4c. How do I pay CIS subcontractors, by invoiced 'CIS labour'?

3:40

"How do I pay CIS subcontractors, by invoiced "CIS labour"?"

Sometimes your CIS subcontractors, rather than giving you their total hours worked, instead give you an invoice for their: "CIS labour"

To pay a CIS subcontractor for their invoiced "CIS labour":

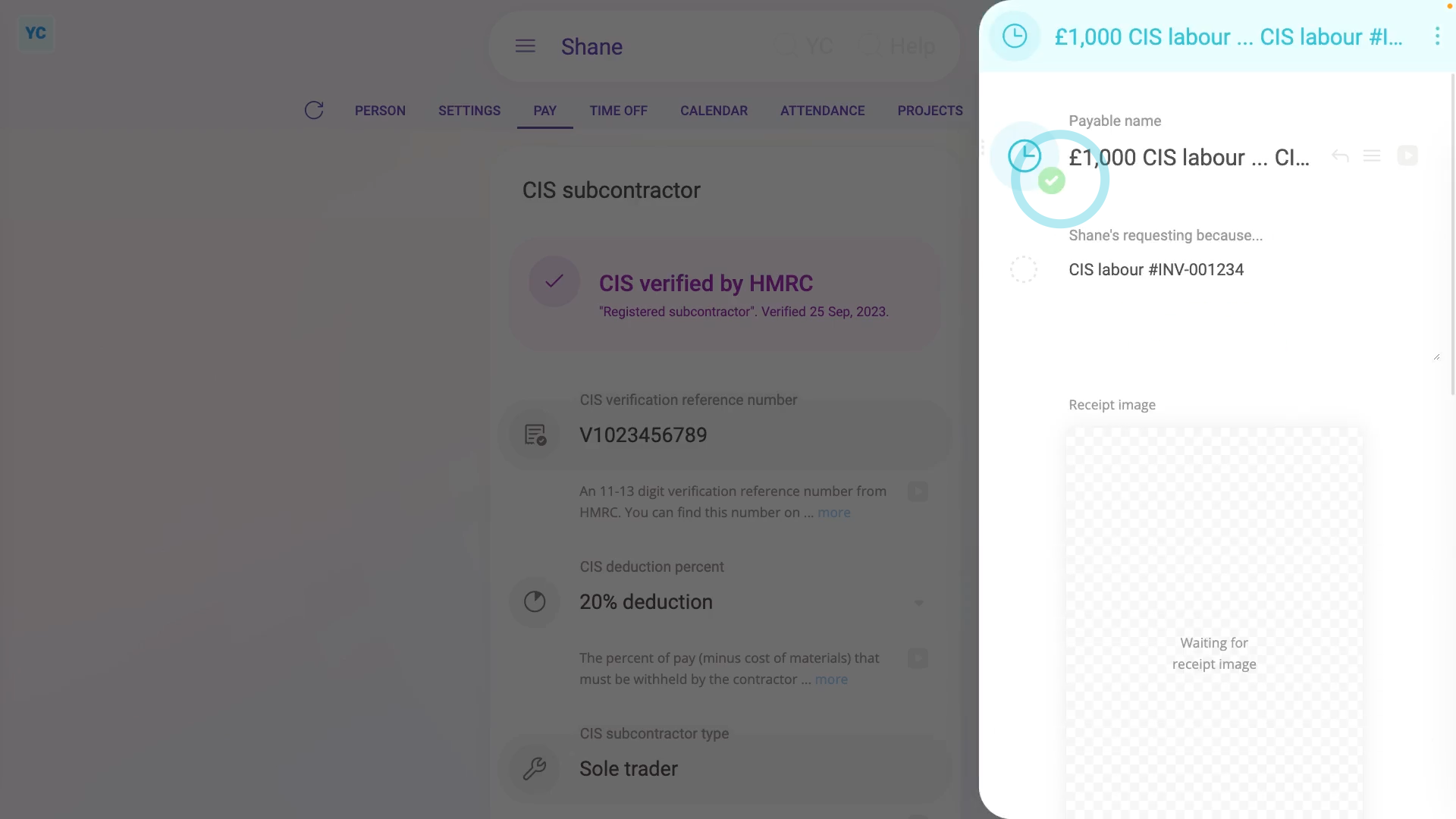

- First, select the CIS subcontractor on: MenuPeople

- Then tap: TaxTax settings

- And, if it's your first time to pay them, check the CIS subcontractor's been: "CIS verified by HMRC"

- Then to pay the CIS subcontractor, tap: PayAdd expense claim

- And select: "CIS labour"

- Type in the money amount on the invoice and tap: Next

- Type in any notes to go along with the expense claim. For example, you could enter the invoice number. Then tap: Next

- And because you're entering the "CIS labour" expense claim as an admin, you'll see that it's been automatically approved.

- Next, to see their "CIS labour" expense claim on the CIS subcontractor's payslip, tap the arrow (at the top).

- And scroll down to see the gross amount that the CIS subcontractor charged.

- You'll also see the CIS deduction that you'll pay to HMRC in a few weeks.

- And you'll see the "Net pay" amount that the CIS subcontractor gets paid into their bank account.

- Normally you'll wait until payday to pay it, but to pay the payslip now, tap: Go to "Pay now" report

- Once everything's checked, tap: File now

- Now that it's filed, if you go to the pay batch's "To-do" tab.

- And open the upcoming "HMRC taxes" task that comes after the payday for the payslip you recently filed.

- And finally, you'll see that the "CIS deduction" of "£200" is all queued up, and ready for payment to HMRC.

You may notice:

- That sometimes your CIS subcontractors are VAT registered, and add a VAT amount to their invoices.

- If the CIS subcontractor is VAT registered: only enter the amount before VAT is added (remove the VAT if you need to).

- However, if the CIS subcontractor isn't VAT registered: VAT shouldn't appear, so use the amount from the invoice.

To learn more:

- About paying CIS subcontractors who are using their own time tracking system, watch the video on: Paying CIS hourly from hours worked.

- Alternatively, to learn about paying CIS subcontractors using timesheets, watch the video on: Paying CIS hourly by timesheets

Keep in mind that:

- It's fine for a single pay batch to have some CIS subcontractors using timesheets, and others using a system for tracking their hours.

- And still others invoicing for a money amount of CIS labour.

- Any combination of the three payment methods works, and you can switch from one to another with any CIS subcontractor, at any time.

And that's it! That's all you need to do to pay CIS subcontractors, based on their invoiced CIS labour!

Was this page helpful?

4b. How do I pay CIS subcontractors hourly, by self-reported hours4d. How do I pay CIS subcontractors for invoiced materials, etc