Loans. How do I set up postgraduate loan repayments?

4:21

"Loans. How do I set up postgraduate loan repayments?"

Like student loans, postgraduate loans are a deduction that's automatically taken off a person's pay, and then marked for onward payment to HMRC.

There's two ways to set up a person's postgraduate loan repayments:

- First, when the postgraduate loan repayments are set up by you manually.

- Or second, when it's automatically set up by HMRC through an: "HMRC notice"

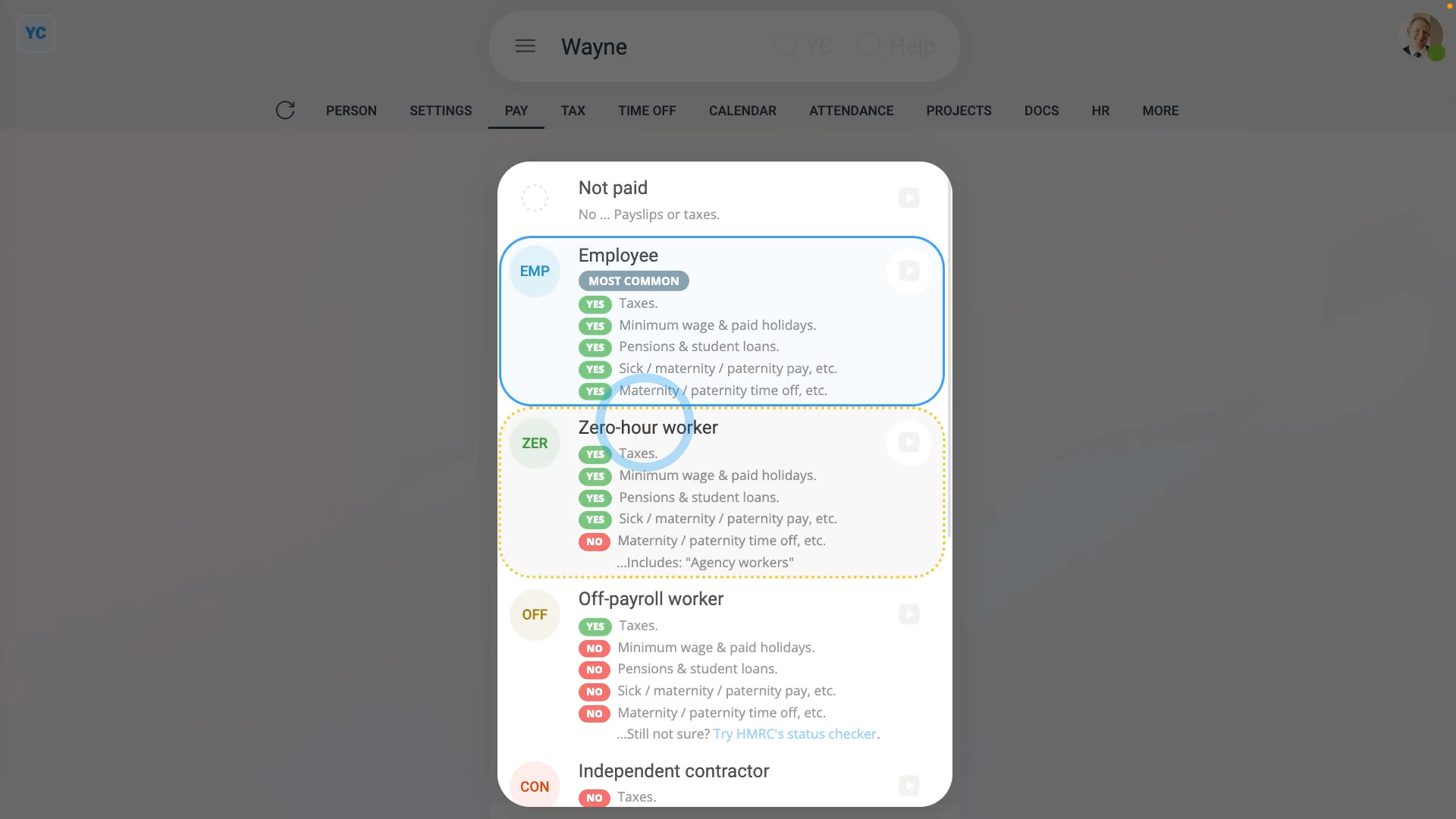

Before starting, it's important to note that postgraduate loan repayments only apply to the employment types of: "Employees" and: "Zero-hour workers"

The first way to add a postgraduate loan repayment ... is manually:

- First, select the person who's getting the postgraduate loan repayment added on: "Menu", then "People"

- And then go to: "Pay", then "Pay settings"

- And scroll down to the "Repeat payables ... personal" heading.

