1. How do I decide the right employment type?

6:35

"How do I decide the right employment type?"

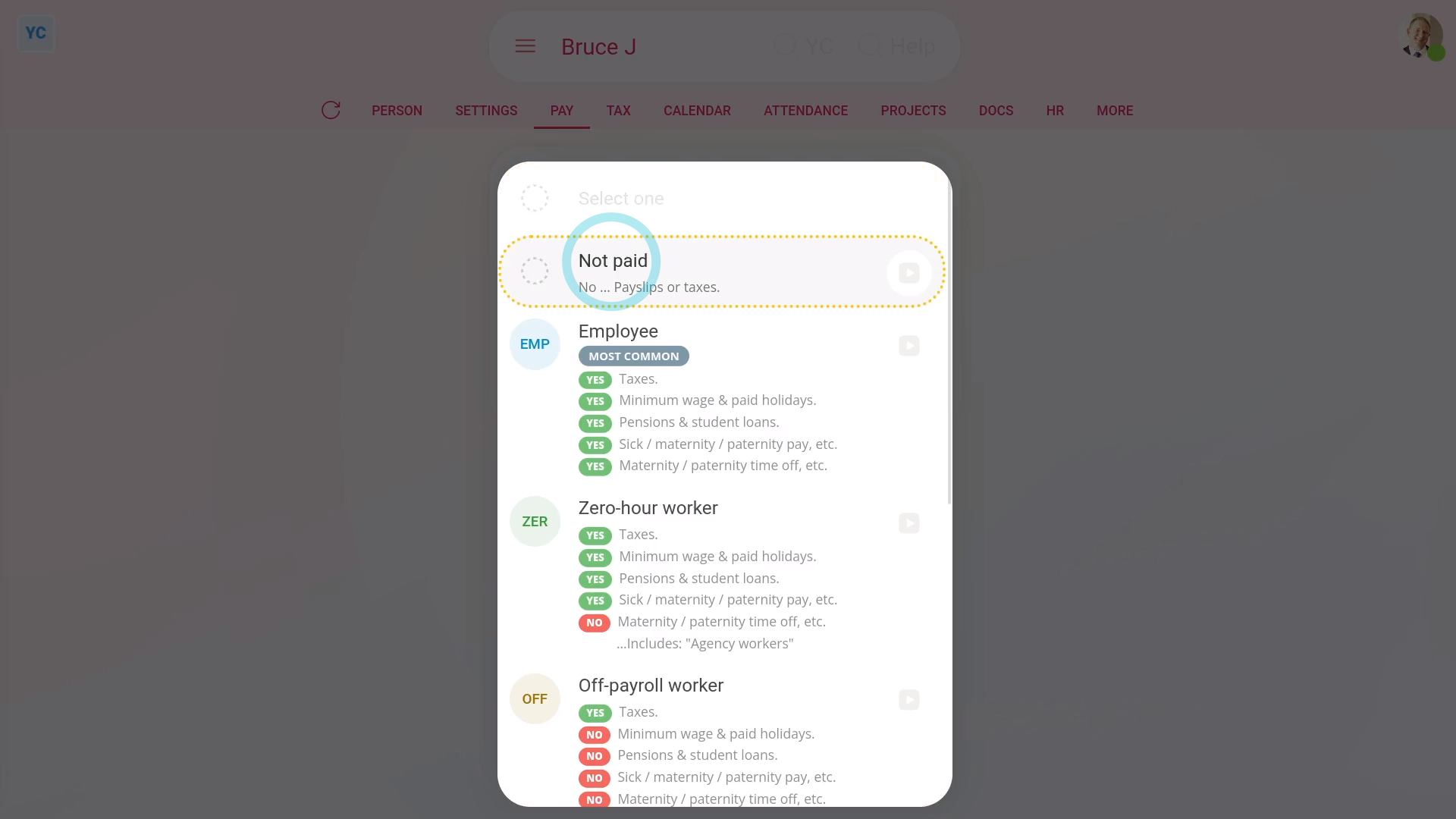

Setting "Employment type" tells you if a person's a contractor or an employee. It also tells you whether the person gets holiday pay or pensions, along with a few other things.

