C. Vouchers and credit cards

1. If vouchers are given to an employee, how's it recorded?

2:23

"If vouchers are given to an employee, how's it recorded?"

When the company gives employees a voucher, it needs to be recorded as a: "Benefit-in-kind"

To record a voucher given to an employee by a company:

- First, tap: "Menu", then "Expense claim"

- Select the person who's been given the voucher.

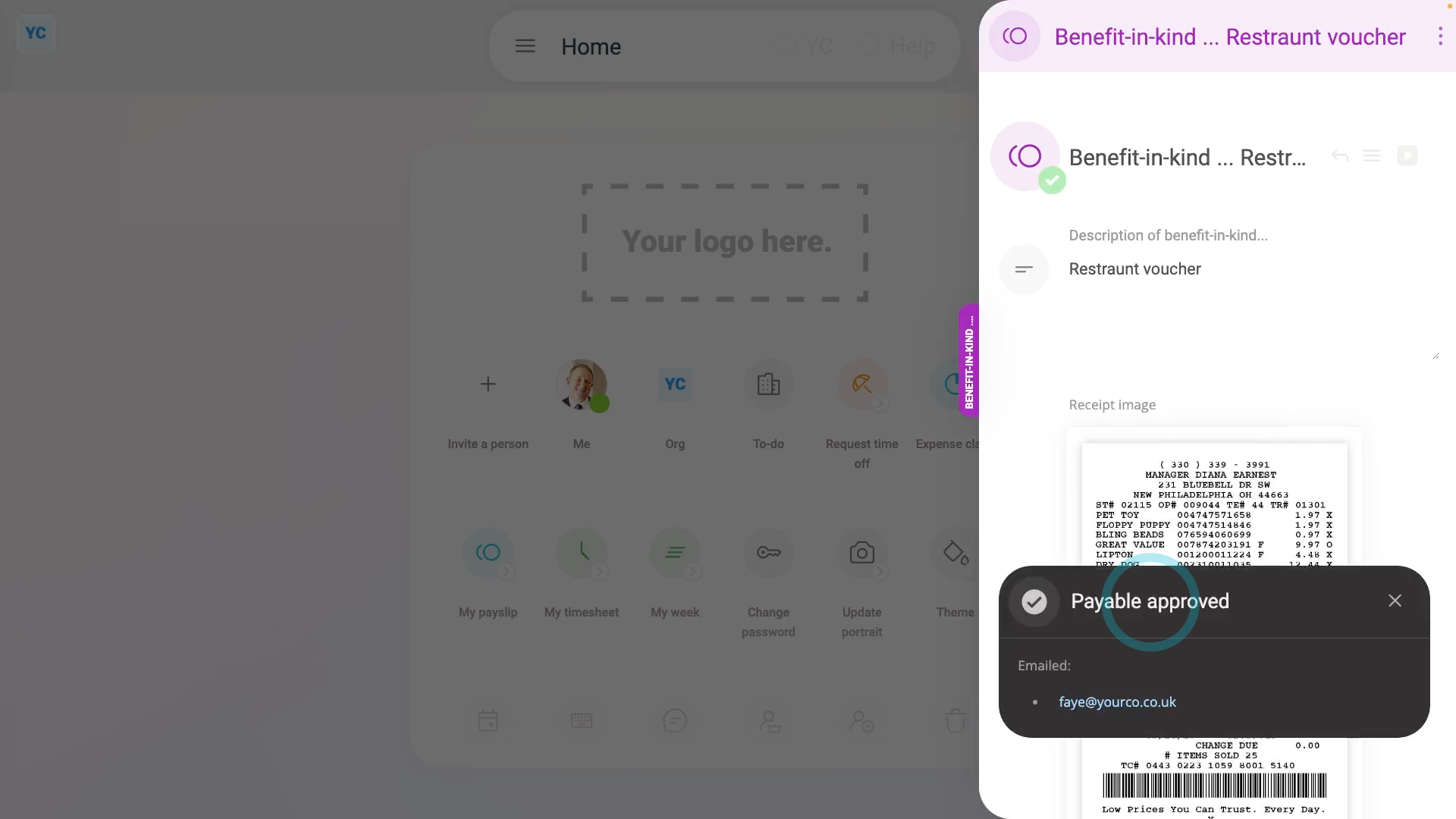

- Next, tap: Benefit-in-kind

- If you've got an image, like a receipt, that you'd like to include, you can upload, or take a photo of it.

- Then tap: Next

- Type in the value of the voucher.

- Set "Arranged by" to: "Employee"

- Optionally, if there's a co-pay, or an amount that the person's agreed can be taken off their pay, enter that also in: "Employee deducted co-pay"

- Then tap: Next

- Optionally, type in a short description about the voucher, and tap: Next

- And because it's a payroll admin who's entering it, the expense is automatically approved.

- Now, to see how it shows up on the person's payslip, scroll down and tap: See on payslip

- And when you hover your mouse over the "Benefit-in-kind" amount, you'll see the details.

- There may have been a co-pay, or an amount that the person's agreed can be taken off their pay. If so, you'll also see that amount showing as "Employee deducted co-pay" with its own notes when you hover.

- And finally, you'll know that the voucher's value is being correctly recorded and taxed.

Keep in mind that:

- The co-pay amount is automatically set to be deducted from the person's pay.

- The company doesn't have to separately collect the co-pay amount from the person.

- Also, there's no difference in the treatment of vouchers that're exchangeable for goods and services, compared to vouchers that're exchangeable for cash only.