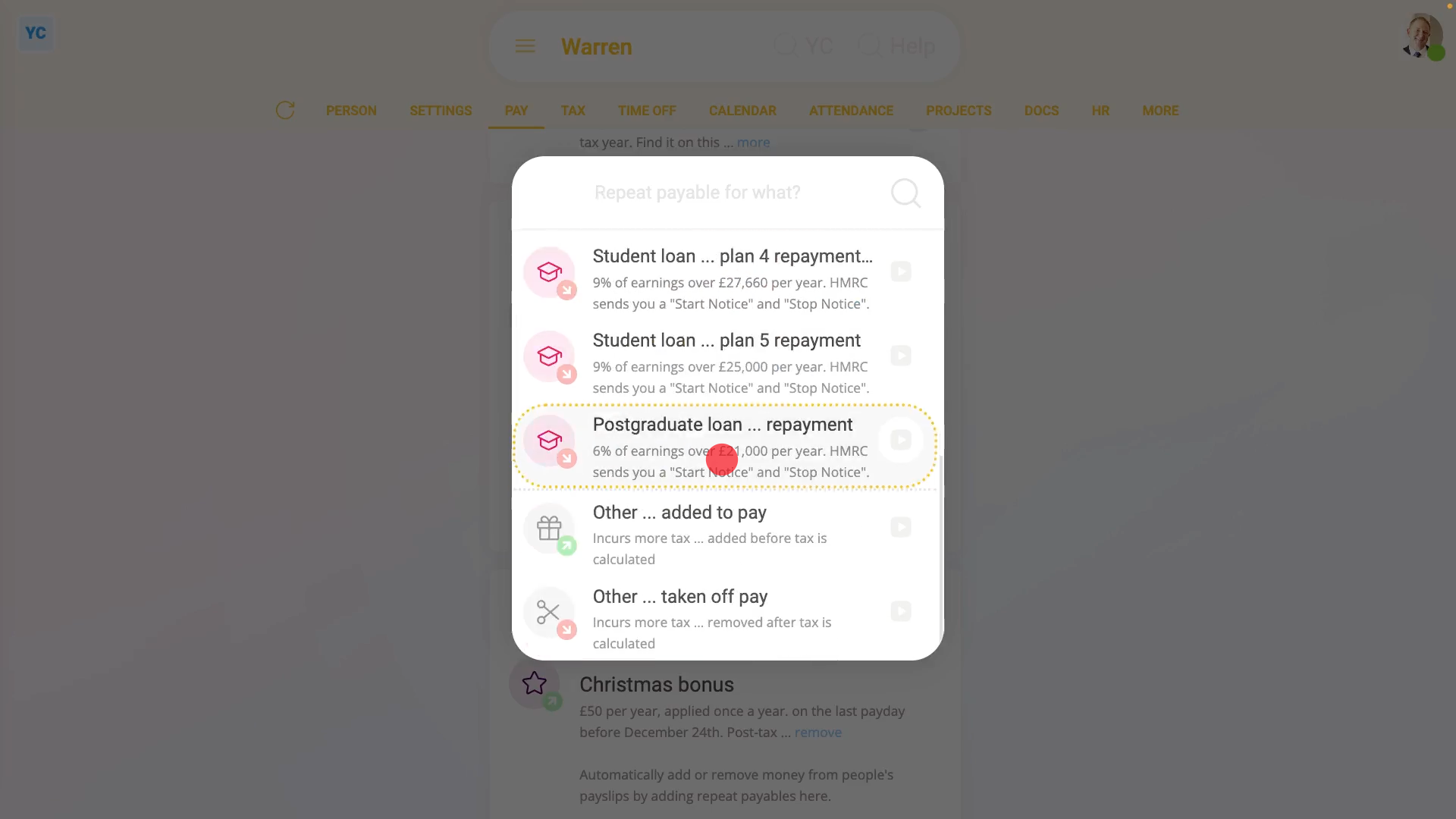

- Then tap: New repeat payable

- Next, select: Postgraduate loan ... repayment

- For 99% of postgraduate loan repayments, all the defaults are now already correct.

- Including the "Payee", which is the bank account that the postgraduate loan repayments are paid to. The payee is automatically set to HMRC and can't be changed.

- You can now tap off, and you'll see that the person's postgraduate loan repayments are all set up.

- If you're curious to see how the postgraduate loan repayments look on the person's payslip, hover your mouse over the postgraduate loan, and tap the "See on payslip" button:

- You'll now see a payslip amount showing under: "Post-tax withholdings"

- And if you hover your mouse over the amount, you'll see a breakdown of the postgraduate loan repayment calculation.

- Also, if a person already has student loan repayments, it's quite normal for them to also have postgraduate loan repayments side-by-side. Having two loans is quite common if the person's gone on to do postgraduate studies.

- And finally, if you scroll up and tap the "Next payslip" circle, you'll see the same amount repeated on every payday, as expected.

