How do I enter a National Insurance number and make sure it's valid?

2:32

"How do I enter a National Insurance number and make sure it's valid?"

National Insurance numbers help HMRC keep track of the identity of each tax payer.

To enter a National Insurance number for a person:

- First, select the person on: "Menu", then "People"

- Then tap: "Tax", then "Tax settings"

- Then enter their: "National Insurance number"

- Then once you tap Save, 1st Money first confirms that you've entered all HMRC's required info about the person.

- The required info includes: name, address, legal gender, date of birth, and payroll ID.

- If you're missing some of the required info, you'll get a warning that something's missing.

- To fix the warning, tap the item that's missing.

- Type in their missing info.

- Then tap: Save

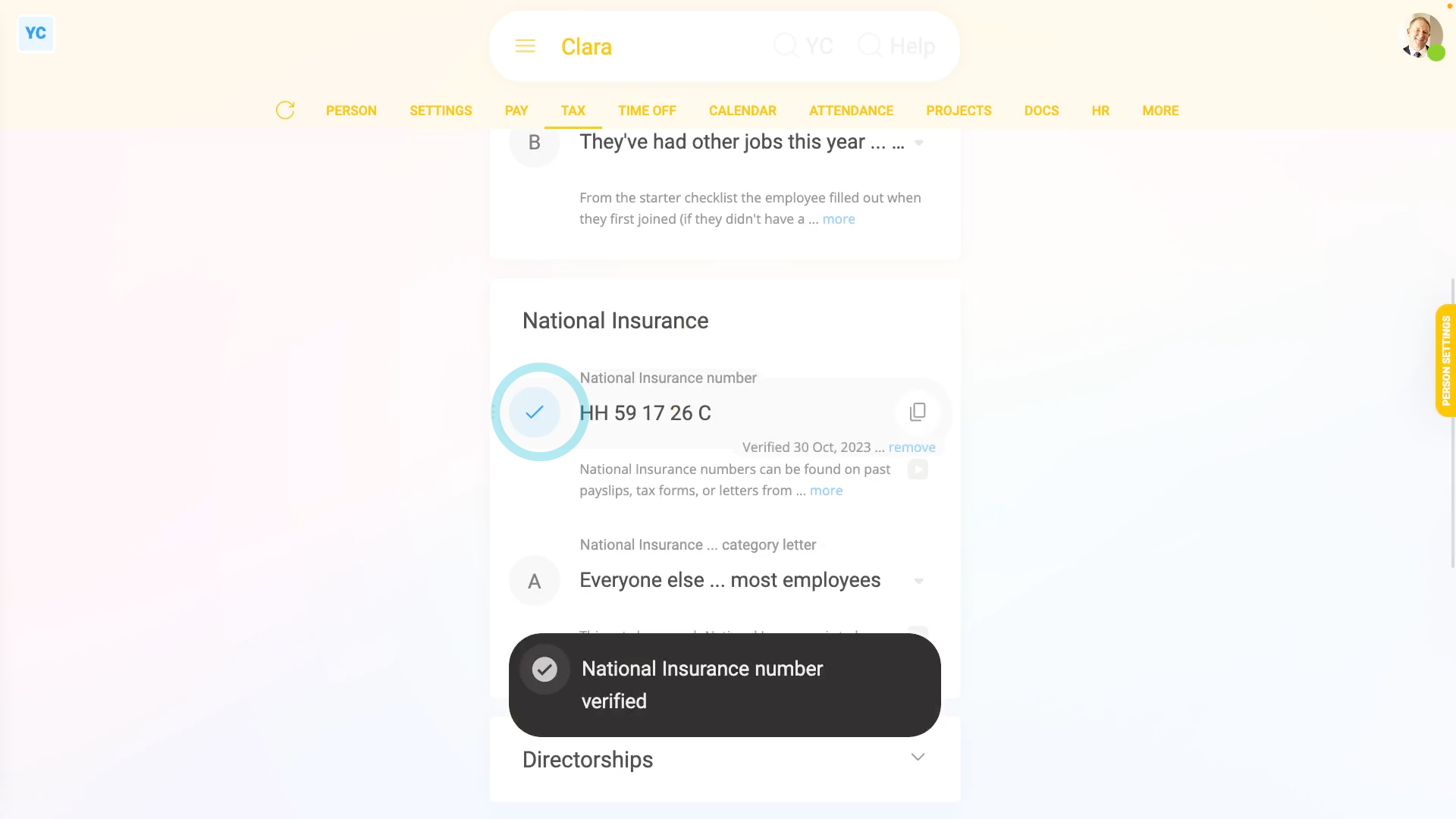

- Now, to try again, tap: Verify NI

- Their National Insurance number is now verified by HMRC again.

- It usually takes 15 to 20 seconds for HMRC to finish processing your verification request.

- As part of the verification, the person's name, address, legal gender, date of birth, and payroll ID are all sent to HMRC.

- And finally, once HMRC's finished verifying, you'll see the confirmation message, and the person's National Insurance number is now verified with a blue tick.

Keep in mind that:

- The person's National Insurance number can be found on their past payslips, tax forms, or letters from HMRC.

- Also, a person's National Insurance number verification only has to be done once.

For advanced usage:

- It's possible to pay a person without a verified National Insurance number.

- However, on payday, the payroll admin sees a red warning saying that the National Insurance number hasn't been verified.

- Also, a warning email is sent to the person receiving the pay, for each payday that their National Insurance number hasn't been verified.

And that's it! That's all you need to do to verify a person's National Insurance number with HMRC!

How do I decide my payrolling benefits setting, and do my P11DHow do I get a printable PDF of filed payslips