How do I set up a HMRC Tax Filing company connection?

2:27

"How do I set up a HMRC Tax Filing company connection?"

Before sending filed payslips to HMRC, you first need an "HMRC Tax Filing" connection. There's two ways to connect. A external tax agent connection, or a company connection.

To set up your company connection to HMRC:

- First, select the pay batch on: "Menu", then "Pay batches"

- Then tap: "Settings", then "HMRC Tax Filing"

- Now type in your: "Accounts Office reference"

- You can find it on the welcome letter HMRC sent when you first registered as an employer.

- Also type in your: "Employer PAYE reference"

- It's also found on the welcome letter, in your Government Gateway account, or on other letters and emails from HMRC.

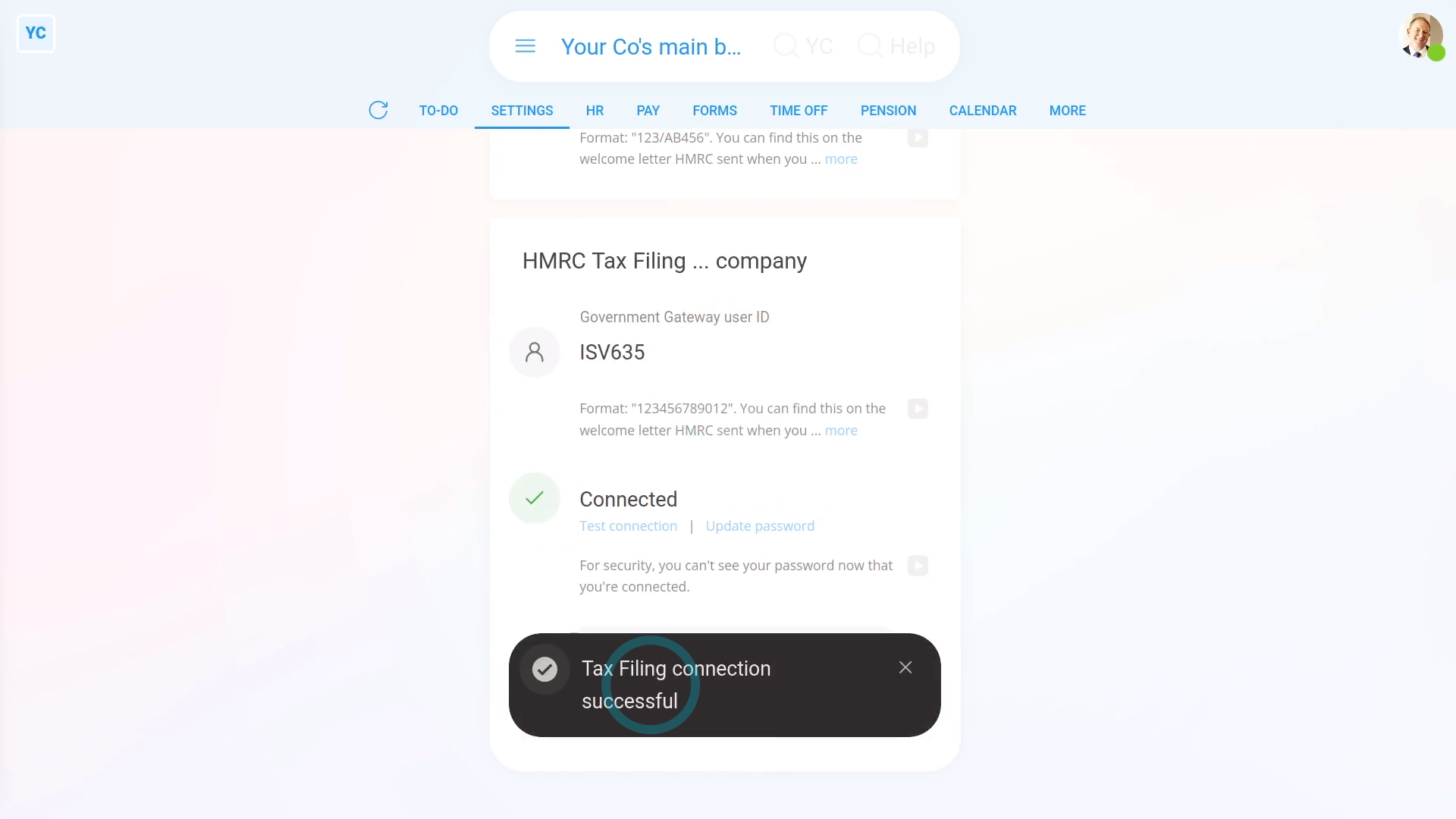

- Next, type in your company's: "Government Gateway user ID"

- And then your company's: "Government Gateway password"

- Tap: Save

- All your details are now being checked by HMRC. In a few seconds you'll see the confirmation message.

- Once you get the confirmation message, your pay batch's all connected to HMRC.

- And finally, you're now ready to submit payroll each payday. You won't have to set your connection details again.

Keep in mind that:

- Your "HMRC Tax Filing" connection is used for FPS and EPS submissions. It's also used for verifying National Insurance numbers.

- If you've got more than one pay batch, you'll need to do the connection steps again, for each of your other pay batches as well.

- If multiple pay batches all belong to the same company, reuse the exact same ID and password for each pay batch.

- Also, if you're choosing between a company connection, or a external tax agent connection, it's recommended to pick the company connection.

- The advantage with a company connection is if the external tax agent's off sick, other people can fill in and do HMRC submissions.

To learn more:

- About setting up your HMRC external tax agent connection, watch the video on: HMRC Tax Filing external tax agent connection

And that's it! That's everything you need to know about setting up an HMRC Tax Filing company connection!