Benefits-in-kind. 3. How do I add as company arranged?

2:26

"Benefits-in-kind. 3. How do I add as company arranged?"

A company arranged benefit-in-kind is a way for the company to provide something beneficial to an employee beyond only money.

To add a company arranged benefit-in-kind:

- First, select the person who's getting the company arranged benefit-in-kind, on: "Menu", then "People"

- Next, go to: "Pay", then "Pay settings"

- And scroll down to the "Repeat payables ... personal" heading.

- Then tap: New repeat payable

- Next, select: Benefit-in-kind

- Next, type in a "Description" of the benefit-in-kind.

- Select the time frame for the: "Amount type"

- And then type in the: "Amount"

- By default, "Arranged by" is already set to: "Company"

- Then scroll down and tap the "Advanced" heading.

- If there's a co-pay, or an amount that the person's agreed can be taken off their pay, enter that also in: "Employee deducted co-pay"

- Then tap: Save

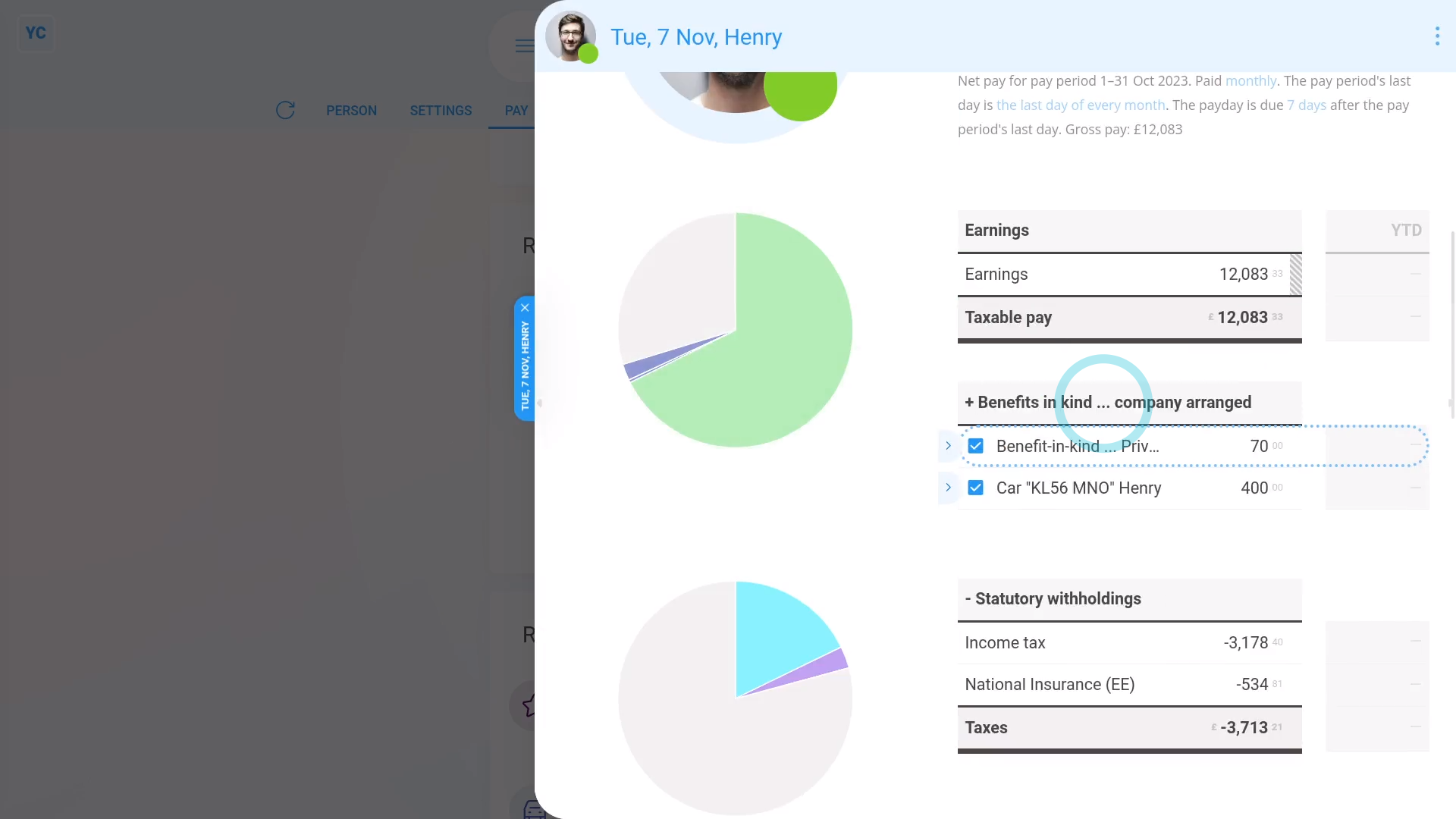

- Now, to see how it shows up on the person's payslip, hover your mouse over the repeat payable, and tap the "See on payslip" button:

- You'll now see an amount showing under: "Benefits-in-kind ... company arranged"

- There may have been a co-pay, or an amount that the person's agreed can be taken off their pay. If so, you'll also see that amount showing as: "Employee deducted co-pay"

- And finally, if you hover your mouse over the amounts, you'll see a breakdown of their calculations.

Keep in mind that:

- As a "Benefits-in-kind ... company arranged", the benefit is taxed by both "Income Tax" and: "National Insurance (Class 1A)"

- Which results in the person paying slightly higher taxes, compared to a: "Benefits-in-kind ... employee arranged"

- Also, because it's a benefit-in-kind, there's no change to the person's in-the-hand pay (besides the tax adjustment).

To learn more:

- About a "Benefits-in-kind ... employee arranged", watch the video on: Employee arranged benefit

And that's it! That's everything you need to know about adding a company arranged benefit-in-kind.

Benefits-in-kind. 2. How do I give to a person as repeatingBenefits-in-kind. 4. How do I add as employee arranged