A. Assets transferred

2 videos, with a playing time of 4 minutes

1. If an asset's sold or gifted to an employee, how's it recorded?

2:18

"If an asset's sold or gifted to an employee, how's it recorded?"

When the company sells or gifts an asset to an employee, it's considered a: "Benefit-in-kind"

To record selling or gifting of assets to employees:

- First, tap: "Menu", then "Expense claim"

- Select the person who's being sold or given the asset.

- Then tap: Benefit-in-kind

- You can attach an image, like a receipt, or tap: Skip image

- Type in how much the asset is worth when you're transferring it to the employee.

- Optionally, you can also enter an amount in "Employee deducted co-pay" if you're selling the asset. Or, in other words, if the employee's paying an amount towards the asset.

- By default, "Arranged by" is already set to: "Company"

- Then tap: Next

- Then type a short description of the asset, and tap: Next

- And because it's a payroll admin who's entering it, the expense is automatically approved.

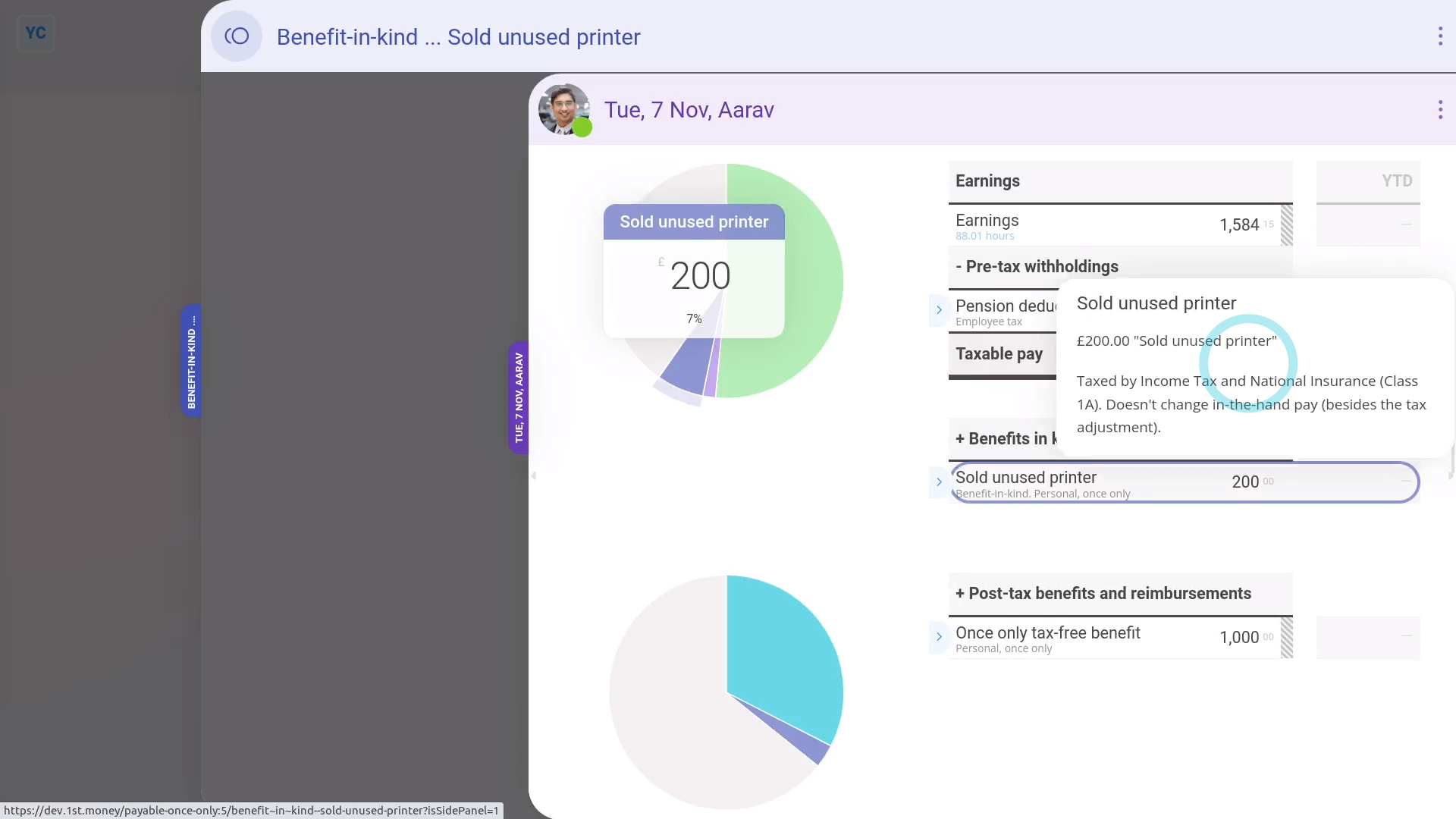

- Now, to see how it shows up on the person's payslip, scroll down and tap: See on payslip

- And when you hover your mouse over the "Benefit-in-kind" amount, you'll see the details.

- There may have been a co-pay, or an amount that the person's agreed can be taken off their pay. If so, you'll also see that amount showing as "Employee deducted co-pay" with its own notes when you hover.

- And finally, you'll know that the asset's value has been taxed by Income Tax (PAYE) correctly.

Keep in mind that:

- The co-pay amount is automatically set to be deducted from the person's pay.

