4b. How do I pay CIS subcontractors hourly, by self-reported hours?

5:01

"How do I pay CIS subcontractors hourly, by self-reported hours?"

Sometimes your CIS subcontractors have their own time tracking system, and all you need to enter is their total hours worked.

To setup a CIS subcontractor for hourly pay, based on hours worked from their own time tracking system, and to then pay them:

- First, tap: MenuPeopleInvite a person

- Once it's open, tap Add a new person, and enter the subcontractor's email and tap: Invite

- Next, fill in the subcontractor's name.

- And set the Employment type to: "CIS subcontractor"

- Then set the Pay batch to the same pay batch used by your other CIS subcontractors, and tap: Next

- Set any of the "Job settings" if you wish, and tap: Next

- Next, select: CIS subcontractor type

- In the example, because you're doing a new CIS subcontractor, set "Previously verified" to: "No"

- Then fill in the other details.

- And tap Set address and type in your CIS subcontractor's address.

- Then tap Next and then: Verify CIS

- A request for a new 11-13 digit CIS verification reference number is now made to HMRC.

- It usually takes 15 to 20 seconds for HMRC to finish processing your request and send back your: CIS verification reference number

- Once you receive the CIS verification reference number on behalf of the person (or company), it can then be used by them while working with your company. It can also be used by them while working as a CIS subcontractor for any other company.

- Verifying a CIS subcontractor sets the deduction rate to 20% if the person (or company) is registered with HMRC, or 30% if not registered.

- Once HMRC responds, you'll see a purple check with the person (or company's) CIS verification reference number above it.

- Next, set their Rate amount, and set it to: "Per hour ... target hours"

- Then tap: Next

- Now, after you tap your way through the remaining steps, your new CIS subcontractor is 100% complete with admin onboarding.

- Over the coming days, your new CIS subcontractor can track their hours worked through their own time tracking system.

- Then on payday, get their total hours worked.

- To pay them, select the pay batch that the CIS subcontractor works in: MenuPay batches

- Then tap: PayPay now

- You may need to jump forwards one payday if your CIS subcontractor's join date was set to today.

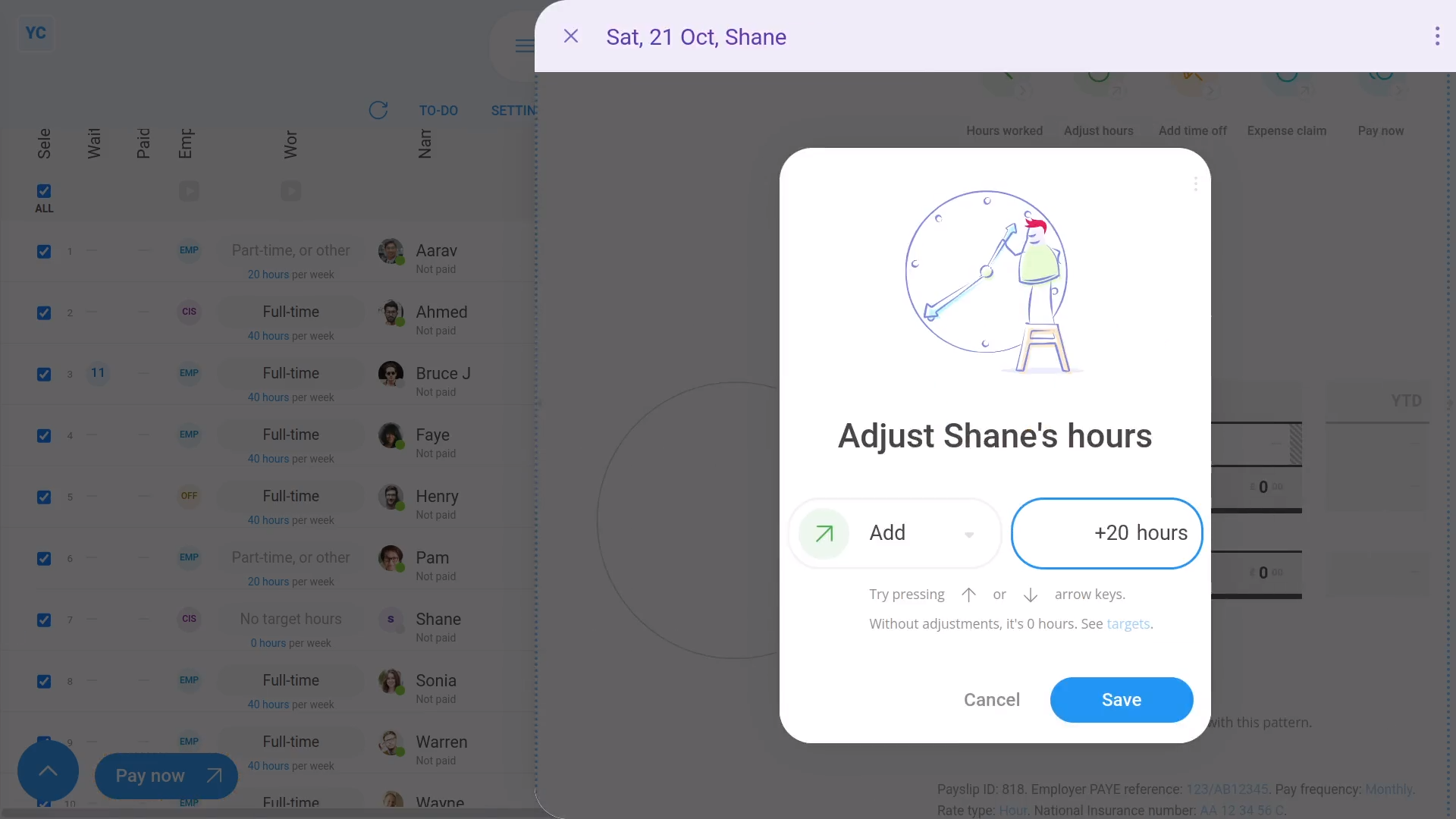

- Once you find your new CIS subcontractor on the "Pay now" report, tap the blue zeros in the "Net pay" column.

- And type in the number of hours you'd like to add for the CIS subcontractor to be paid.

- Now you'll see their amounts for "Net pay" and "CIS deduction" for the hours you entered.

- To pay the payslip, tap: Go to "Pay now" report

- And finally, once everything's checked, tap: File now

To learn more:

- About paying CIS subcontractors using timesheets, watch the video on: Paying CIS hourly by timesheets

- Alternatively, to learn about paying for an invoiced money amount of CIS labour, watch the video on: Paying invoiced CIS labour

Keep in mind that:

- It's fine for a single pay batch to have some CIS subcontractors using timesheets, and others using a system for tracking their hours.

- And still others invoicing for a money amount of CIS labour.

- Any combination of the three payment methods works, and you can switch from one to another with any CIS subcontractor, at any time.

And that's it! That's all you need to do to pay CIS subcontractors hourly, based on their hours worked from their own time tracking system!

Was this page helpful?

4a. How do I pay CIS subcontractors hourly, by timesheet hours4c. How do I pay CIS subcontractors, by invoiced 'CIS labour'