Expense claims. 1. How do I submit one?

1:44

"Expense claims. 1. How do I submit one?"

When you spend your personal money to buy something for your employer, you can claim the cost back by submitting an expense claim.

To submit an expense claim:

- First, tap: "Menu", then "Expense claim"

- If you've got an image, like a receipt, that you'd like to include, you can upload, or take a photo of it.

- Then tap: Next

- Type in the amount you're requesting.

- And tap: Next

- You can add notes to help your payday person know why you're requesting the expense.

- Or you can select one from the list.

- Then tap: Next

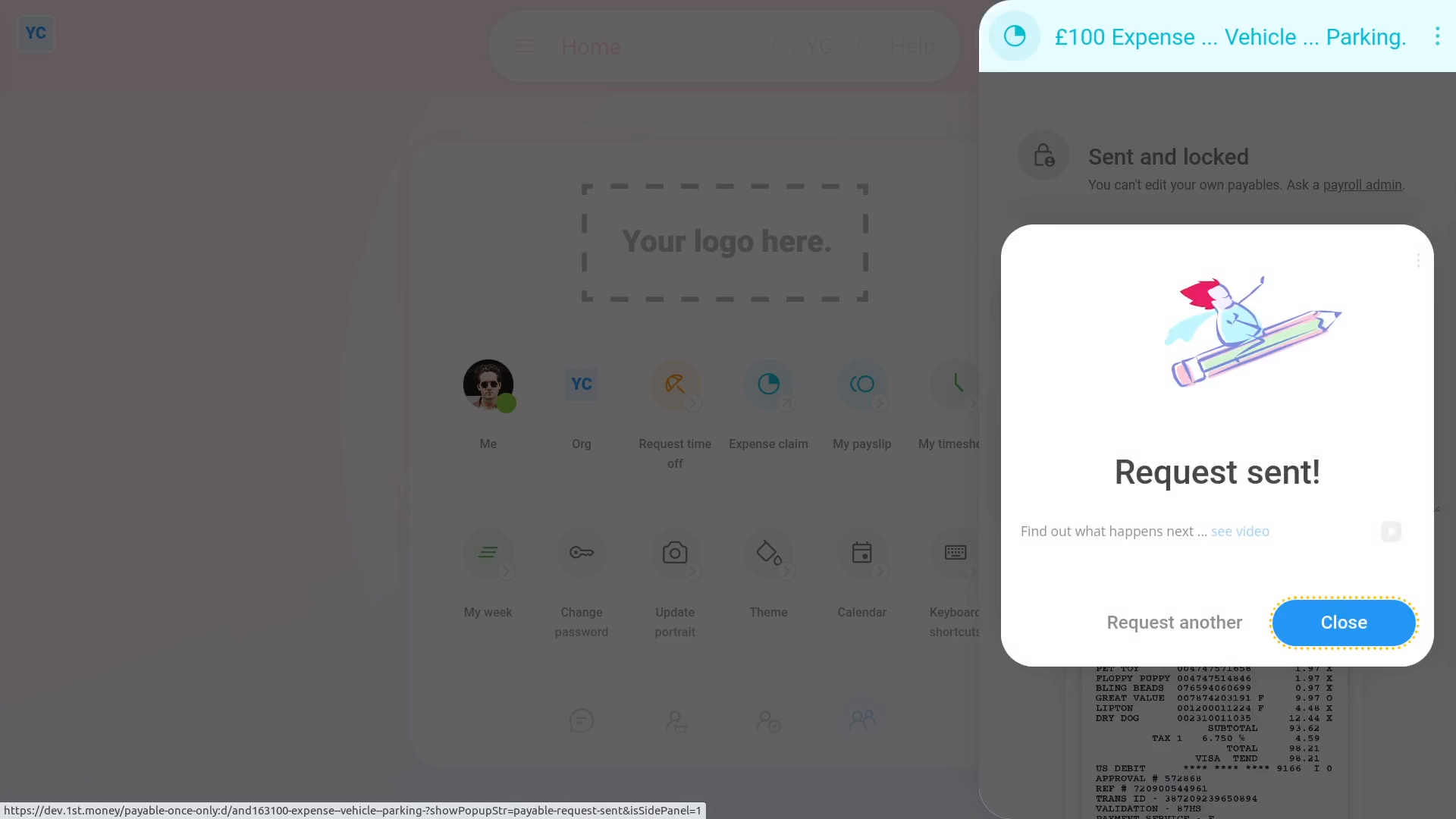

- And now you're all done submitting your expense.

- If you want to submit another one, tap: Request another

- Otherwise, tap Close to review your expense claim.

- Then in the background, an email's been sent to your payday person to approve your expense claim.

- Once your payday person's approved your expense, you'll get an email.

- From the email, tap: See expense

- And you'll see the green tick showing that it's been approved.

- And finally, when you scroll down you'll see (at the bottom) the date of the payslip that it's to be paid with.

Keep in mind that:

- Any expense claim payment that's paid back to you is paid free of any tax deductions.

- Once approved, your expense claim is paid back to you along with your normal payslip.

And that's it! That's everything you need to know about submitting an expense claim!

Benefits-in-kind. 5. How do I deduct the co-payExpense claims. 2. How do I resubmit if it's declined