- The company doesn't have to separately collect the co-pay amount from the person.

- Also, a benefit-in-kind increases the employee's taxable pay, but doesn't increase the employee's in-the-hand pay.

- However, the person still gains by receiving the non-cash asset.

And that's it! That's everything you need to know about selling or gifting an asset to an employee!

2. If a company buys an asset from an employee, how's it recorded?

1:49

"If a company buys an asset from an employee, how's it recorded?"

When the company buys an asset from an employee, the buying price of the asset is tax-free.

To record buying an asset from an employee:

- First, tap: "Menu", then "Expense claim"

- Select the person who the company is buying the asset from.

- Then tap: Once only tax-free benefit

- You can attach an image, like a sale agreement, or tap: Skip image

- Type in how much the asset is worth when you're buying it from the employee, and tap: Next

- Then for "Requesting because", type a short description of the asset the company's buying, and tap: Next

- And because it's a payroll admin who's entering it, the expense is automatically approved.

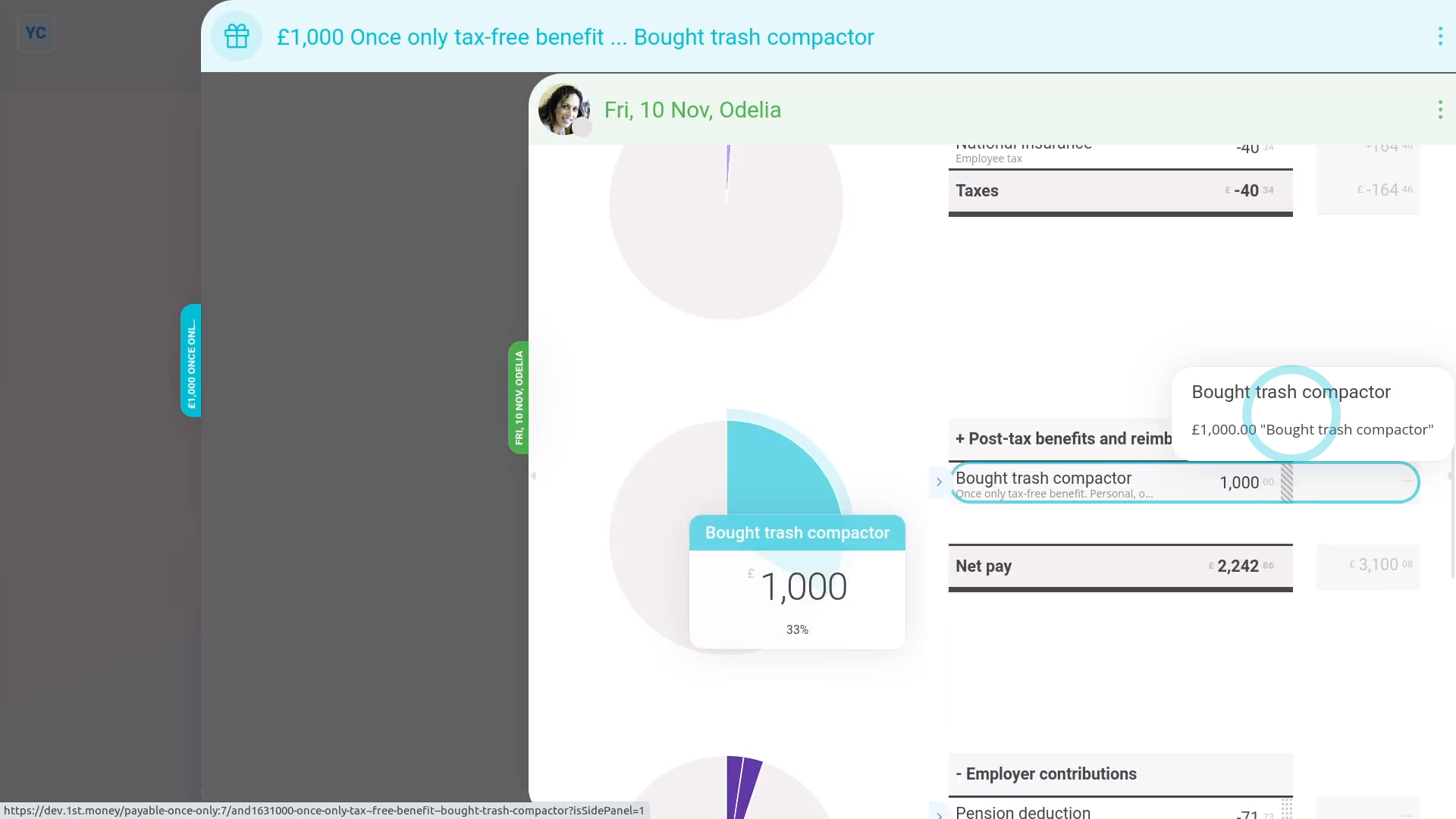

- Now, to see how it shows up on the person's payslip, scroll down and tap: See on payslip

- And when you hover your mouse over the "Once only tax-free benefit" amount, you'll see the details.

- And finally, you'll know that the asset's value is being correctly paid to the employee, free of tax.

Keep in mind that:

- If the company buys an asset from an employee for more than it's market value, the amount over the market value is taxable.

- To record it, still do the steps above, to record the amount up to the market value.

- And then also add a "Once only taxable benefit" expense for the amount over the market value.

And that's it! That's everything you need to know about buying an asset from an employee!