2. How do I add a new un-verified CIS subcontractor?

3:49

"How do I add a new un-verified CIS subcontractor?"

When you hire a new CIS subcontractor, either as a person or a company, your first step is to add them as a person.

To add a person (or company) as a CIS subcontractor:

- First, tap: "Menu", "People", then "Invite a person"

- Once it's open, tap Add a new person, and enter the subcontractor's email and tap: Invite

- Next, fill in the subcontractor's name.

- And set the "Employment type" to: "CIS subcontractor"

- Then set the "Pay batch" to the same pay batch used by your other CIS subcontractors, and tap: Next

- Set any of the "Job settings" if you wish, and tap: Next

- You're welcome to set a "Rate amount", but for CIS subcontractors it's optional, as you may be paying them per job.

- Then tap: Next

- Select the subcontractor type.

- In the example, because you're doing a new CIS subcontractor, set "Previously verified" to: "No"

- Then fill in the other details.

- Then tap Set address and type in your CIS subcontractor's address.

- Then tap Next and then: Verify CIS

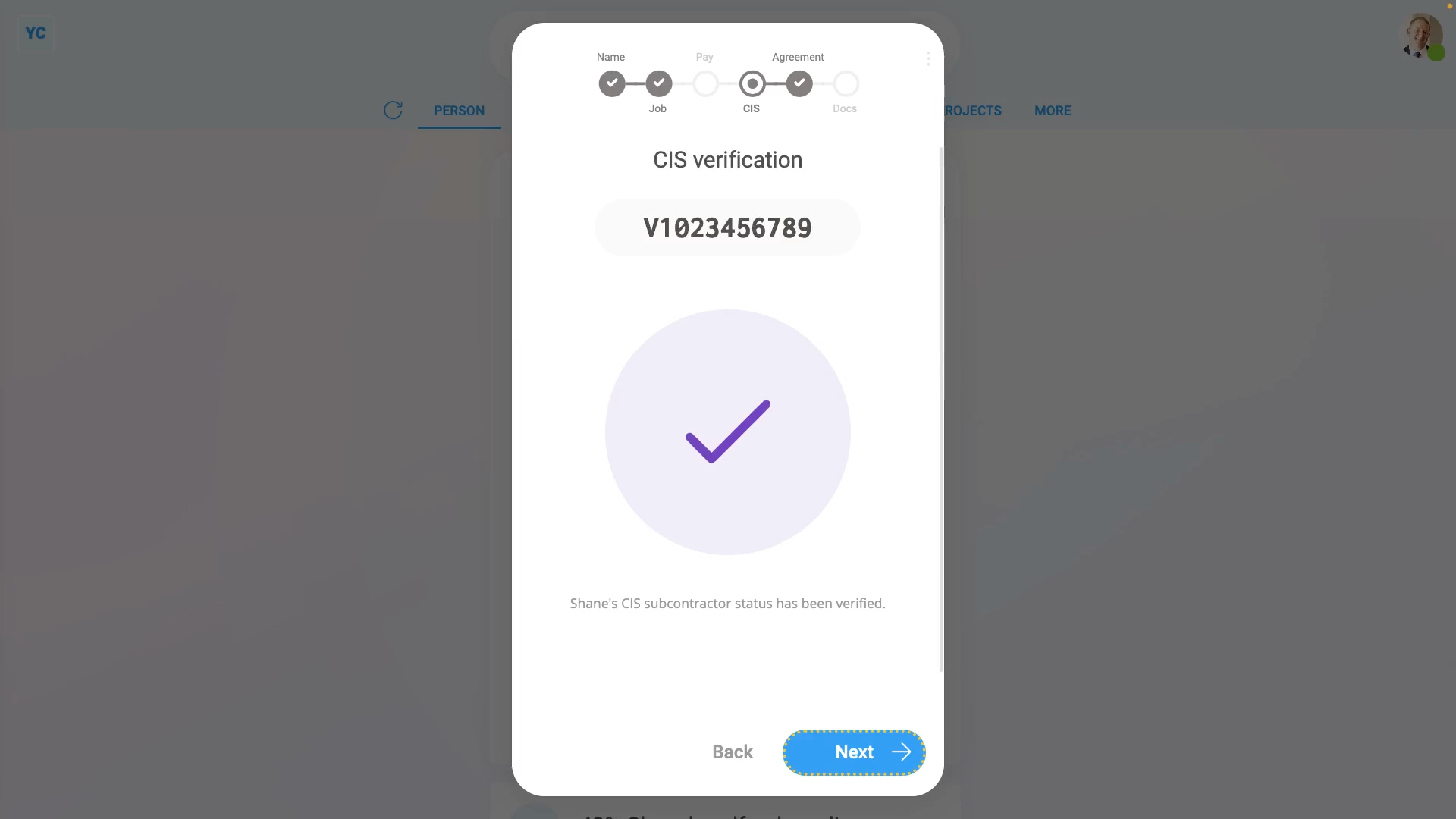

- A request for a new 11-13 digit CIS verification reference number is now made to HMRC.

- It usually takes 15 to 20 seconds for HMRC to finish processing your request and send back your: "CIS verification reference number"

- Once you receive the CIS verification reference number on behalf of the person (or company), it can then be used by them while working with your company. It can also be used by them while working as a CIS subcontractor for any other company.

