How do I set a pay batch's Unique Taxpayer Reference?

1:44

"How do I set a pay batch's Unique Taxpayer Reference?"

The Unique Taxpayer Reference, or UTR, is a 10-digit code that uniquely identifies you or your business. Your UTR is used by HMRC whenever HMRC is dealing with your tax.

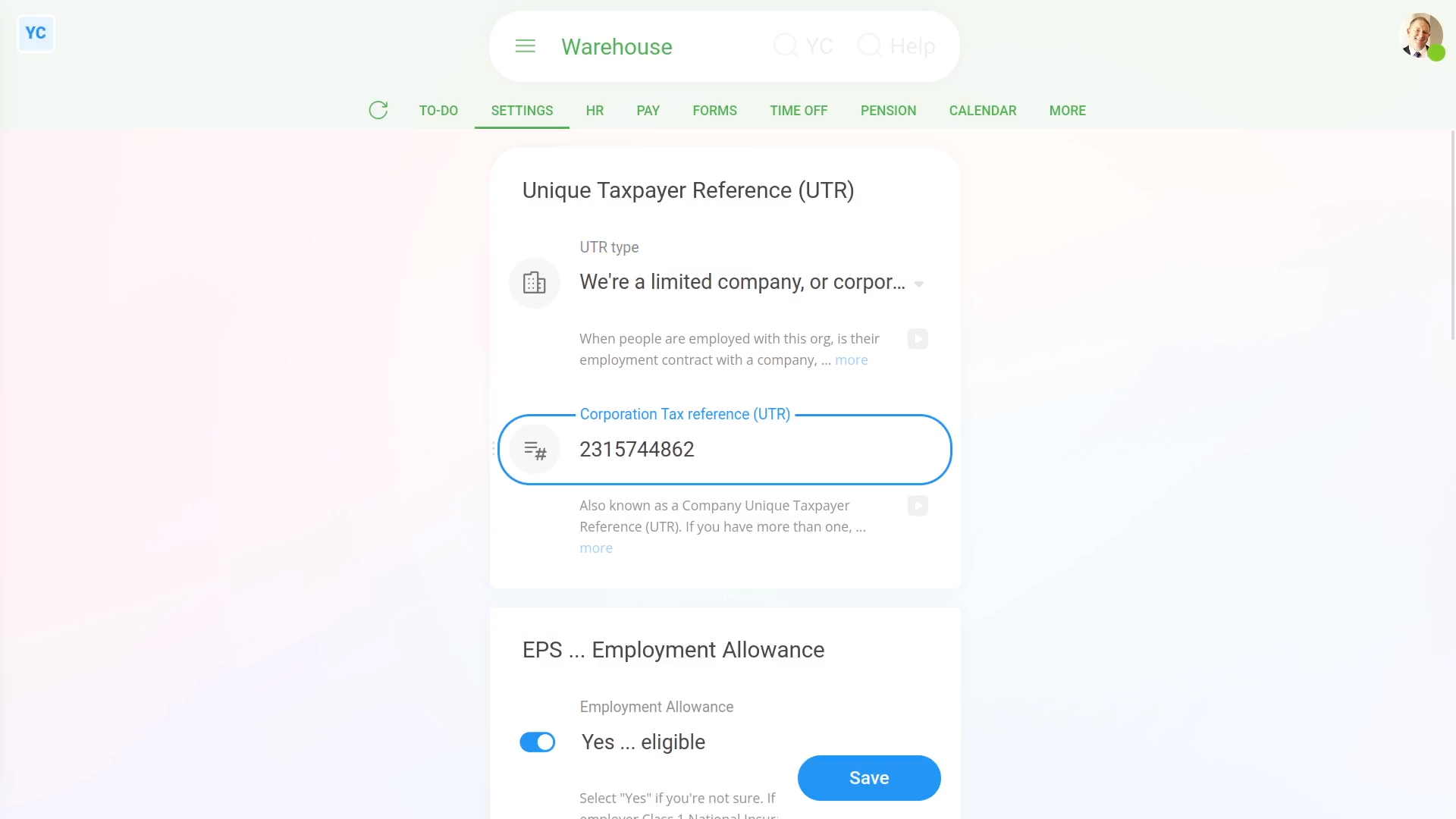

To set a pay batch's UTR:

- First, select the pay batch on: "Menu", then "Pay batches"

- Then tap: "Settings", then "Tax settings"

- Next, you'll need to decide if you're doing your Tax Filing as a company or a sole trader.

- And then you can type in your 10-digit UTR code.

- If you need help finding your UTR, tap the link to HMRC's website, and rea d HMRC's advice.

- And finally, tap: Save

Keep in mind that:

- Each pay batch can have a different UTR, or all your pay batch's can all share the same UTR. It's up to you.

- Each time you tap File now, your UTR is included, when your Tax Filing's sent to HMRC.

- Once the UTR is set, there normally isn't any reason to change it.

- If you're still waiting for your UTR to be sent to you, from HMRC, you can still run File now as long as you've set up your HMRC connection.

To learn more:

- About setting up your HMRC company connection, watch the video on: HMRC Tax Filing company connection

And that's it! That's everything you need to know about setting a pay batch's Unique Taxpayer Reference!