6. How do I send the 'CIS monthly'?

4:02

"How do I send the "CIS monthly"?"

The "CIS monthly" is used to declare any tax deductions you've made on payments to your CIS subcontractors. It needs to be submitted to HMRC by the 19th of every month.

To send a pay batch's "CIS monthly" as a "nil return":

- First, select the pay batch on: "Menu", then "Pay batches"

- Then on the "To-do" tab, tap the upcoming: "CIS monthly"

- Check the details are correct.

- In some cases, you'll be sending a "nil return", if there hasn't been any CIS payments in the month.

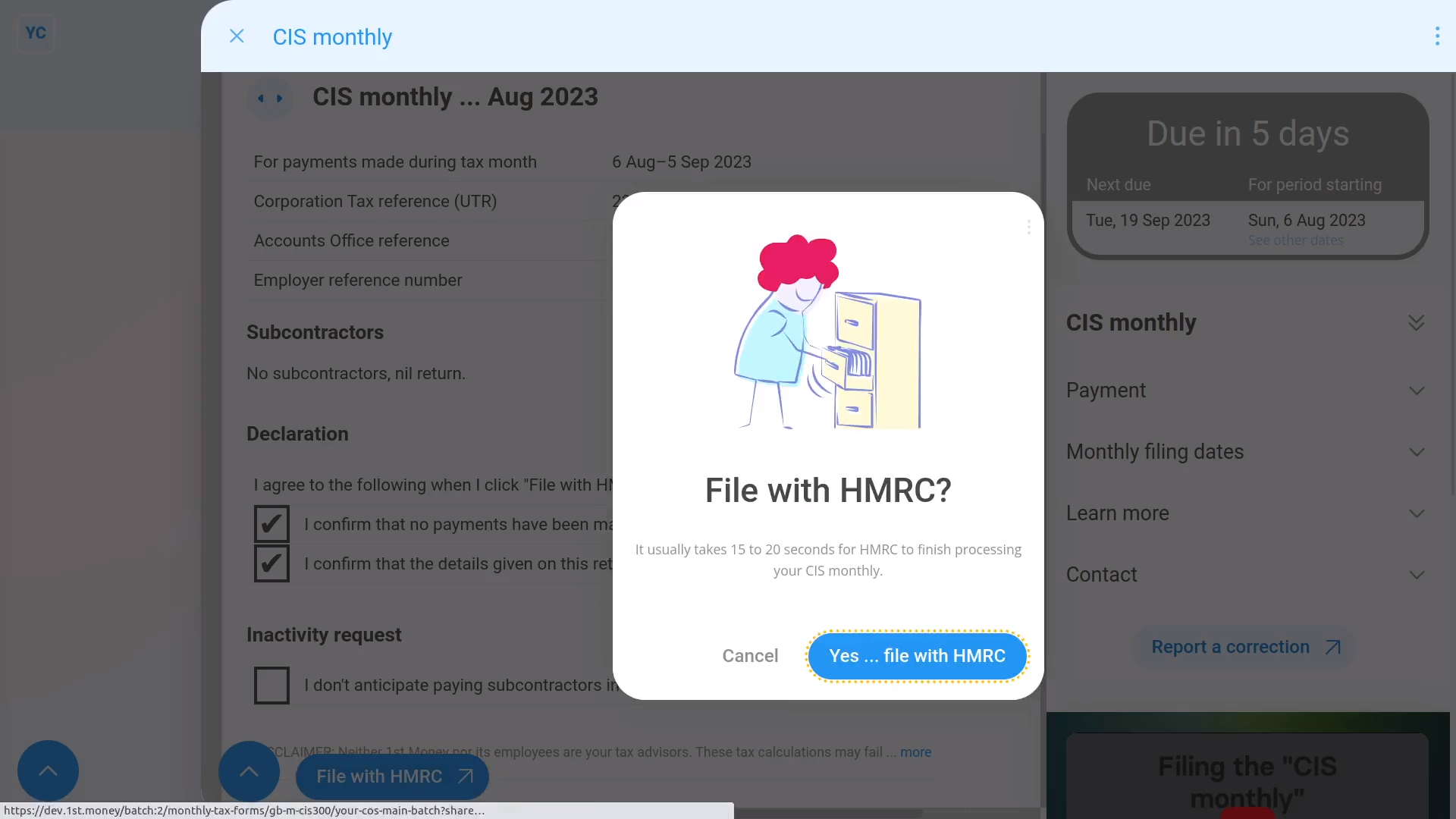

- When you're ready, tap: File with HMRC (at the bottom)

- Then: Yes ... file with HMRC

- It usually takes 15 to 20 seconds for HMRC to finish processing your CIS monthly.

- While you're waiting for HMRC to respond, you can review the notes about "Payment", "Monthly filing dates", and more.

- Once HMRC responds, you'll see a green tick to show it's been sent. You'll also see the confirmation receipt from HMRC.

- And finally, if you ever need a confirmation receipt in the future, tap the tick on the "To-do" tab.

Keep in mind that:

- Sometimes you go to a pay batch and there's no mention of "CIS monthly" in the "To-do" tab. If so, it means that the pay batch doesn't have any CIS subcontractors.

- It could also mean that the reminders have been turned off for six months.

- You only have to send a pay batch's "CIS monthly" if the pay batch has CIS subcontractors.

- Also keep in mind that you may sometimes need to send a: "nil return"

- A "nil return" submission is still required for any month where the pay batch does have CIS subcontractors, but didn't make any CIS payments.