Not paid: To set a person's "Employment type" to "Not paid":

- First, select the person on: "Menu", then "People"

- Then tap: "Pay", then "Pay settings"

- And then: "Employment type"

- In the list that opens, select: "Not paid"

- "Not paid" is for people who are unpaid or paid elsewhere.

- And finally, selecting "Not paid" still lets you use all the HR features like timesheets and HR docs. But without the payroll features like payslips or taxes.

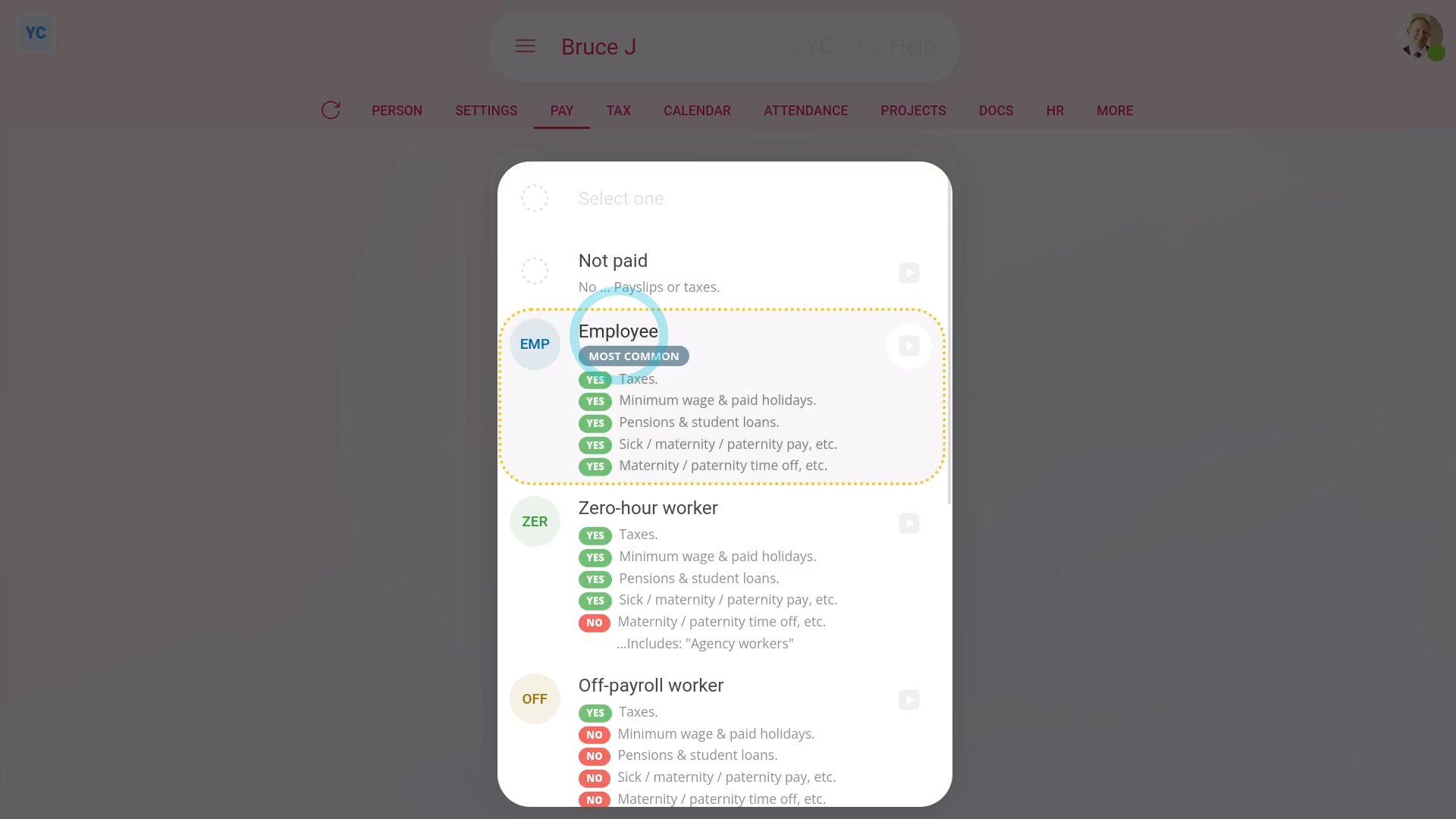

Employee: To set a person's "Employment type" to "Employee":

