What tax settings do I need to set for a veteran?

2:51

"What tax settings do I need to set for a veteran?"

If you employ a veteran, you may get tax relief from the government for the first 12 months after the veteran starts their first job.

To set a person's veteran tax settings:

- First, select the veteran on: "Menu", then "People"

- Then tap: "Tax", then "Tax settings"

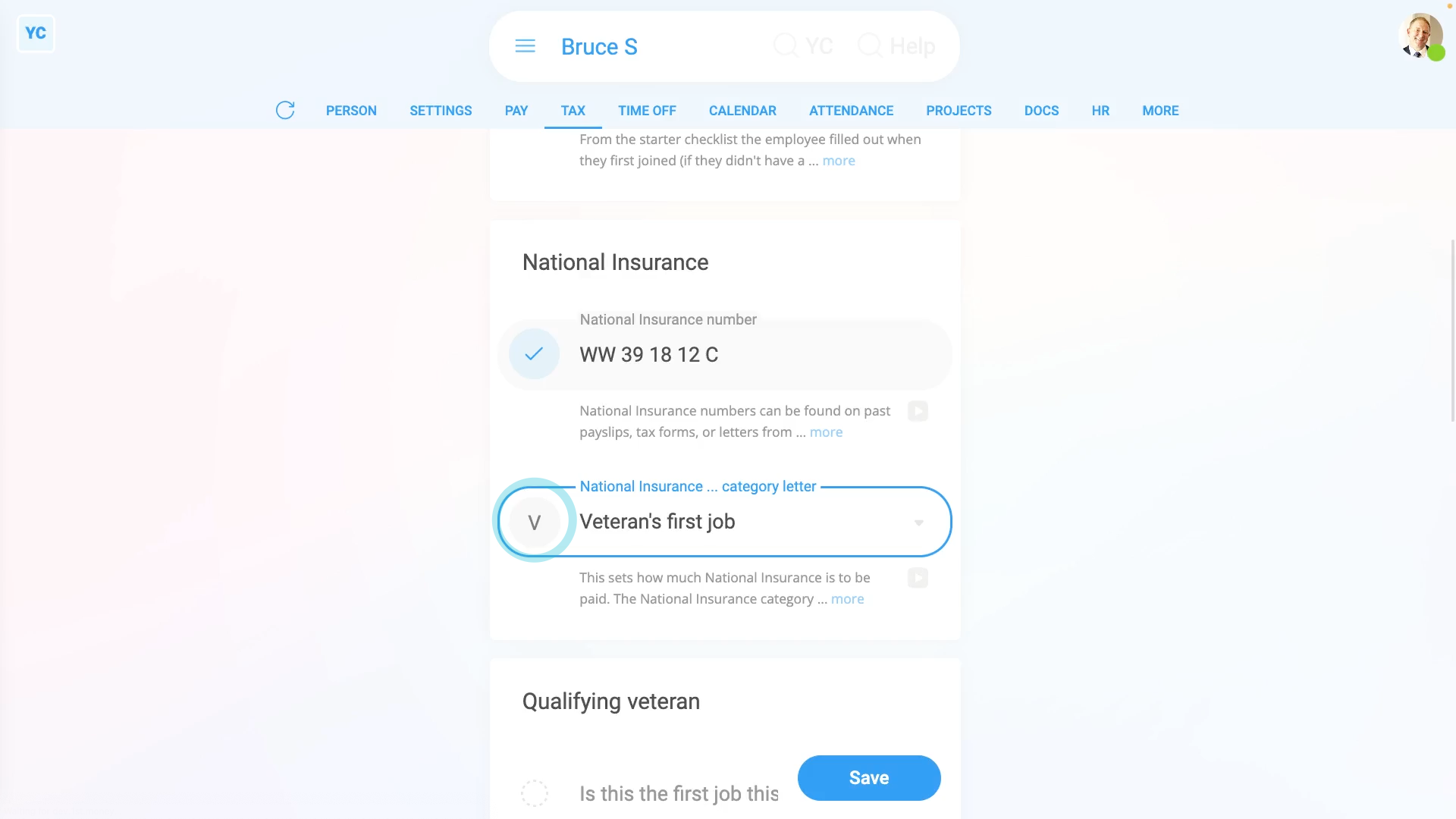

- Then scroll down to the "National Insurance" heading.

- Next, to decide if the veteran qualifies.

- Find out if it's their first job since leaving the armed forces.

- If "Yes", then set their "National Insurance category letter" to: "V"

- Otherwise, find out when, after leaving the armed forces, their "first job start date" was.

- If it's not yet been 12 months since their "first job start date", then also set their "National Insurance category letter" to: "V"

- In all other cases, if it's been over 12 months since their "first job start date", set their "National Insurance category letter" to something else.

- If you've set their "National Insurance category letter" to: "V"

- You'll see a new heading appear, called: "Qualifying veteran"

- Next, select if it's their "first job as a veteran", or if the veteran's: "had another job"

- Then if the veteran's "had another job", enter their: "Date of first civilian employment"

- Next, upload, or take a photo of a document that shows their armed forces employment.

- And finally, after you've uploaded the document, your changes are now auto-saved.

Examples of an approved document to upload, include:

- Their discharge papers.

- Their identification card, which shows their time in the armed forces.

- Their letter of employment, or contract with the armed forces.

- Or their P45, from leaving the armed forces.

Keep in mind that:

- A UK veteran includes any person that's ever served in any regular branch of the British Armed Forces.

- Including: the Royal Navy, the British Army, and the Royal Air Force.

- And that the qualifying period begins on the first day of the veteran's first civilian employment, since leaving the armed forces.

- The qualifying period ends 12 months later.

- Their tax relief could mean that the employer doesn't have to pay any employer National Insurance for the veteran's first 12 months.

And that's it! That's everything you need to know about tax settings for a UK veteran!

What does the 'Show pay as' setting doWhen can a person's pay be lower than the standard minimum wage