To learn more:

- About turning off the reminders for six months, watch the video on: Stop CIS monthly reminders

Sometimes, you may find you've made additional CIS payments for the tax month, even after you've sent your: "CIS monthly"

Any additional CIS payments still need to be sent to HMRC. Which is done through an amendment submission of your: "CIS monthly"

To make an amendment submission of a pay batch's "CIS monthly":

- First, select the pay batch on: "Menu", then "Pay batches"

- Then on the "To-do" tab, find the upcoming: "CIS monthly"

- Next, hover your mouse over the row and tap the "Redo" link.

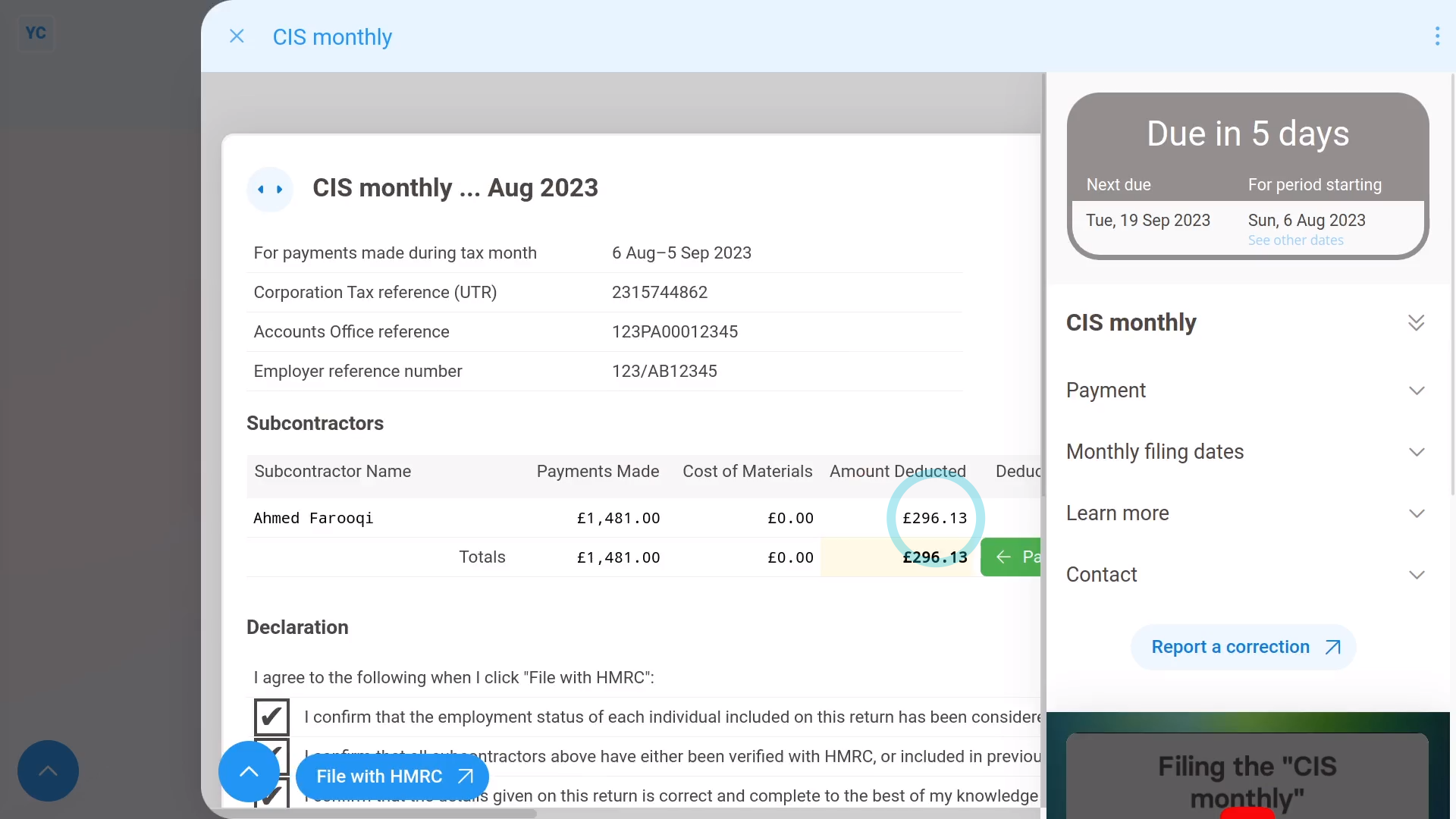

- The "CIS monthly" now loads with your up-to-date CIS payments for the month.

- You'll see a listing of each of your CIS subcontractors that you've made a CIS payment to, listed on one-row each.

- When you're ready, tap: File with HMRC (at the bottom)

- Then: Yes ... file with HMRC

- Like before, it usually takes 15 to 20 seconds for HMRC to finish processing your CIS monthly.

- And finally, as usual, you'll see a green tick to show it's been received by HMRC.

Also remember that:

- Changes of the "CIS monthly" can be made at any time two months before the end of the tax month. Changes can also me made up to nine months after the end of the tax month.

- Which still means that you've got to send something by the 19th of every month, even if it's a: "nil return"

- But you can later resend further CIS amendments, even months afterwards.

- Whenever you resend the "CIS monthly" with changes, HMRC only stores the latest sent CIS filing for that tax month.

And that's it! That's all you need to do to send your "CIS monthly"!

5. How do I get my CIS 'Payment and Deduction statement'How do I turn off the CIS monthly reminders for the next 6 months