J. Qualifying relocation

How do I enter both 'qualifying' and remaining moving costs?

4:14

"How do I enter both "qualifying" and remaining moving costs?"

When moving house, your "qualifying" moving cost can be up to the tax-free maximum of £8,000, and is recorded as a "Standard moving expense". Anything over the tax-free maximum of £8,000 is recorded as a: "Remaining moving expense"

To create a "Standard moving expense" for your part up to a tax-free maximum of £8,000:

- First, if your total "qualifying" moving costs are over the £8,000 tax-free limit, you'll need to start by creating a "Standard moving expense" for the original £8,000.

- And then separately create a "Remaining moving expense" for the remaining amount.

- However, keep in mind, if your total cost's less than the £8,000 tax-free limit, you'll only need to do the first step.

- To start with the first step, tap: "Menu", then "Expense claim"

- Select the person who's moving.

- Then tap: Expense

- If you've got an image, like a receipt, that you'd like to include, you can upload, or take a photo of it.

- Then tap: Next

- If your amount's less than £8,000, then enter it. However, if it's over, enter only £8,000, and tap: Next

- And select "Moving costs", then tap: Next

- And because it's a payroll admin who's entering it, the expense is automatically approved.

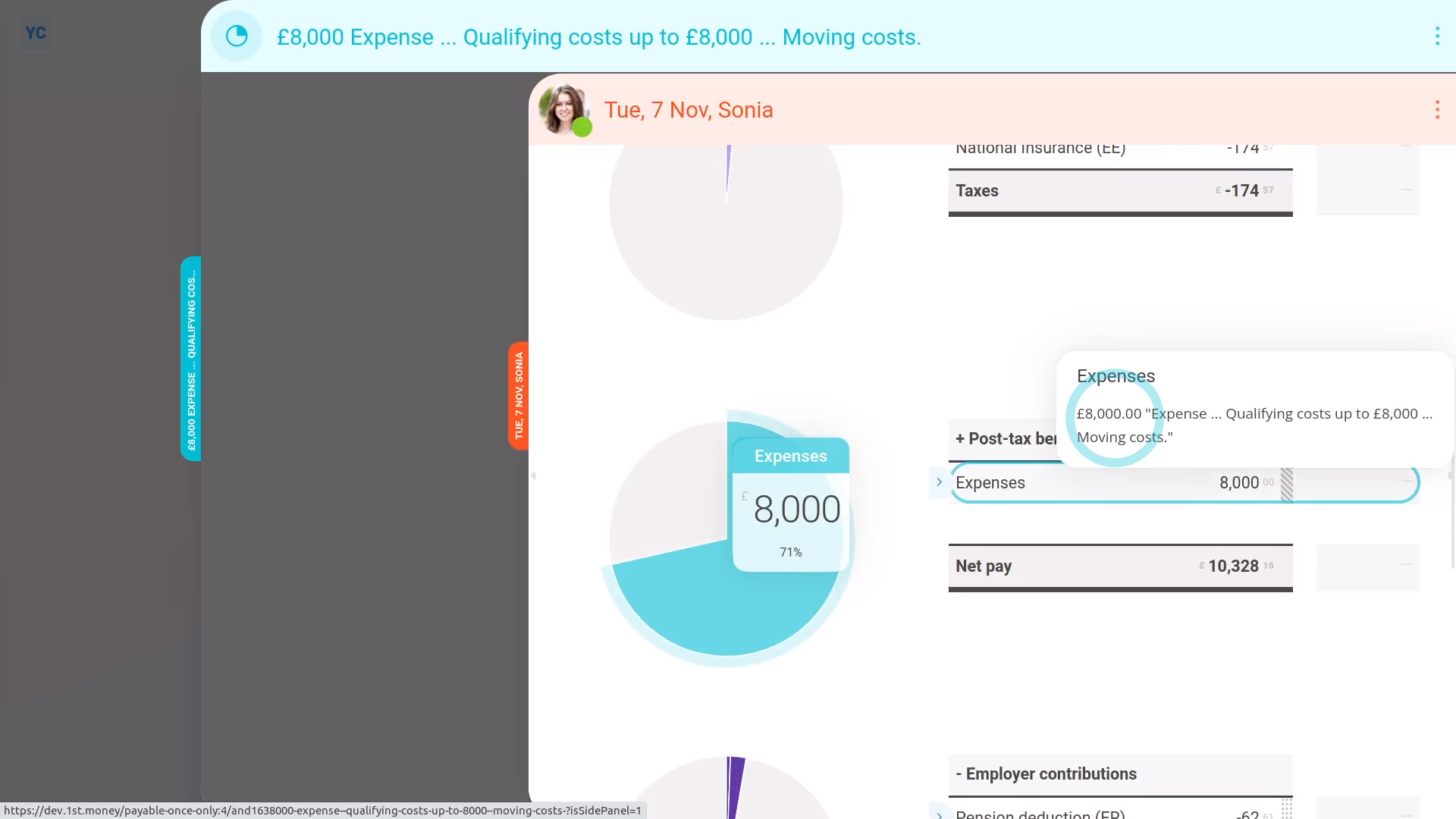

- Now, to see how it shows up on the person's payslip, scroll down and tap: See on payslip

- And finally, when you hover your mouse over the "Expenses" amount, you'll see the details.

To create an optional "Remaining moving expense" for only when a person's moving cost was over your tax-free maximum of £8,000:

- First, again tap: "Menu", then "Expense claim"

- And again select the person who's moving.