- Verifying a CIS subcontractor sets the deduction rate to 20% if the person (or company) is registered with HMRC, or 30% if not registered.

- Once HMRC responds, you'll see a purple check with the person (or company's) CIS verification reference number above it.

- And finally, after you tap your way through the remaining steps, and tap Close, your new CIS subcontractor is all ready.

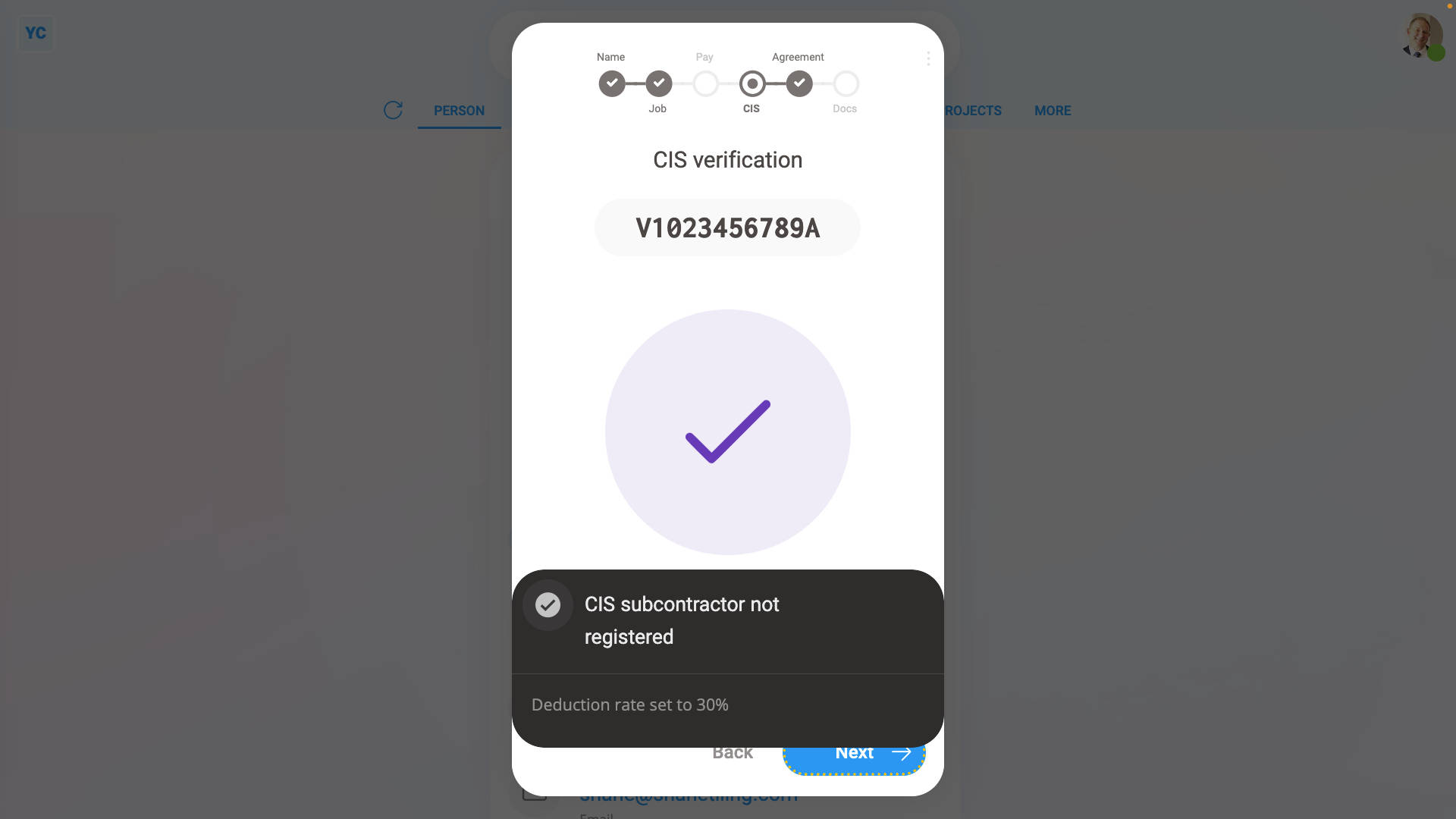

Sometimes, once HMRC responds, you may see a popup saying "CIS subcontractor not found by HMRC". Which means:

- That your CIS subcontractor wasn't found in HMRC's database, so your CIS subcontractor can't yet get the lower 20% deduction rate.

- Your CIS subcontractor can still work for you, and you can still pay them, but ask your CIS subcontractor to register themselves with HMRC.

- Until your CIS subcontractor's registered, their CIS subcontractor deductions are set to the higher 30% rate.

- Once HMRC's received their registration, HMRC contacts you (the employer) and asks you to set them to the lower 20% rate.

- CIS subcontractors can register for CIS on the Government Gateway website.

- Your CIS subcontractor can also register by calling the CIS helpline number (that you can search for on Google).

And that's it! That's everything you need to know about adding a CIS subcontractor that isn't registered!

1. How do I add a CIS subcontractor who's got a reference number3a. How do I reverify an existing CIS subcontractor