And that's it! That's everything you need to know about how to record a voucher given to an employee by a company!

2. How do I record employee personal items bought on a company card?

2:18

"How do I record employee personal items bought on a company card?"

When an employee buys personal items on a company credit card, it's normally recorded as a: "Benefit-in-kind"

To record a benefit-in-kind when an employee buys personal items on a company credit card:

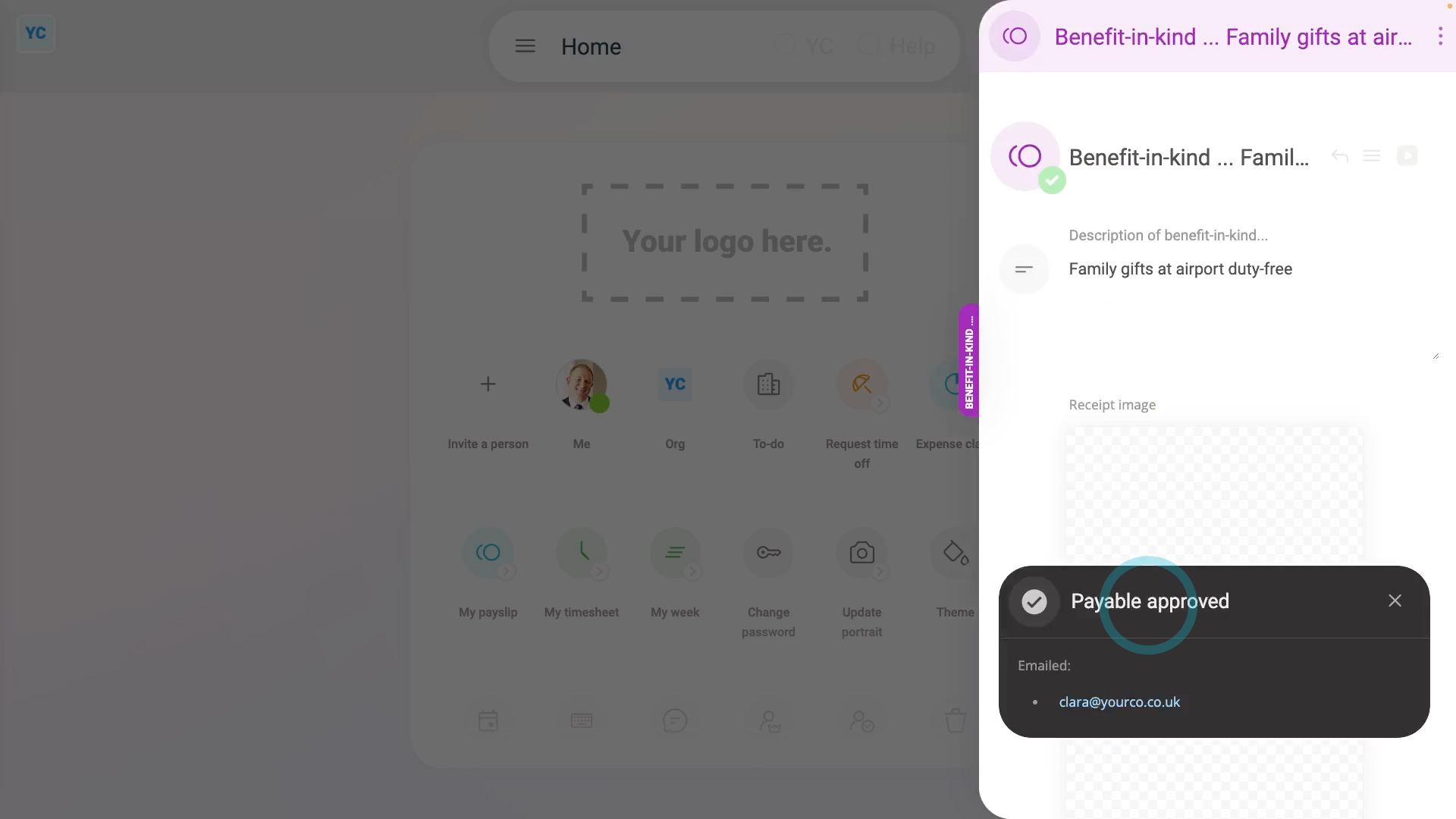

- First, tap: "Menu", then "Expense claim"

- Select the person who used a company credit card to buy personal items.

- Then tap: Benefit-in-kind

- You can attach an image, like a receipt, or tap: Skip image

- Type in how much was spent by the employee.

- Set "Arranged by" to "Employee", and tap: Next

- Next, type in a short description of what was purchased, and tap: Next

- And because it's a payroll admin who's entering it, the expense is automatically approved.

- Now, to see how it shows up on the person's payslip, scroll down and tap: See on payslip

- And when you hover your mouse over the "Benefit-in-kind" amount, you'll see the details.

- And finally, you'll know that the purchased items' value is being correctly recorded and taxed.

Keep in mind that:

- Recording an employee's personal items purchases applies equally to those done with a company debit card, or other company charge card.

- Also, it applies equally whether the company approved of the purchase or not.

- However, in most cases, the employee's company credit card purchase was for approved business purposes, like business travel, and not for personal items.

- For any business related purchase, using a company credit card, nothing needs to be recorded in their payroll.

And that's it! That's everything you need to know about what to do when an employee buys personal items on a company credit card!