What are the advanced tax settings?

2:04

"What are the advanced tax settings?"

There's four advanced tax settings that occasionally you may need to set.

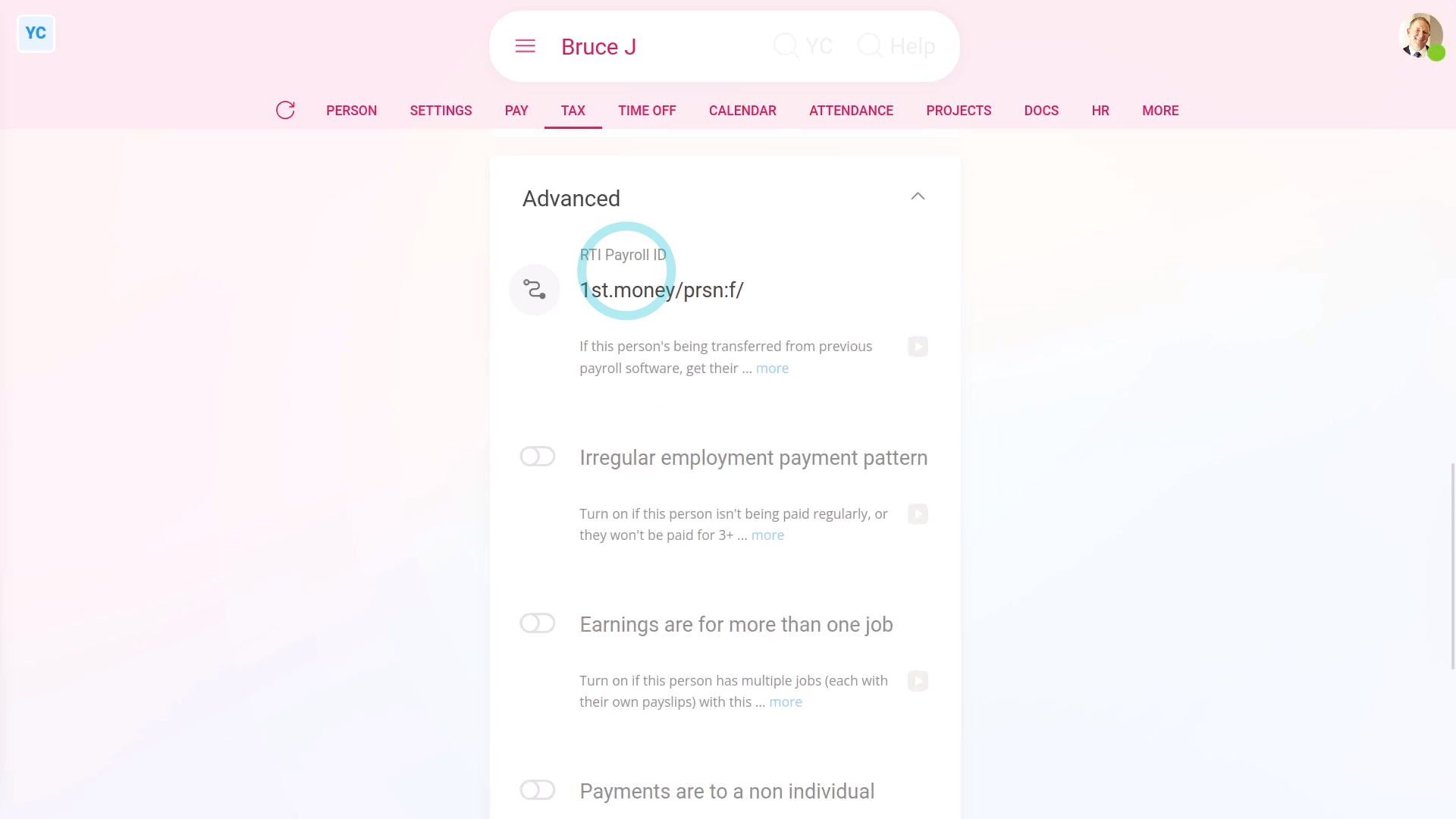

To set a person's advanced tax settings:

- First, select the person on: "Menu", then "People"

- Then tap: "Tax", then "Tax settings"

- Then scroll down and tap the heading "Advanced", to show its contents.

- The first advanced tax setting is: "RTI Payroll ID"

- It must always have something in it, and must never be empty.

- If you've migrated the person over from another payroll platform, HMRC requires you to enter the "RTI Payroll ID" used on the other platform.

- Maintaining the same "RTI Payroll ID" allows HMRC to match up their records, throughout the tax year, from both platforms.

- Next, is "Irregular employment payment pattern" which is for when the person isn't being paid regularly.

- Including when you won't be paying them for 3 months, or more. Like, for casual employees, or when on long-term sick leave.

- Check out the HMRC link, to learn more.

- Next, is "Earnings are for more than one job" which is for when the person's got multiple jobs.

- But only for when those multiple jobs are each inside a single company, or with associated businesses.

- See the HMRC link, to learn more.

- Last is "Payments are to a non individual" which is for when payday payments aren't made to the person.

- Instead, payday payments are made in the name of: "a personal representative, trustee or corporate organisation"

- And finally, tap the HMRC link, to learn more.

Keep in mind that:

- It's rare that you'll ever have to set any of the advanced tax settings, but the settings are there if you need them.

And that's it! That's everything you need to know about advanced tax settings!