4. How do I pay payslips each payday?

3:25

"How do I pay payslips each payday?"

Your pay batch's "To-do" list is there to remind you of when it's time to pay payslips.

To file & confirm payslips:

- First, select the pay batch on: "Menu", then "Pay batches"

- Then on the "To-do" tab, tap the upcoming: "Payday"

- Once the "Payday" is open, you'll see details about each payslip, like net pay, taxes, and more.

- To see even more details about any payslip, tap the blue "See payslip" button: (at the start of any row)

- Sometimes you may have a reason to skip a person for now, and pay them later. To skip paying a payslip for now, turn off the row.

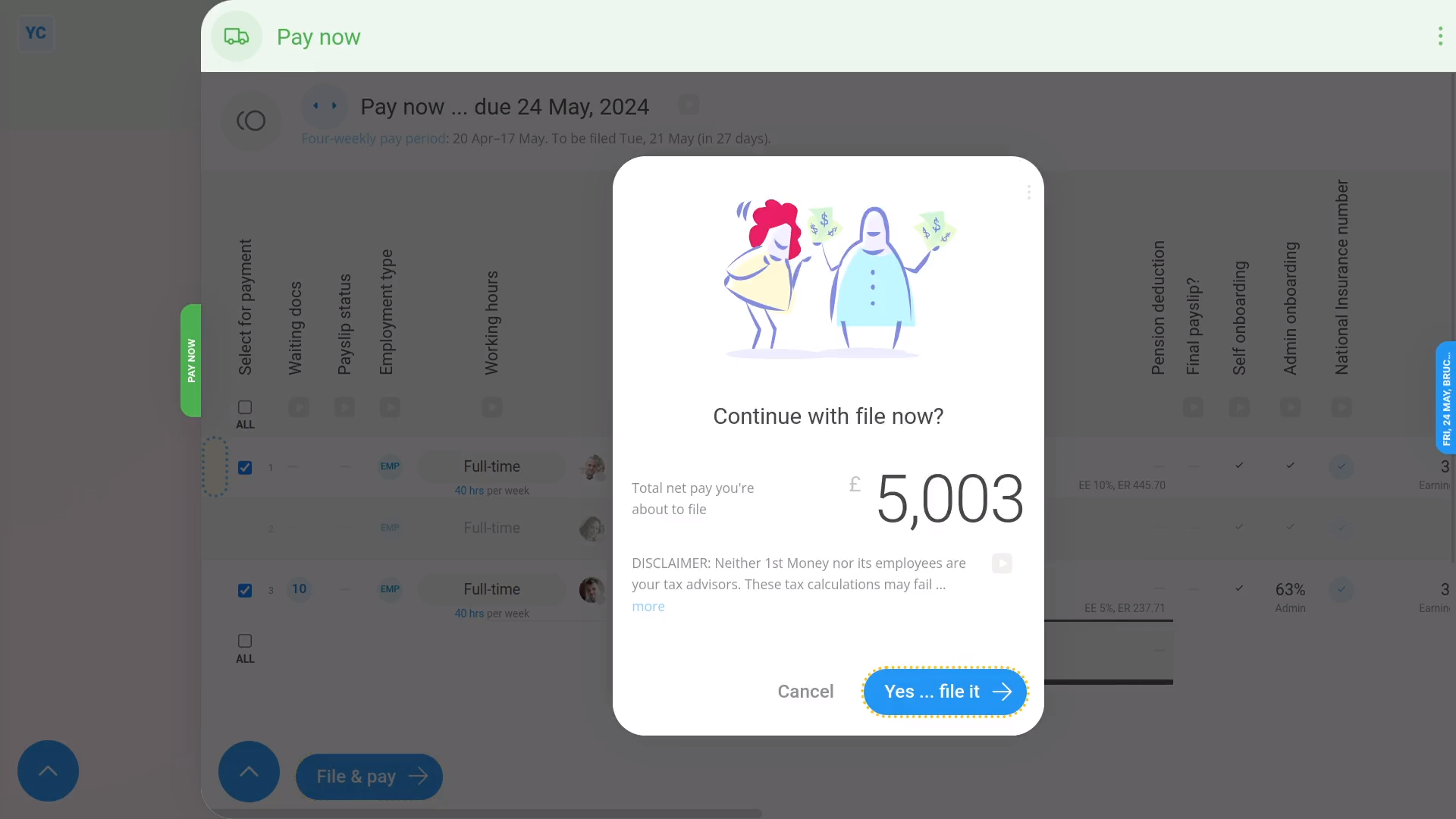

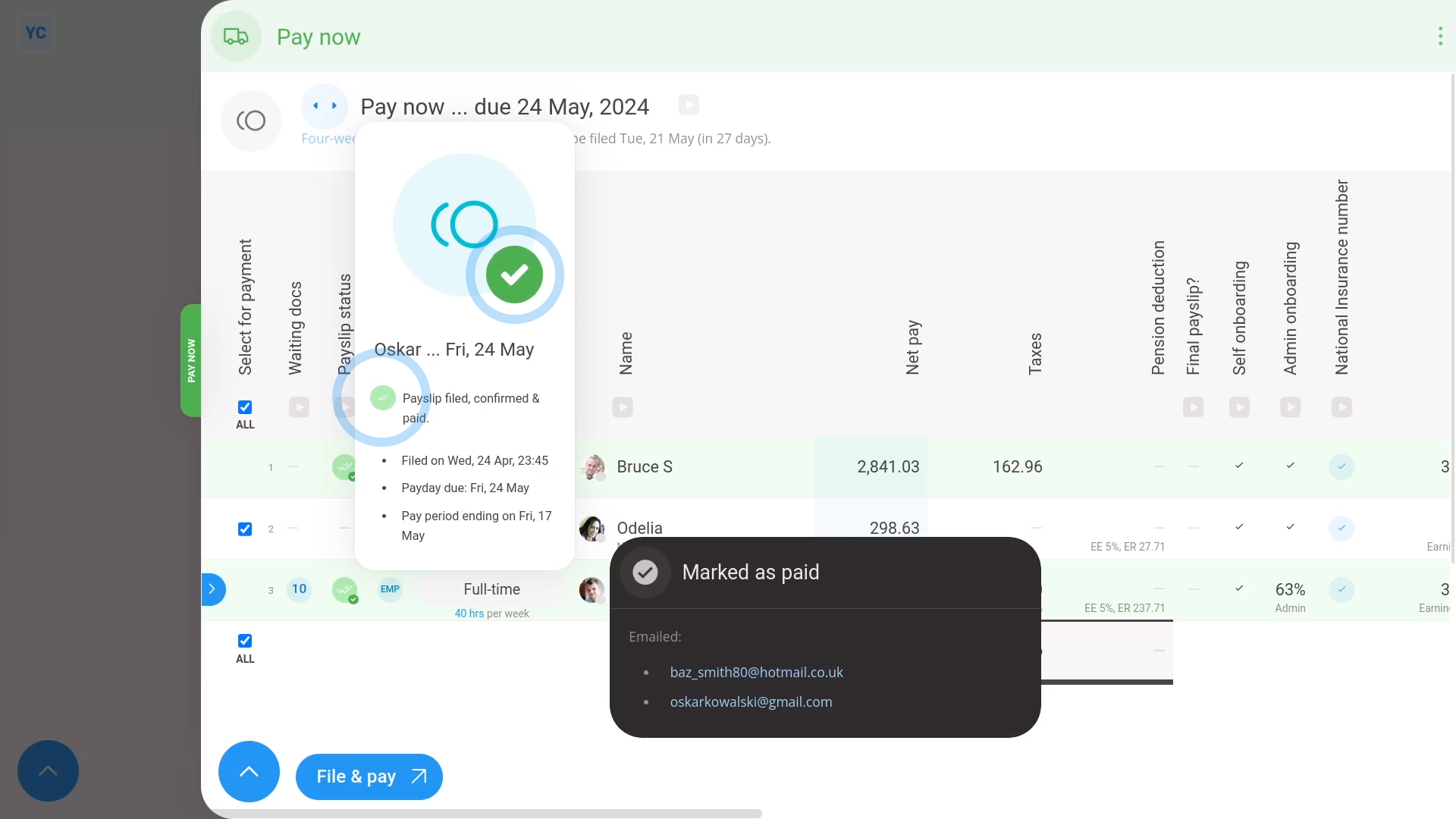

- Then when you're ready, tap: File & pay

- You'll now see the total amount of net pay you're about to pay your people.

- And finally, tap: Yes ... file it

Immediately after filing payslips, 1st Money sends details of the filed payslips to confirm with HMRC.

Once HMRC's confirmed the payslips you filed, you can make your payday payments.