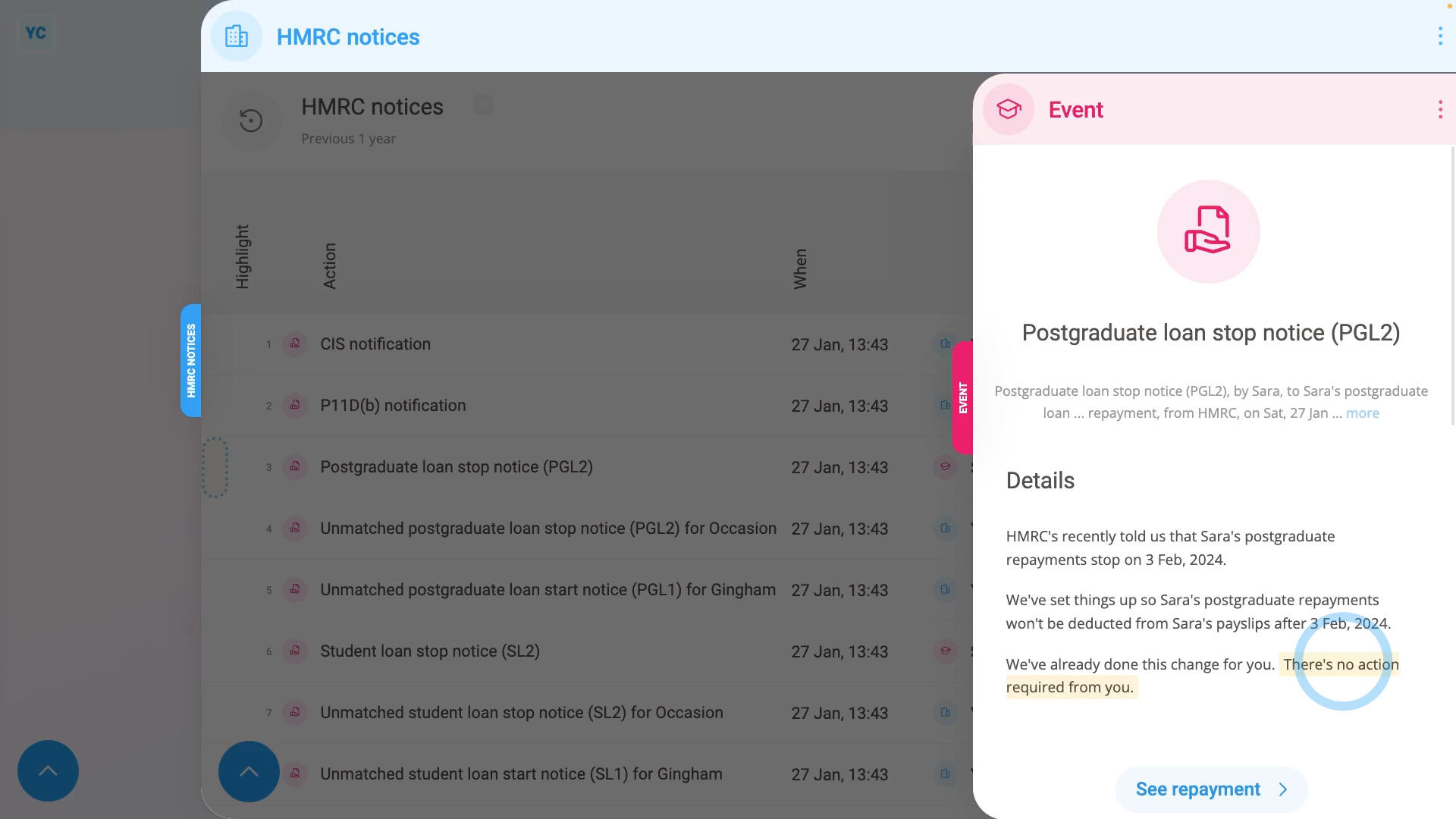

The second way to add a postgraduate loan repayment ... is when it's automatically set up, or modified, by HMRC through an "HMRC notice":

- First, to see the "HMRC notices", select the pay batch on: "Menu", then "Pay batches"

- Then tap: "Forms", then "HMRC notices"

- You'll now see all your pay batch's HMRC notices from over the last year.

- Examples of "HMRC notice" actions include: starting or stopping a postgraduate loan repayment, or modifying the postgraduate loan repayment type.

- To see an HMRC notice's full message, tap the blue "See event" button: (at the start of any row)

- As long as the "HMRC notice" can be matched to a person, the action in the notice is auto-scheduled to be carried out by 1st Money.

- So in most cases: "There's no action required from you."

- Also, for every auto-scheduled change that involves a person, two copies of an HMRC notice are emailed out.

- And finally, one is emailed to the person involved, and the other to the pay batch's payday person, so everyone knows what's happened.

Keep in mind that:

- If the option for postgraduate loan repayments doesn't show up in the list, check that the person's employment type is one of: "Employee" and: "Zero-hour workers"

- Which are the only two employment types that're eligible for postgraduate loans.

- Also, postgraduate loans can only be set up manually because postgraduate loans don't automatically show up as an option during onboarding.

To learn more:

- About "HMRC notices", watch the video on: HMRC notices

- To learn about deleting a postgraduate loan repayment, watch the video on: Deleting a repeat payable

And that's it! That's all you need to do to set up a postgraduate loan repayment!