P60. How does a person's P60 get sent each year?

2:44

"P60. How does a person's P60 get sent each year?"

The P60 shows how much tax a person's paid during the tax year. It's automatically emailed when their last payslip is filed for the end of the tax year.

To pay a person's last payslip in a tax year and send their P60:

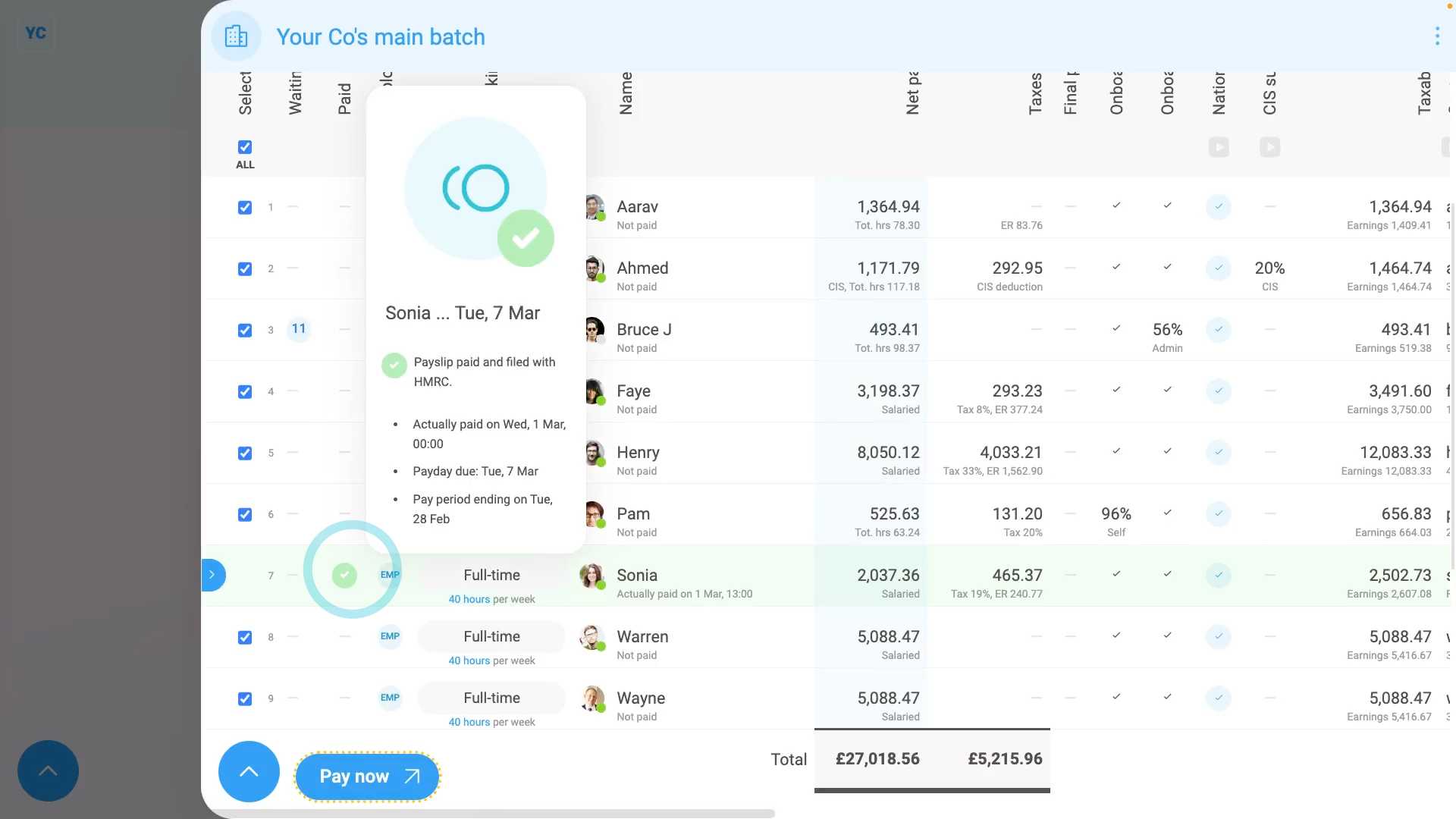

- First, during the month of March, select the person's pay batch on: "Menu", then "Pay batches"

- Now, on the "To-do" tab, look for: "Payday ... P60s are sent"

- That payday is the last payslip to be filed before the end of the tax year, ending on April the 5th.

- Next, tap the payday, so it slides out on the right.

- Normally you'd pay everyone. But for now, you can untick everyone, and then tick the people you're ready to pay.

- Then tap File now, and then: Yes ... file it

- It usually takes 15 to 20 seconds for HMRC to finish processing the payslips and send back confirmation that it's been received.

- Also, because it's the last payslip before the end of the tax year, each person's P60 is also being emailed.

- The emailing happens automatically, in the background. The P60s are emailed to each person's personal email as a PDF attachment.

- Once it's been filed successfully, and the P60s are emailed, you'll see a green tick beside the people that you've paid.

- On most paydays, each person normally only gets one email which contains their payslip PDF.

- On the P60 payday, however, each person also gets their P60, as a PDF, which is sent in a second email.

- Scroll to the bottom of the email to see the P60 attached as a PDF, and tap it to open it.

- The P60 includes the person's total pay for the year.

- And finally, it also includes the person's total tax deducted for the year.

Keep in mind that:

- If a person hasn't entered a personal email, their P60 is sent to their work email instead.

- Also, check that your P60 is stored somewhere safe.

- You could later need your P60 to do your tax return, claim tax credits, or claim Universal Credit.

To learn more:

- About how to prove a person's P60 was sent, or how to re-download a copy of it, watch the video on: Finding a sent P60

And that's it! That's everything you need to know about how P60s are automatically sent!

P45. How do I find a person's P45, or prove one's been sentP60. How do I find a previously sent P60, or prove it's been sent