E. Mileage allowance

How do I set up a repeating mileage allowance?

2:12

"How do I set up a repeating mileage allowance?"

When a person's themself paying their work related travelling costs, you could set them up with a repeating mileage allowance.

To set up a repeating mileage allowance:

- First, select the person who's getting the allowance on: "Menu", then "People"

- Next, go to: "Pay", then "Pay settings"

- And scroll down to the "Repeat payables ... personal" heading.

- Then tap: New repeat payable

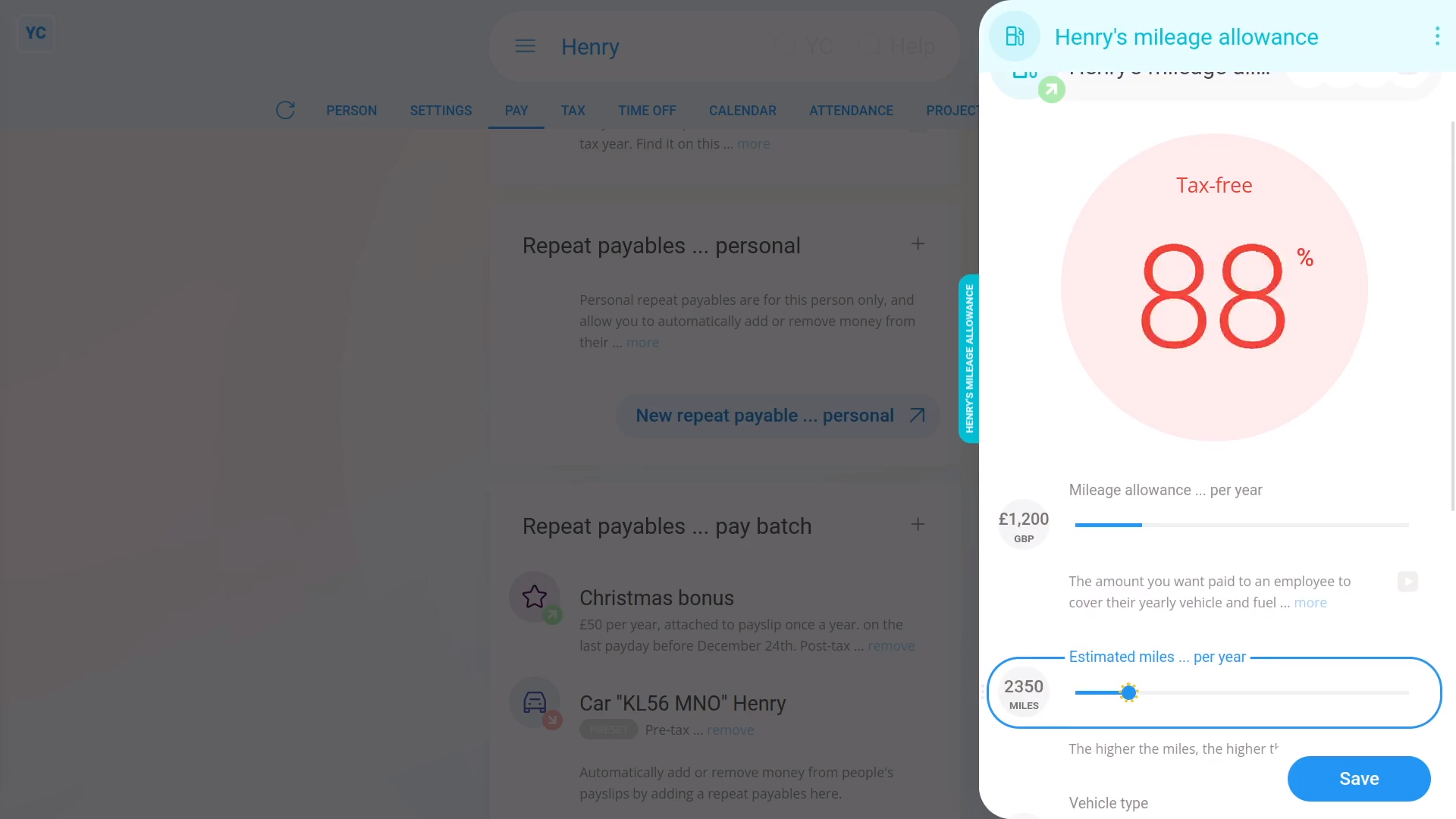

- Next, select: Mileage allowance

- Start setting "Mileage allowance ... per year" by dragging the slider.

- You can also type in a number if you'd like.

- Next, set "Estimated miles ... per year" to an estimate of how many miles the person travels in one year.

- You'll notice as you drag the slider, the big tax-free percent (at the top) changes.

- The higher the miles, the more of the mileage allowance is tax-free.

- If you've got a high enough number of miles, the mileage allowance becomes 100% tax-free.

- Next, tap: Save

- And the tax-free mileage allowance is now added to the person's payslip every payday.

- To see the mileage allowance on the person's payslip.

- Hover your mouse over the mileage allowance, and tap the "See on payslip" button:

- And you'll see the mileage allowance showing under: "Post-tax benefits and reimbursements"

- And finally, if you hover your mouse over the mileage allowance amount, you'll see a breakdown of the calculation.

Keep in mind that:

- If the person's mileage allowance numbers allow it to be 100% tax-free, the entire amount is shown under the "Post-tax benefits and reimbursements" section.

- However, if it's less than 100% tax-free, the mileage allowance is then split between the "Post-tax benefits and reimbursements" and the "Pre-tax benefits" sections.

- Any amount in the "Pre-tax benefits" section means it's taxable, like the person's regular pay.

And that's it! That's all you need to do, to set up a repeating mileage allowance!