N. Expense payments on behalf of employee

If a company pays an employee's personal expenses, how's it recorded?

2:53

"If a company pays an employee's personal expenses, how's it recorded?"

When the company pays for an employee's personal expenses, it needs to be recorded as a: "Benefit-in-kind"

To record a company paying for an employee's personal expenses as a "Benefit-in-kind":

- First, tap: "Menu", then "Expense claim"

- Select the person who the company's paying the personal expenses for.

- Next, tap: Benefit-in-kind

- If you've got an image, like a receipt, that you'd like to include, you can upload, or take a photo of it.

- Then tap: Next

- Type in the value of the personal expenses the company's paying.

- Next, change "Arranged by" to: "Employee"

- Optionally, if there's a co-pay, or a yearly amount that the person's agreed can be taken off their pay, enter that also in: "Employee deducted co-pay"

- Then tap: Next

- Optionally, type in a short description about the personal expense, and tap: Next

- And because it's a payroll admin who's entering it, the expense is automatically approved.

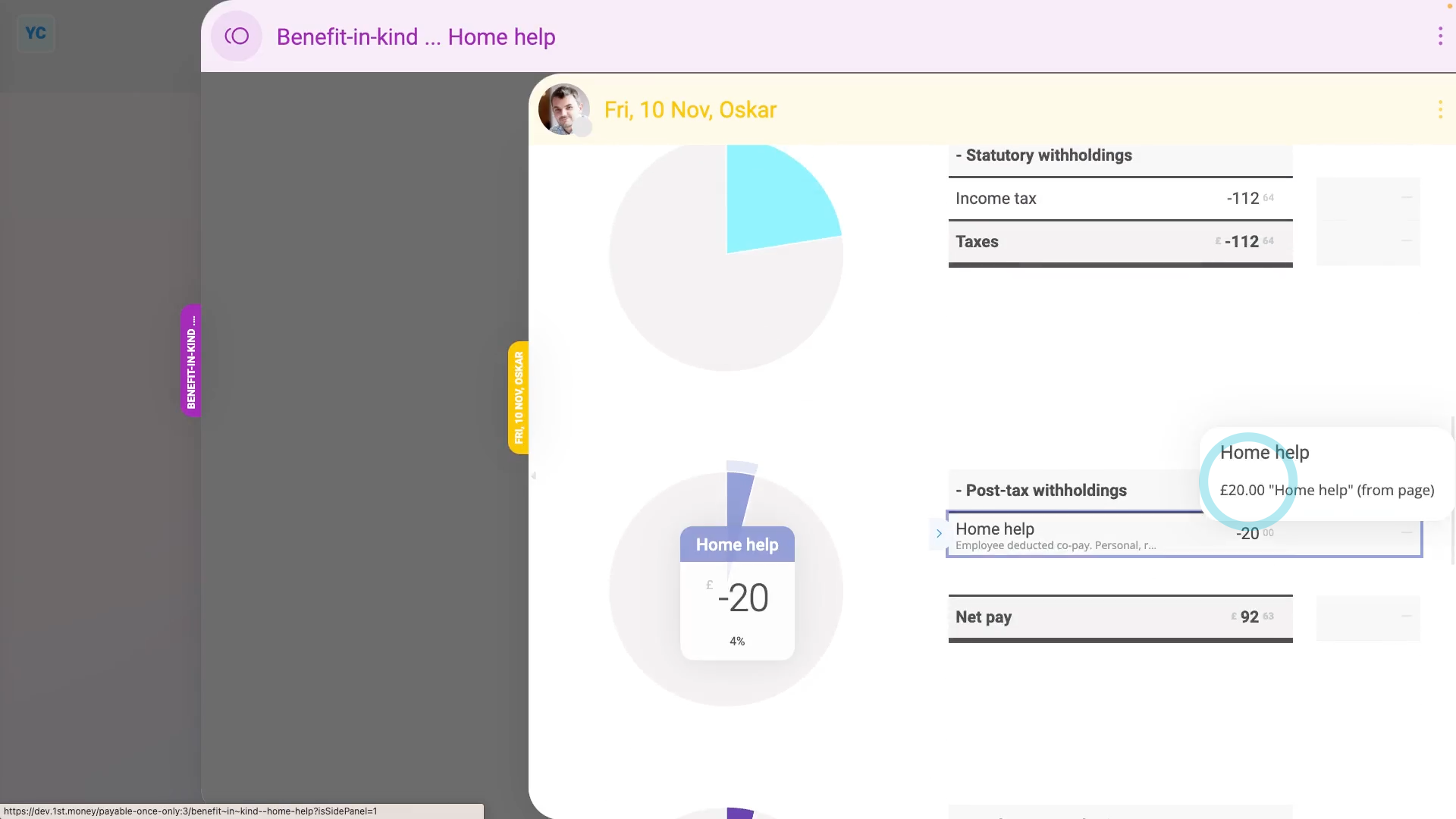

- Now, to see how it shows up on the person's payslip, scroll down and tap: See on payslip

- And when you hover your mouse over the "Benefit-in-kind" amount, you'll see the details.

- There may have been a co-pay, or an amount that the person's agreed can be taken off their pay. If so, you'll also see that amount showing as "Employee deducted co-pay" with its own notes when you hover.

- And finally, you'll know that the personal expense's value is being correctly recorded and taxed.

Keep in mind that:

- The co-pay amount is automatically set to be deducted from the person's pay.

- The company doesn't have to separately collect the co-pay amount from the person.

- Also, in some cases, the employee has themselves paid for the personal expense cost, and is asking the company for a once-only reimbursement.

- To add a "Once only taxable benefit" reimbursement, tap: "Menu", then "Expense claim", select the person, and tap: Once only taxable benefit

- Also, if the personal expense payment is repeating every week, month, or every payday, set it up as a repeating: "Benefit-in-kind"

To learn more:

- About how to set up a repeating "Benefit-in-kind", watch the video on: Repeating benefit-in-kind

- Also, to learn more about personal bills, go to GOV.UK.

And that's it! That's everything you need to know about paying for an employee's personal expenses!