- First, select the person on: "Menu", then "People"

- Then tap: "Pay", then "Pay settings"

- And then: "Employment type"

- In the list that opens, select: "Employee"

- "Employee" is the most common employment type.

- Selecting "Employee" means the person's taxes get taken off their payslips.

- It also means the person gets all the normal benefits like paid holidays, pensions, and Statutory Leave.

- And finally, to learn more, see HMRC's page on: Employee employment status

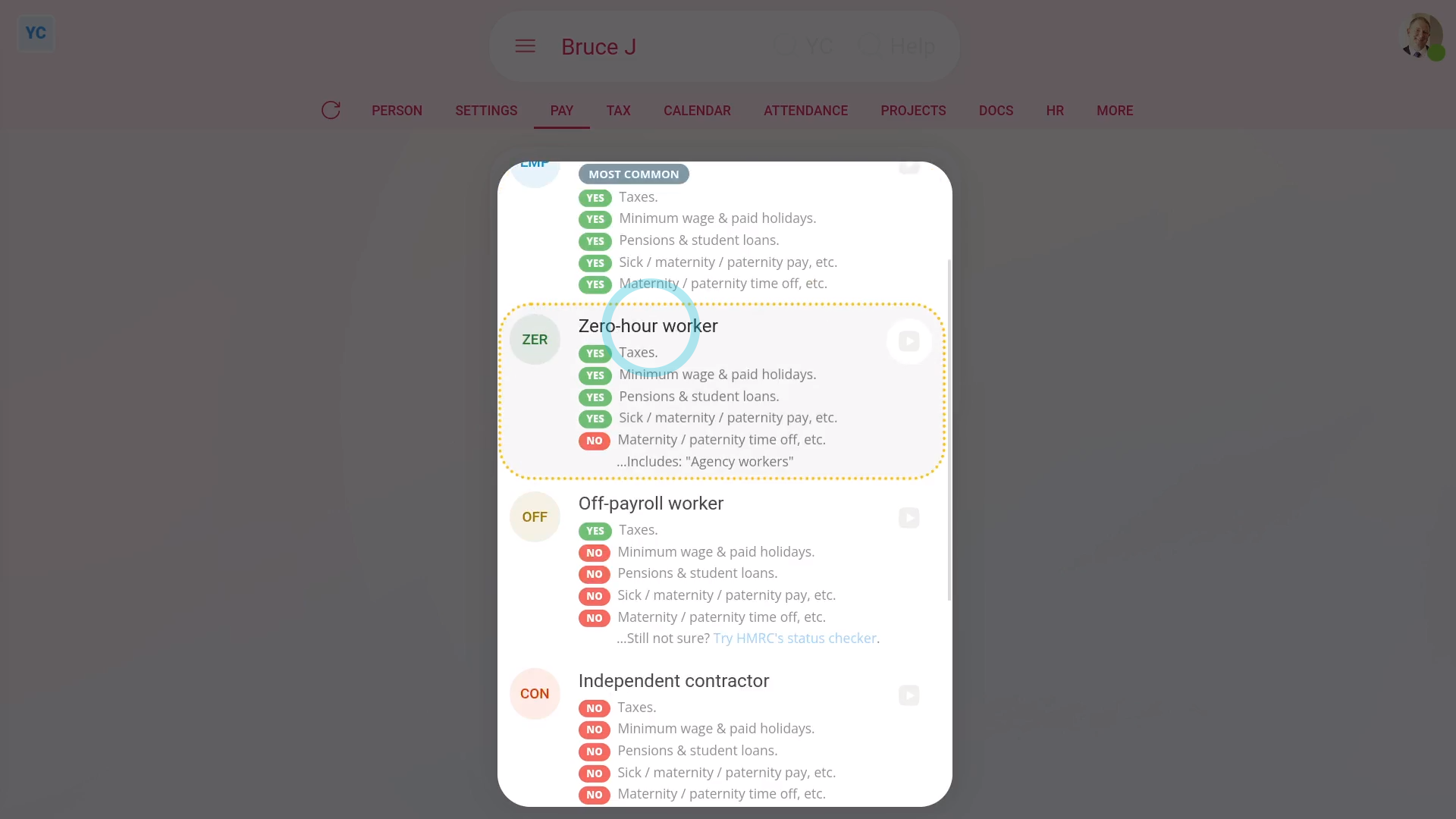

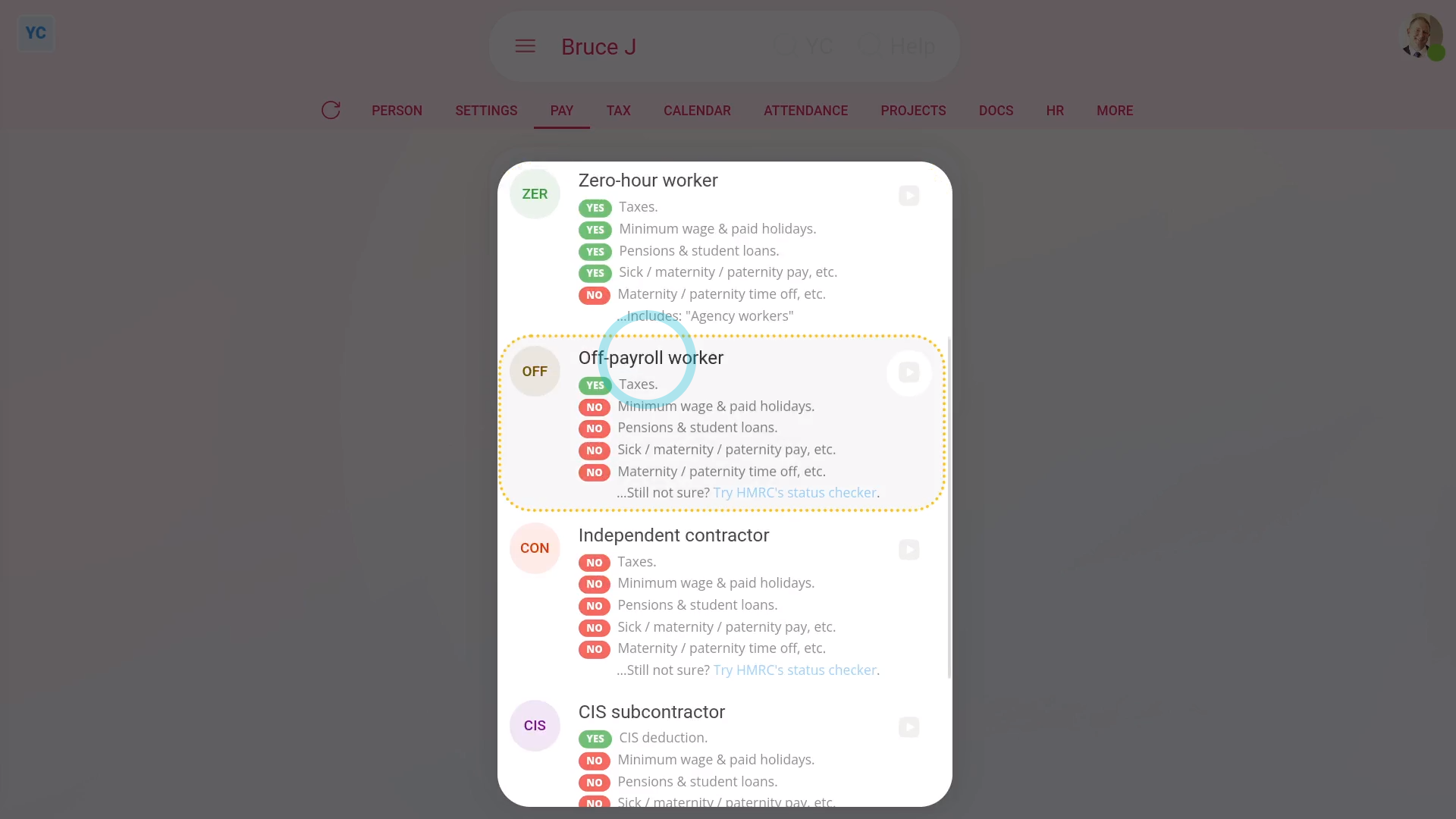

Zero-hour worker: To set a person's "Employment type" to "Zero-hour worker":

- First, select the person on: "Menu", then "People"

- Then tap: "Pay", then "Pay settings"

- And then: "Employment type"

