4. How do I tell HMRC I've got recoverable amounts?

1:49

"How do I tell HMRC I've got recoverable amounts?"

Letting HMRC know about your "Recoverable amounts" from Statutory Pay helps you pay less National Insurance. In particular, it applies when your people claim statutory pay, like maternity pay, etc.

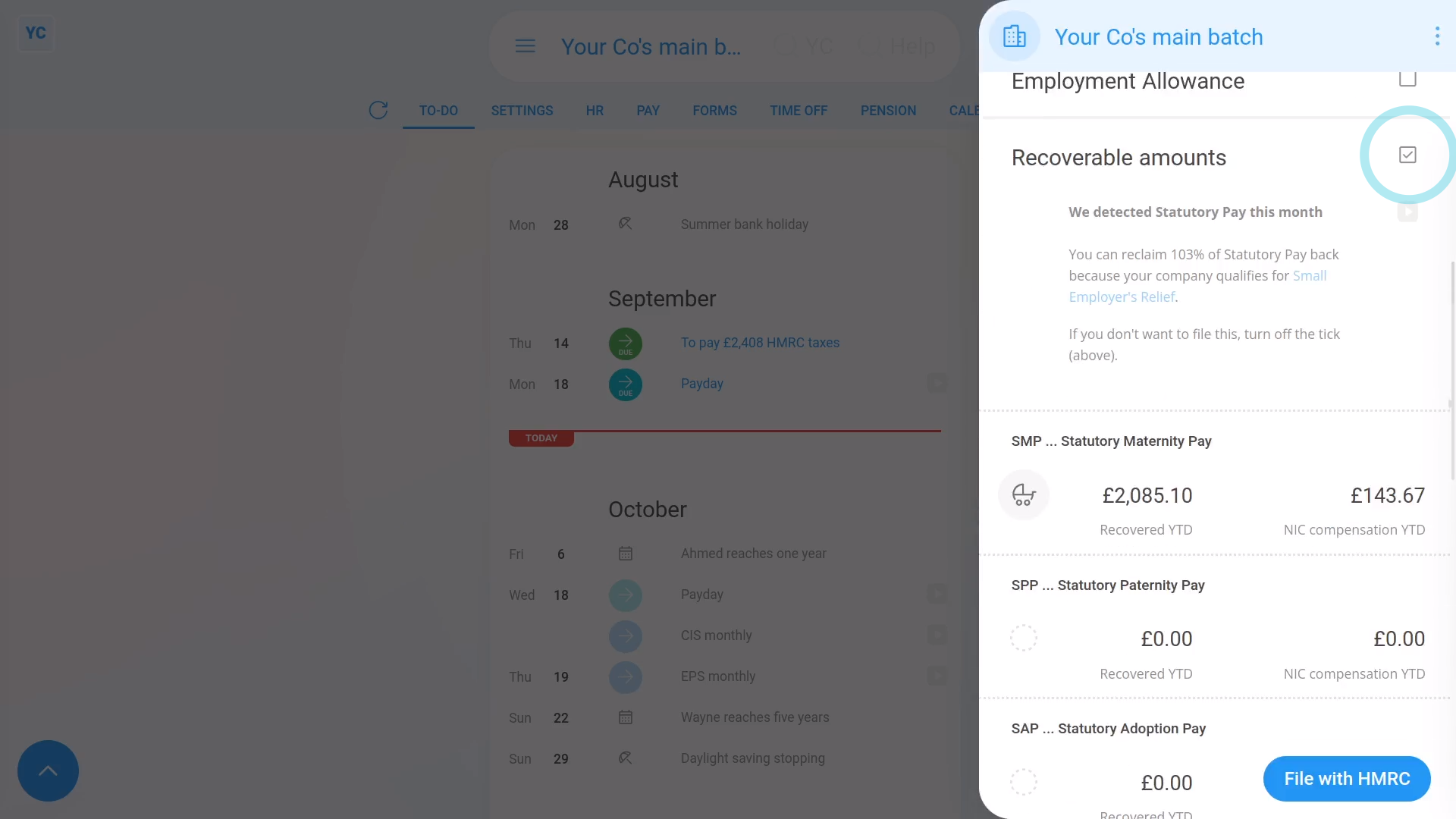

To tell HMRC about your Recoverable amounts for a tax month:

- First, select the pay batch on: "Menu", then "Pay batches"

- Then tap: "Forms", then "EPS monthly"

- Once the EPS monthly is open, if there's "Recoverable amounts" to claim, the heading is already ticked and expanded.

- You'll then see the calculation of the tax month's recoverable amounts, based on how much Statutory Pay you've paid your people.

- Check the amounts that've been automatically detected.

- And finally, if you're all ready to send it to HMRC, tap: File with HMRC (at the bottom)

Keep in mind that:

- Whenever your people get Statutory Pay, you can usually reclaim at least 92% back from HMRC.

- You can sometimes even reclaim 103% back if your business qualifies for: "Small Employers' Relief"

- If you know you've received CIS payments, you can also manually reclaim your CIS deductions.

- 1st Money can't do it for you automatically. You'll have to enter the "CIS deductions YTD" yourself, every month.

And that's it! That's everything you need to know about telling HMRC about your recoverable amounts!

3. How do I tell HMRC when I've got Employment Allowance changes5. How do I tell HMRC that I'm turning on the Apprenticeship Levy