1. How do I check payslips before paying payroll on payday?

3:53

"How do I check payslips before paying payroll on payday?"

If your team's payslips frequently include timesheets and expenses, on payday, you may want to check each payslip before you tap: File now

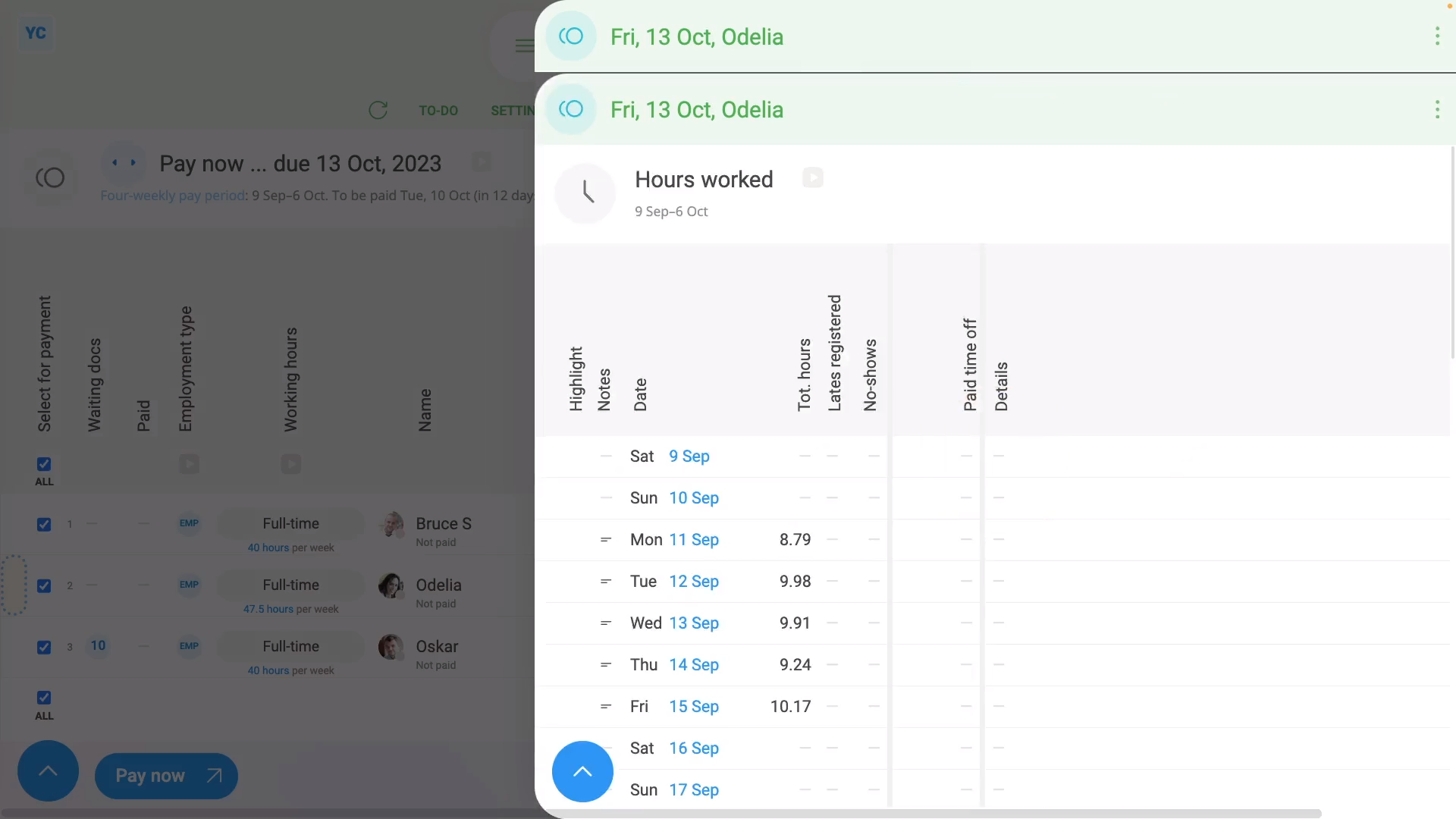

To open a payslip and check its hours worked:

- First, select the pay batch on: MenuPay batches

- Then tap: PayPay now

- Next, hover your mouse over the row of the first payslip you want to check.

- And tap the blue "See payslip" button: (at the start of any row)

- Once their payslip slides out on the right, you can now begin checking.