- In the list that opens, select: "Zero-hour worker"

- Selecting "Zero-hour worker" means the person gets most of the same benefits as employees, like paid holidays and pensions, but doesn't get Statutory Leave.

- Examples of "Zero-hour worker" includes: agency workers, casual or short contract employees, and some freelancers.

- A person's usually a "Zero-hour worker" for either of the following. Either their shift changes with little notice. Or, the person sometimes does work for you, but can also decide to not work for you.

- And finally, to learn more, see HMRC's page on: Worker employment status

Off-payroll worker: To set a person's "Employment type" to "Off-payroll worker":

- First, select the person on: "Menu", then "People"

- Then tap: "Pay", then "Pay settings"

- And then: "Employment type"

- In the list that opens, select: "Off-payroll worker"

- Selecting "Off-payroll worker" means the person is a contractor that HMRC says is to be taxed like an employee.

- However, off-payroll workers don't get the benefits that employees get, like paid holidays, pensions, or Statutory Leave.

- Your off-payroll workers usually work for you through their own company.

- A person's an "Off-payroll worker" and not an "Independent contractor" if the person would be a regular employee if you hired them directly.

- Which can be common for IT contractors or contracts that relate to IR35.

- And finally, if you're not sure whether a person's an "Off-payroll worker", try HMRC's status checker.