- Scroll down and select: Benefit-in-kind

- You can re-attach the same image again, or tap: Skip image

- Next, calculate the amount that's remaining, over the £8,000 tax-free limit.

- Then enter that remaining amount only.

- Leave "Arranged by" as "Company", and tap: Next

- Leave the description empty, and tap: Next

- And because it's a payroll admin who's entering it, the expense is automatically approved.

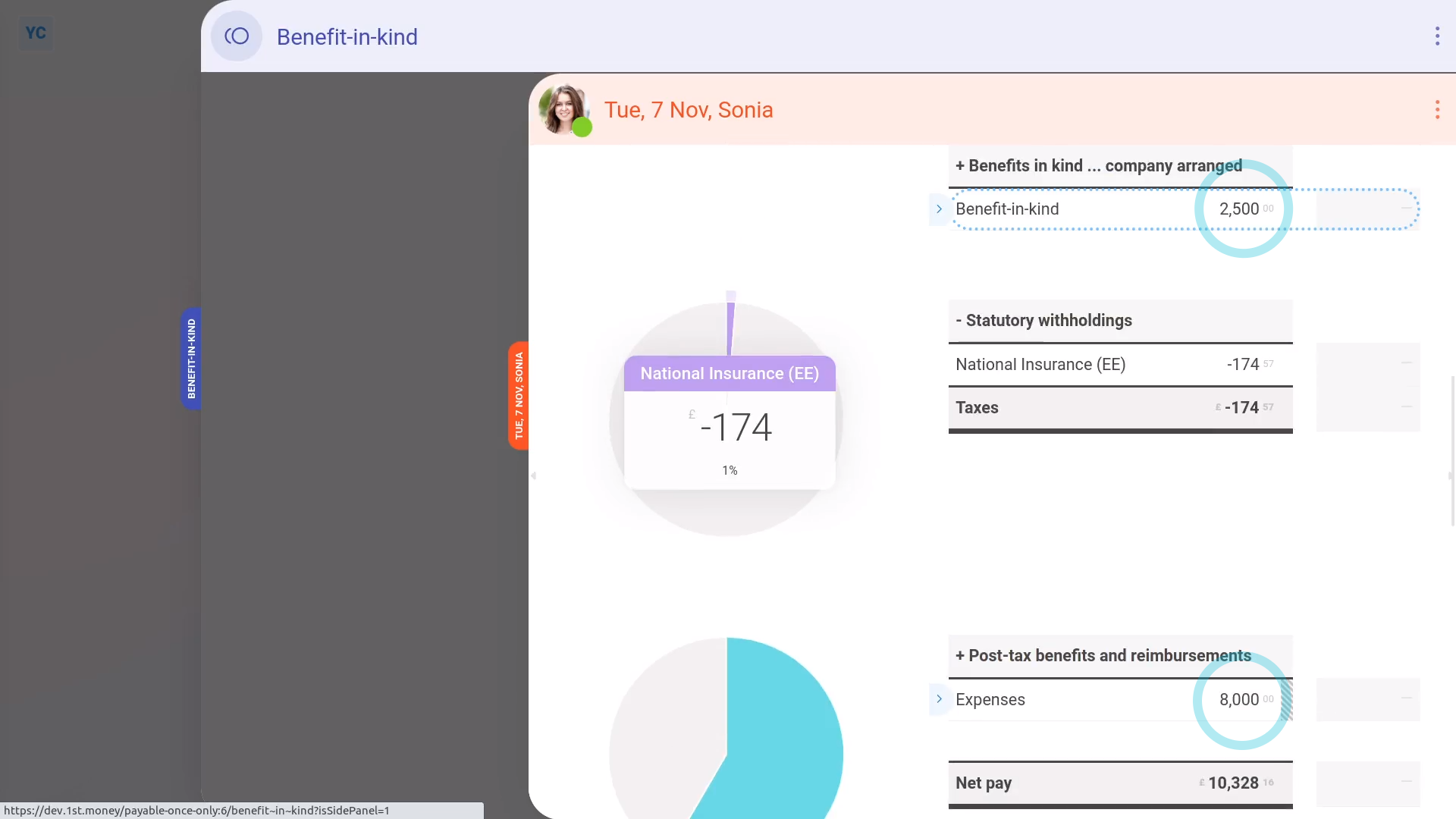

- Now, to see how it shows up on the person's payslip, scroll down and tap: See on payslip

- And when you hover your mouse over the "Benefit-in-kind" amount, you'll see the details.

- And finally, it's in addition to the "Expenses" amount you entered earlier. Both are repaid together on the same payslip.

Keep in mind that:

- Qualifying moving costs include buying or selling the house, moving, buying things for the house, and bridging loans.

- If the moving costs are "qualifying" and less than the tax-free maximum of £8,000, there's no tax or National Insurance to pay.

- If it turns out that the moving expense isn't "qualifying", as an admin, create an "Expense claim" for the person as a: "Once only taxable benefit"

- To add a "Once only taxable benefit" reimbursement, tap: "Menu", then "Expense claim", select the person, and tap: Once only taxable benefit

Also remember that:

- All the steps assume that it's a payroll admin who's entering the moving costs.

- If it's the person who's entering them, the only thing that changes is that the payroll admin still needs to approve them.

- The expense claims won't show up on the person's payslip until the payroll admin has approved them.

To learn more:

- About what's included in the "qualifying" relocation costs, go to GOV.UK.

- Also, if you're searching the internet for more info, HMRC sometimes labels "moving costs" as: "qualifying costs"

And that's it! That's everything you need to know about adding "qualifying" moving costs!