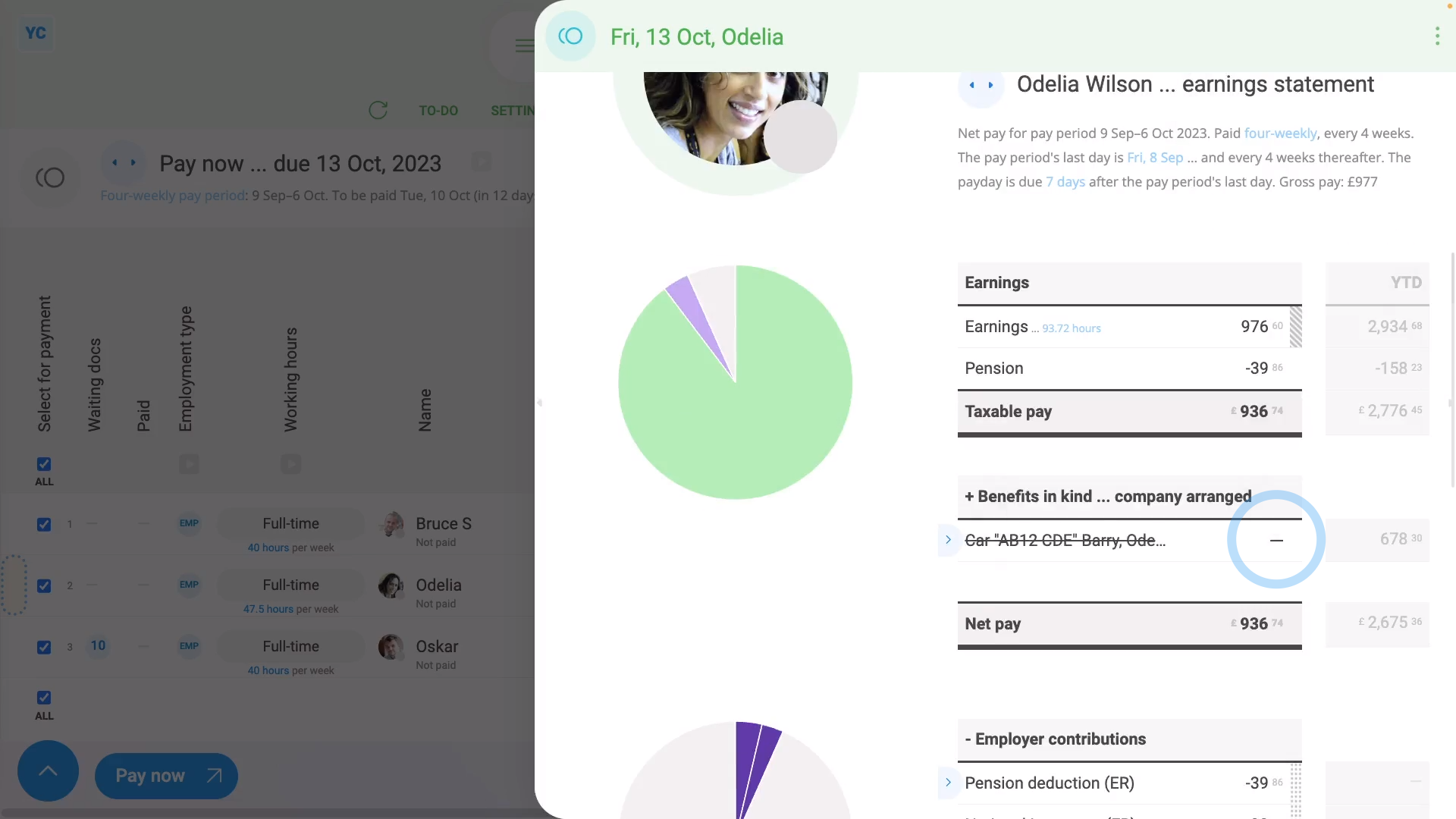

- The first thing to check is the big number (at the top).

- Which is their "Net pay", or, in other words, how much is paid to their bank account.

- Make sure that it "feels" like the number you're expecting to pay.

- Then if the person does timesheets, tap Hours worked, and a list of their timesheet times slides out on the right.

- If you need to change one of the day's times done, tap it to make changes.

- Now, tap the shift on that day that you want to change, drag the slider to make your change, and tap: Save

- Once it's reloaded, you'll see that the payslip's "Earnings" number has changed.

- And finally, when you hover your mouse over the "Earnings" number, the hours to be paid has also changed.

To open a payslip and check for any repeat payables to be removed, like a benefit-in-kind:

- First, select the pay batch on: MenuPay batches

- Then tap: PayPay now

- Next, hover your mouse over the row of the payslip you want to open.

- And tap the blue "See payslip" button: (at the start of any row)

- Next, on the payslip, find the repeat payable that you'd like to remove.

- One-time removal:

To remove a repeat payable from only a single payslip, but have it still show up on all future payslips, untick the repeat payable. - Once you've unticked the repeat payable, it's removed from the current payslip as a one-time removal.

- However, it still shows up in all future payslips, as expected.

- Permanent removal:

To permanently remove a repeat payable, tap the light blue "Edit" button: (at the front of the repeat payable) - Then scroll down to "People getting it", and tap the person you'd like removed.

- Then in the person's pay settings, tap the blue "remove" link, and then tap: Yes ... remove

- Now that the repeat payable's reloaded, you can see that it no longer has the person listed.

- Then back on the payslip, tap the three dots: (in the top-right corner), and tap: Reload

- Now, on the reloaded payslip, the repeat payable's money value is set to nothing.

- The reason the row's still showing is because it's been filed on previous payslips in the tax year.

- Because it's been previously filed, the "year to date" amount still needs to be listed.

- And finally, once you get to the next tax year, the "year to date" amount gets reset, and the repeat payable row permanently disappears.

For advanced usage:

- If you're paying lots of people, you may want to plan your payday payslip checking job out in advance.

- You could share your "checking" job with others on your payroll team.

- Checking payslips can be done by multiple people, all during the same time.

- All it takes is to set up each person in your payroll team with their own login.

- And then give each of them payroll admin permissions.

And that's it! That's everything you need to know about checking payslips!

Was this page helpful?