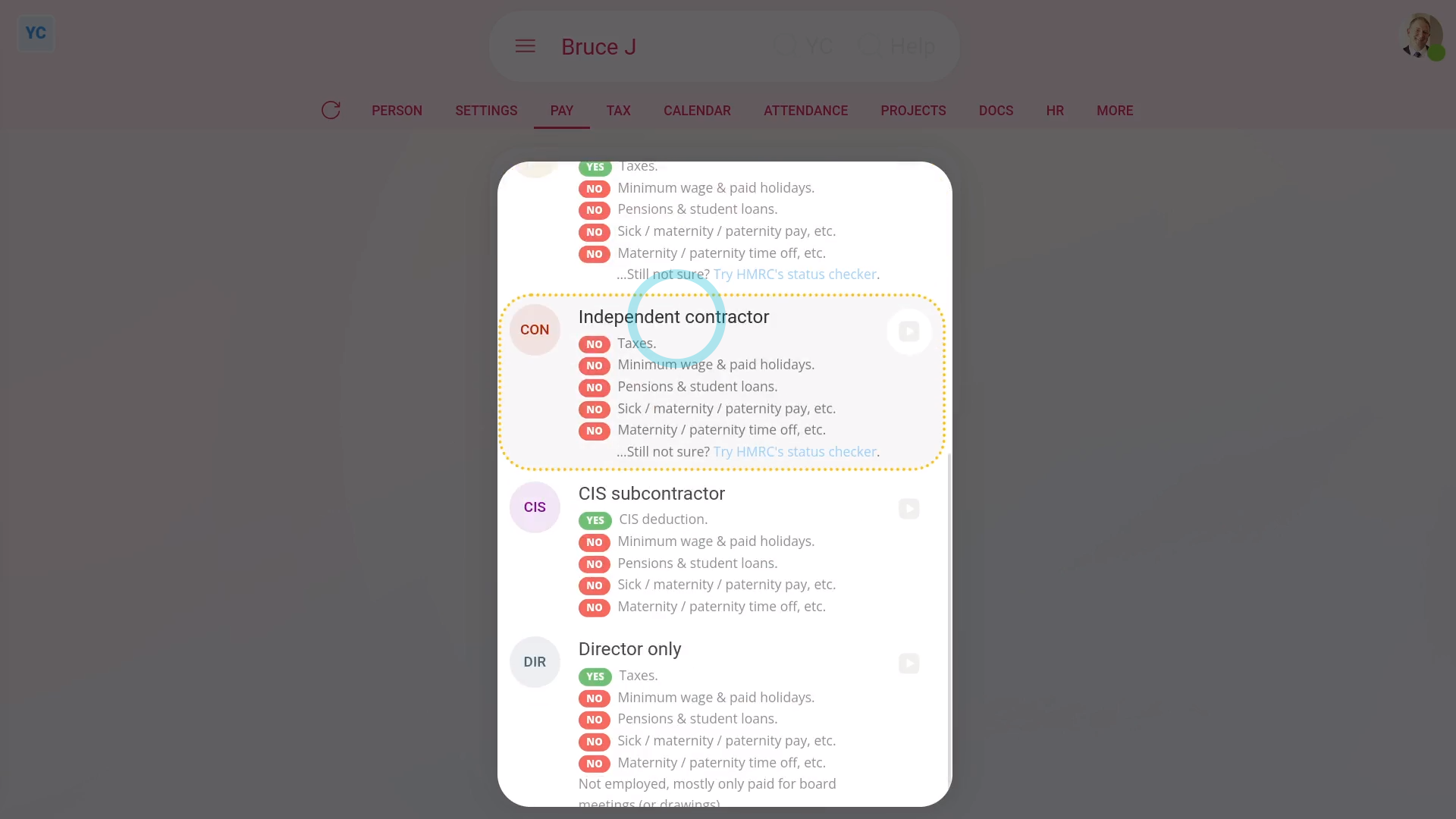

Independent contractor: To set a person's "Employment type" to "Independent contractor":

- First, select the person on: "Menu", then "People"

- Then tap: "Pay", then "Pay settings"

- And then: "Employment type"

- In the list that opens, select: "Independent contractor"

- Selecting "Independent contractor" means the person doesn't have taxes taken off their payslips.

- Also, contractors don't get any of the benefits employees have, like paid holidays, pensions, and Statutory Leave.

- An independent contractor runs their own business and does their own taxes.

- Your independent contractors usually decide their own work hours, supply their own work tools, invoice you for the work done, and don't get paid for holidays.

- To learn more, see HMRC's page on: Self-employed and contractor employment status

- And finally, if you're not sure whether a person's an "Independent contractor", try HMRC's status checker.