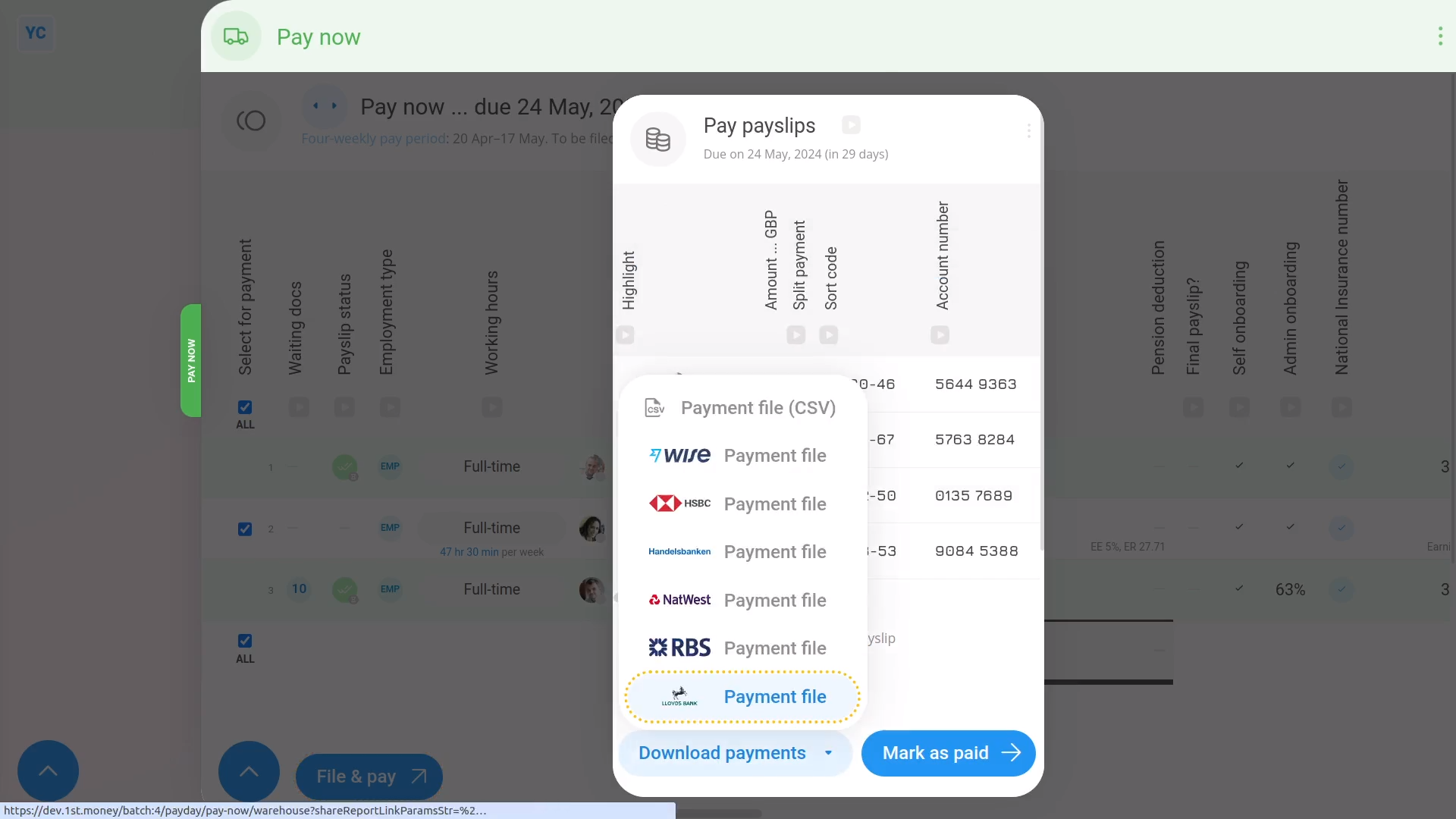

To make your payday payments:

- First, tap: Download payments

- Then tap the bank you use, and a payment file's downloaded.

- The payment file has all the payments to be paid for the payday.

- And finally, upload the payment file to your banking software.

