap File now, and then: Yes ... file it

- It usually takes 15 to 20 seconds for HMRC to finish processing the payslips and send back confirmation that it's been received.

- Also, because it's their final payslip, the person's P45 is also being emailed.

- The emailing happens automatically, in the background. The P45s are emailed to each persons' personal email as a PDF attachment.

- Once it's been filed successfully, and the P45s are emailed, you'll see a green tick beside the payslips that you've filed.

- On most paydays, each person normally only gets one email which contains their payslip PDF.

- On a final payday, however, each person also gets their P45, as a PDF, which is sent in a second email.

- Scroll to the bottom of the email to see the P45 attached as a PDF, and tap it to open it.

- The P45 includes the person's: "Total pay in the employment"

- And includes the person's: "Total tax in the employment"

- And finally, it records the person's: "Tax code at leaving date"

Keep in mind that:

- If a person hasn't entered a personal email, their P45 is sent to their work email instead.

- Also, when a person starts their next job, the person needs their P45 to tell their new employer their tax code and other employment details.

- Once a person's P45 is sent, it can't be changed or updated. HMRC requires that there's only one P45 per employment.

To learn more:

- About how to prove a person's P45 was sent, or how to re-download a copy of it, watch the video on: Finding a sent P45

And that's it! That's everything you need to know about how a person's P45's are automatically sent!

1. How do I see a historical list of all my old tax formsP45. How do I find a person's P45, or prove one's been sent