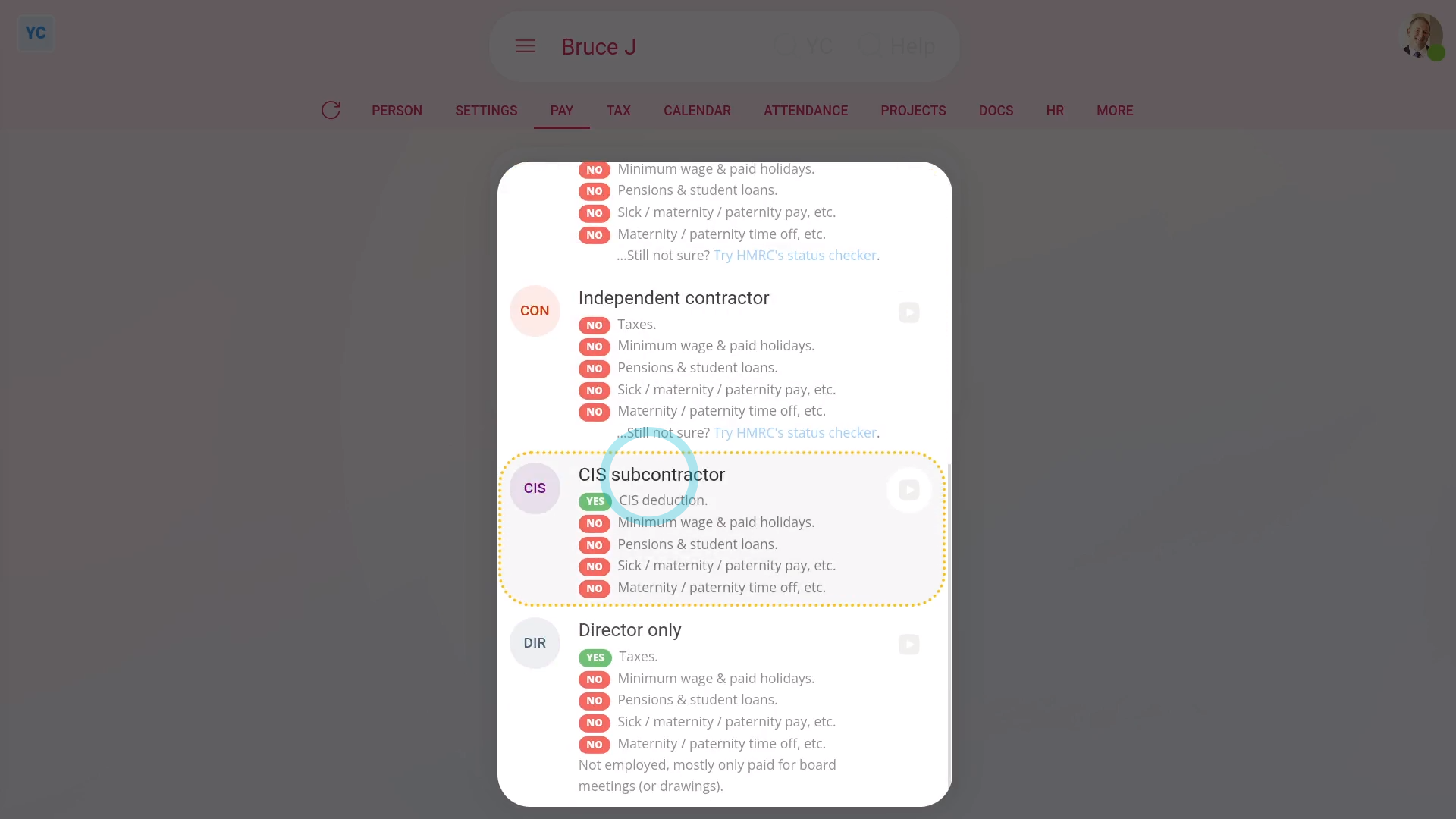

CIS subcontractor: To set a person's "Employment type" to "CIS subcontractor":

- First, select the person on: "Menu", then "People"

- Then tap: "Pay", then "Pay settings"

- And then: "Employment type"

- In the list that opens, select: "CIS subcontractor"

- Selecting: "CIS subcontractor" means the person works in construction jobs. It also means a 20 to 30 percent amount is taken off their pay for what HMRC calls a: "CIS deduction"

- Your CIS subcontractors don't get any of the employee benefits like paid holidays, pensions, and Statutory Leave.

- To learn more about how to see how to set up a new "CIS subcontractor", watch the video on: Adding a pre-verified CIS subcontractor

- Also watch the video on: Adding an un-verified CIS subcontractor

- And finally, see HMRC's page on the: Construction Industry Scheme (CIS)

