How do I set up my HMRC Tax Filing external tax agent connection?

2:55

"How do I set up my HMRC Tax Filing external tax agent connection?"

Before sending filed payslips to HMRC, you first need an "HMRC Tax Filing" connection. There's two ways to connect. A company connection, or a external tax agent connection.

To set up your external tax agent connection to HMRC:

- First, open yourself on: "Menu", then "Me"

- Then tap: "Tax", then "External tax agent"

- And turn on: "Are you an external tax agent, accountant, or bookkeeper?"

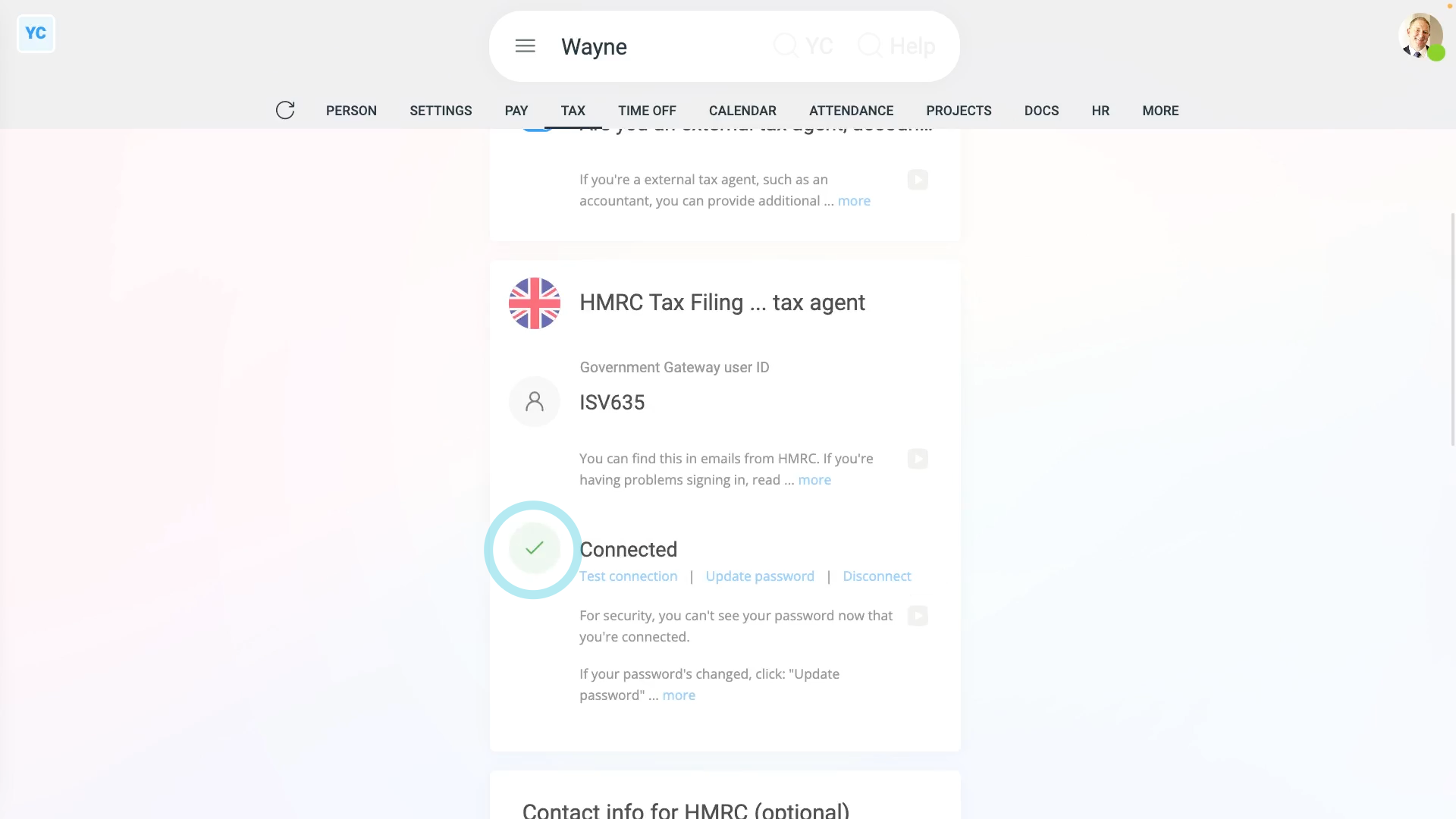

- Next, scroll down to the "HMRC Tax Filing ... tax agent" heading.

- To learn how to set up the required logins, see the "GOV.UK" links.

- Then type in your: "Government Gateway user ID"

- And then your external tax agent: "Government Gateway password"

- And tap: Save

- All your details are then checked by HMRC.

- And in a few seconds you'll get a confirmation message.

- Once you get the confirmation message, you'll see a green check confirming that you're all connected to HMRC.

- And you're now ready to submit payroll for your client companies each payday. You won't have to set your connection details again.

- If you ever need to check the connection, you can tap the blue "Test connection" link.

- If you ever need to update your password, you can tap the blue "Update password" link.

- And if you want to delete your connection, you can tap the blue "Disconnect" link.

- Optionally, you can also store your contact details to be sent with HMRC submissions.

- The contact details help HMRC know who to go to if HMRC has questions.

- And finally, as an external tax agent, you're now ready to send filed payslips to HMRC on behalf of any of your client companies.

Keep in mind that:

- Only the person, themselves, can set up their own external tax agent connection to HMRC.

- Other users, including admins, can't see the external tax agent page, on behalf of another person.

- Also, if you're choosing between a company connection, or an external tax agent connection, it's recommended to pick the company connection.

- The advantage with a company connection is if the external tax agent's off sick, other people can fill in and do HMRC submissions.

To learn more:

- About setting up your HMRC company connection, watch the video on: HMRC Tax Filing company connection

And that's it! That's all you need to do to set up your HMRC Tax Filing external tax agent connection!