How do I understand added vs taken off, and post-tax vs pre-tax?

4:14

"How do I understand added vs taken off, and post-tax vs pre-tax?"

The "added" vs "taken off", and "post-tax" vs "pre-tax" options can be tricky to understand.

To see a payable's four "added" vs "taken off", and "post-tax" vs "pre-tax" options:

- First, tap: "Menu", then "Expense claim"

- Select the person who the expense is being applied to.

- Now you can decide whether the expense claim's "Added to pay" or: "Taken off pay"

- And whether the expense claim's "Post-tax", or: "Pre-tax"

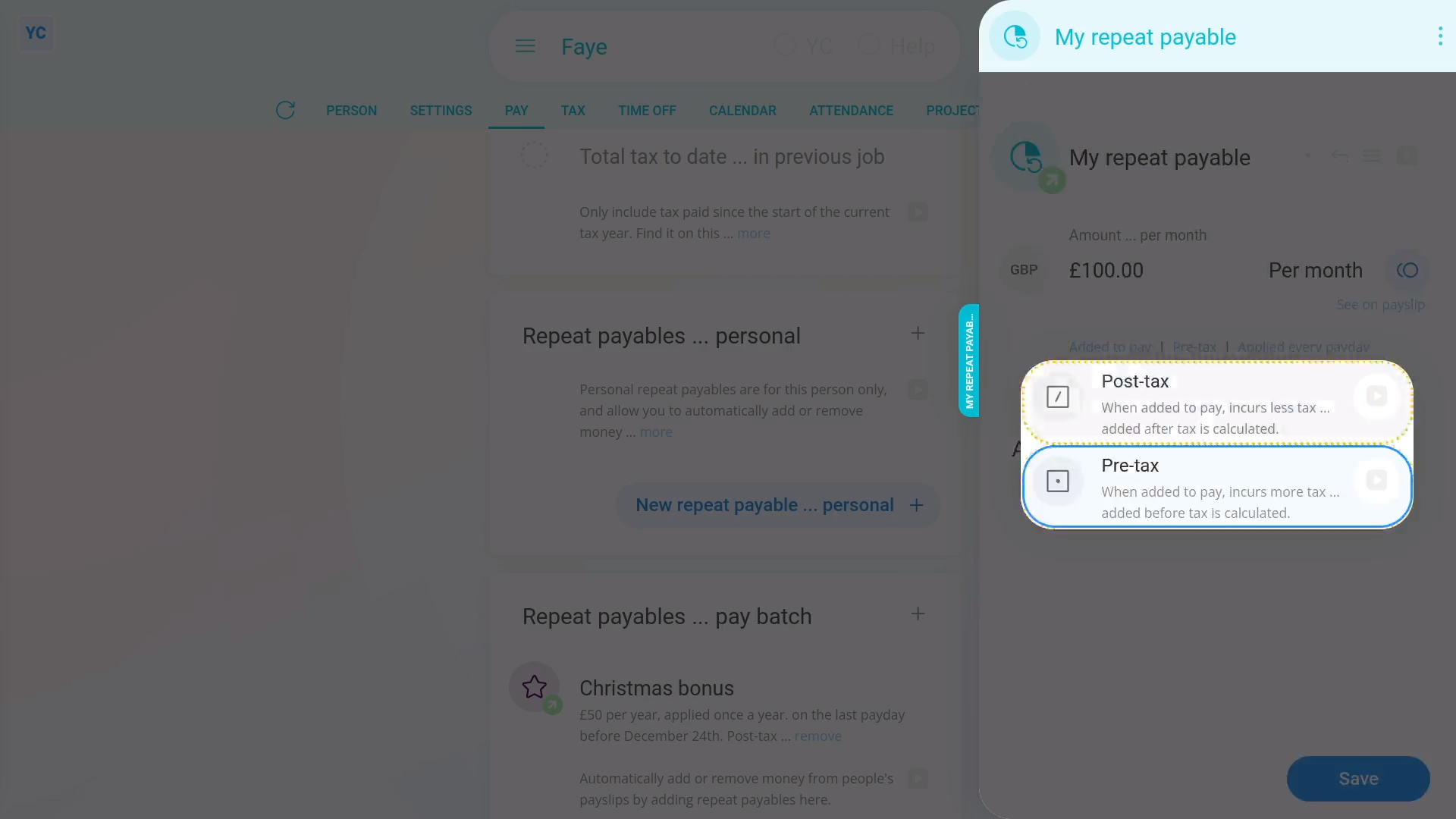

- To see the four "added" vs "taken off", and "post-tax" vs "pre-tax" options for a repeat payable:

- First, open: "Menu", then "People"

- And then go to: "Pay", then "Pay settings"

- And scroll down to the "Repeat payables ... personal" heading.

- Then tap: New repeat payable

- And select the type.

- And give the repeat payable a name and an amount.

- Next up, set it to "Added to pay" with "Post-tax" selected.

- Now, when you tap See on payslip, you'll see the expense listed under the heading: "Post-tax benefits and reimbursements"

- You'll also notice that it's listed below the "Taxes" row.

- The person's better off, as their pay gets added the full amount, without taxes taken off.

- The person's received the full amount added to their pay because it's post-tax.

- Examples of "Post-tax" amounts that are "Added to pay" include: expense claims, out-of-pocket expense reimbursements, company travel expenses, and "per diems" like company business trip costs.

- Next, try setting it to "Taken off pay" with "Post-tax" selected.

- Now, when you tap See on payslip, you'll see the expense listed under the heading: "Post-tax withholdings"

- You'll also notice that it's listed below the "Taxes" row.

- The person's worse off, as their pay is having an amount removed, after already having been reduced by taxes.

- The person's had the full amount taken off their pay because it's post-tax.

- Examples of "Post-tax" amounts that are "Taken off pay" include: garnishments, debt repayments, child payments, alimony payments, County Court judgements (CCJs), employee paid insurance or medical premiums, charitable donations, and employee purchased uniforms or equipment.

- Following that, set it to "Added to pay" with "Pre-tax" selected.

- Now, when you tap See on payslip, you'll see the expense listed under the heading: "Pre-tax benefits"

- You'll also notice that it's listed above the "Taxable pay" row.

- The person's worse off, as their pay is having an amount added, which is then about to be reduced by taxes.

- Examples of "Pre-tax" amounts that are "Added to pay" include: bonuses, employer paid retirement contributions, and underpayment corrections.

- Next, set it to "Taken off pay" with "Pre-tax" selected.

- Now, when you tap See on payslip, you'll see the expense listed under the heading: "Pre-tax withholdings"

- You'll also notice that it's listed above the "Taxable pay" row.

- The person's better off, as their pay is having an amount taken off, which hasn't been reduced by taxes yet. It's then paid out towards something that's wanted.

- And finally, examples of "Pre-tax" amounts that are "Taken off pay" include: government approved employee retirement, health, or savings plans. It also includes government approved commuter schemes, and government approved charitable giving schemes.

And that's it! That's everything you need to know about a repeat payable's "added" vs "taken off", and "pre-tax" vs "post-tax" options!