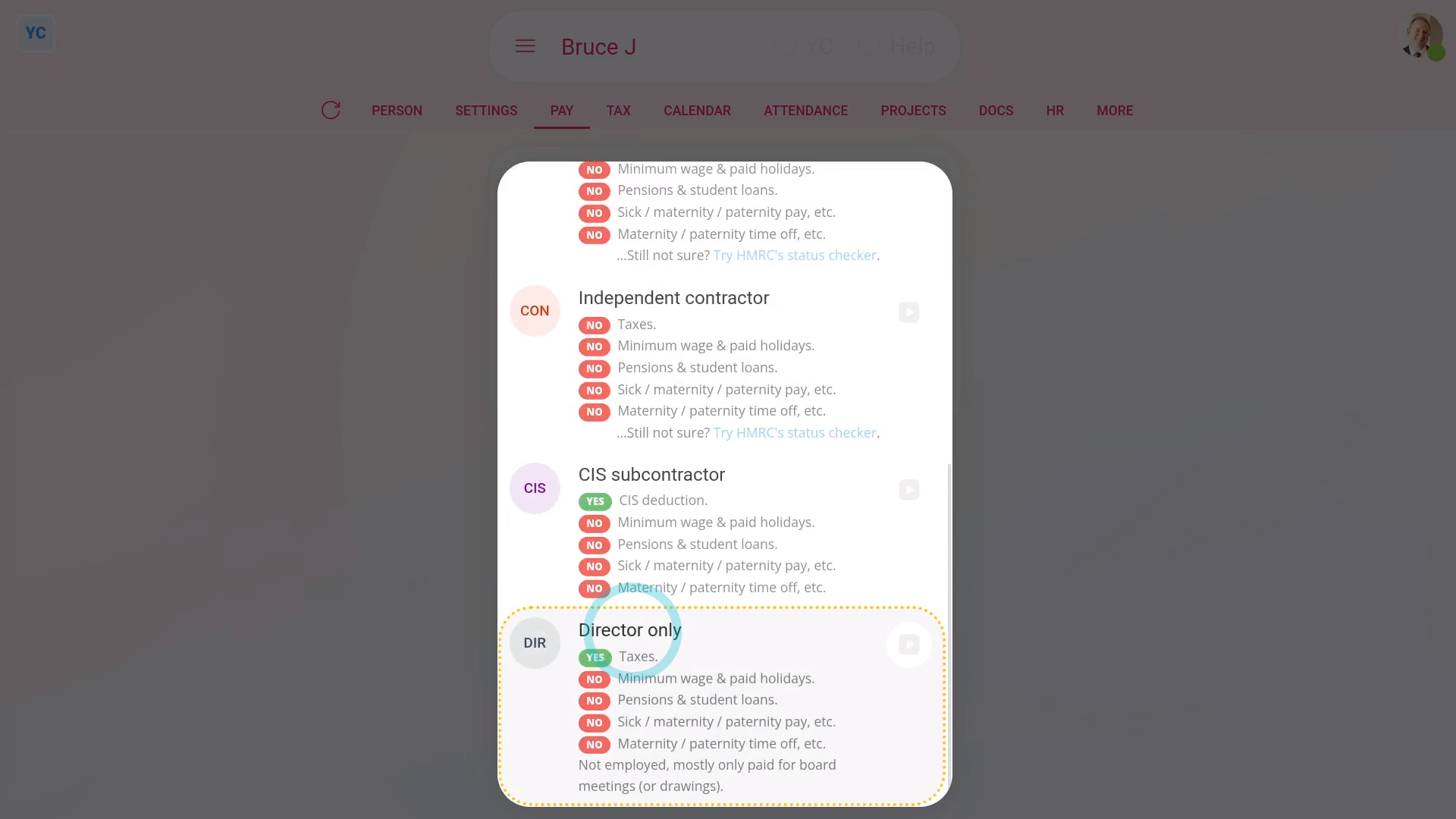

Director only: To set a person's "Employment type" to "Director only":

- First, select the person on: "Menu", then "People"

- Then tap: "Pay", then "Pay settings"

- And then: "Employment type"

- In the list that opens, select: "Director only"

- Selecting "Director only" means the person doesn't also have a job with the company.

- Director only usually means the director gets paid to attend board meetings, but isn't paid for their time worked.

- If the director also works for the company as an employee, set them as an: "Employee"

- To learn more about how to set a person as a director, watch the video on: Setting directorships

- And finally, also see HMRC's page on: Director employment status

And that's it! That's everything you need to know about choosing employment types for your people!