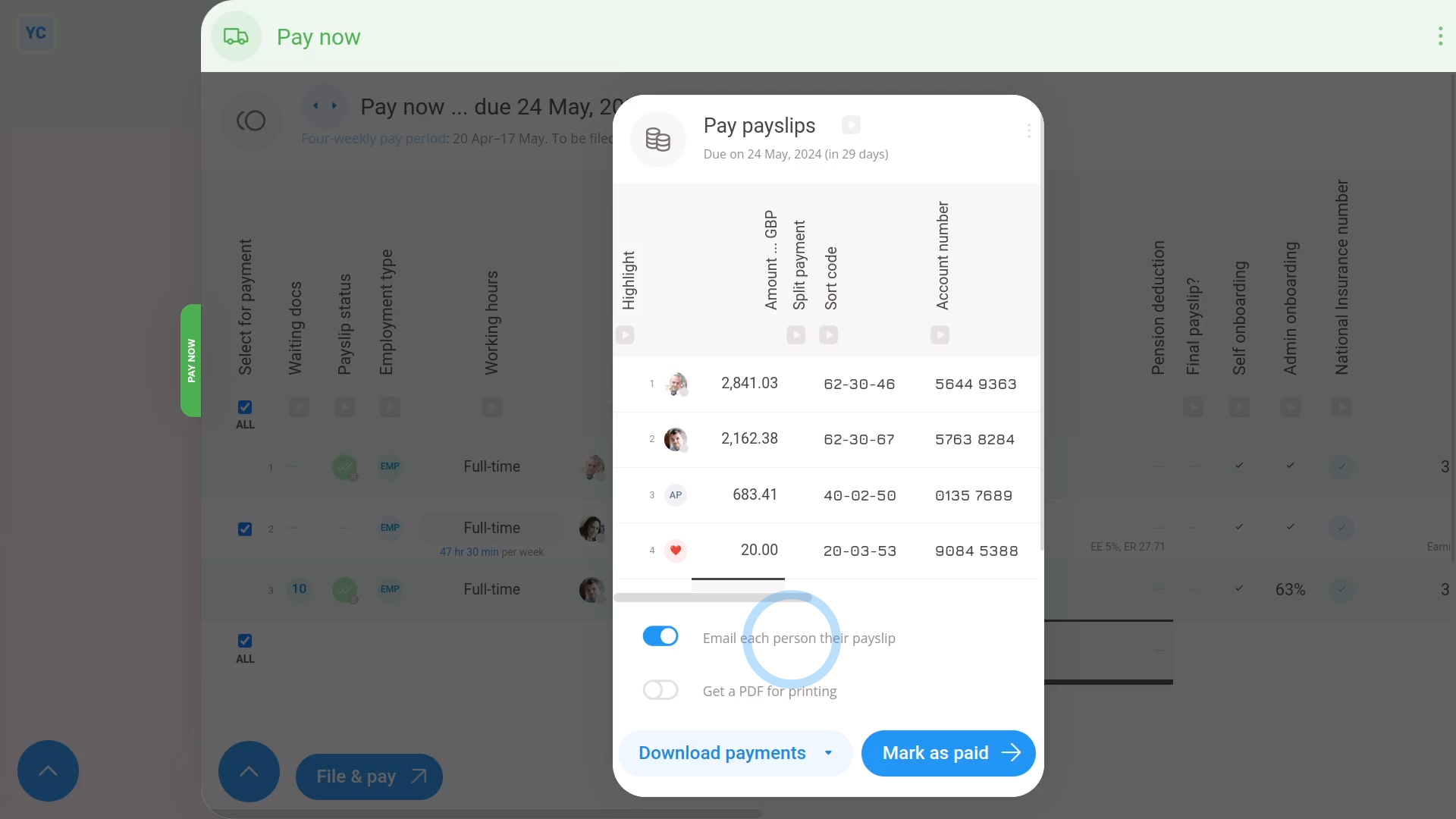

To finish and send emails:

- First, by default, each person gets emailed a PDF of their payslip.

- You can also get an email with a PDF of everybody's payslips, in case you'd like to print them. However, it's off by default.

- But you can always turn any of the payday emails on or off if you'd like.

- And finally, tap: Mark as paid

To confirm that a payslip has been filed with HMRC:

- First, find the "Paid" column with the two green ticks.

- Then hover your mouse over each green tick:

- If you see an hourglass status , it means HMRC is still receiving your payslip submission.

- Once HMRC accepts the payslips, the hourglass status changes to a green tick:

- To see even more "Tax Filing" details, tap the tick status:

- And finally, you'll see who made the submission, how many payslips were submitted, and much more.

For advanced usage:

- To see the actual submission that was sent to HMRC, scroll down further, and tap Show details, or: Show XML

- HMRC calls the "Tax Filing" of filed payslips a "Full Payment Submission", or FPS.

Keep in mind that:

- If you ever want to refresh the status, tap the three dots: (in the top-right corner)

- Then tap: Reload

And that's it! That's everything you need to know about what happens when you pay payslips!

3. How do I see a list of the upcoming tasks for my pay batch5. How do I see payslips that've already been filed