Repeat payable. 6. How do I understand added vs taken off?

1:39

"Repeat payable. 6. How do I understand added vs taken off?"

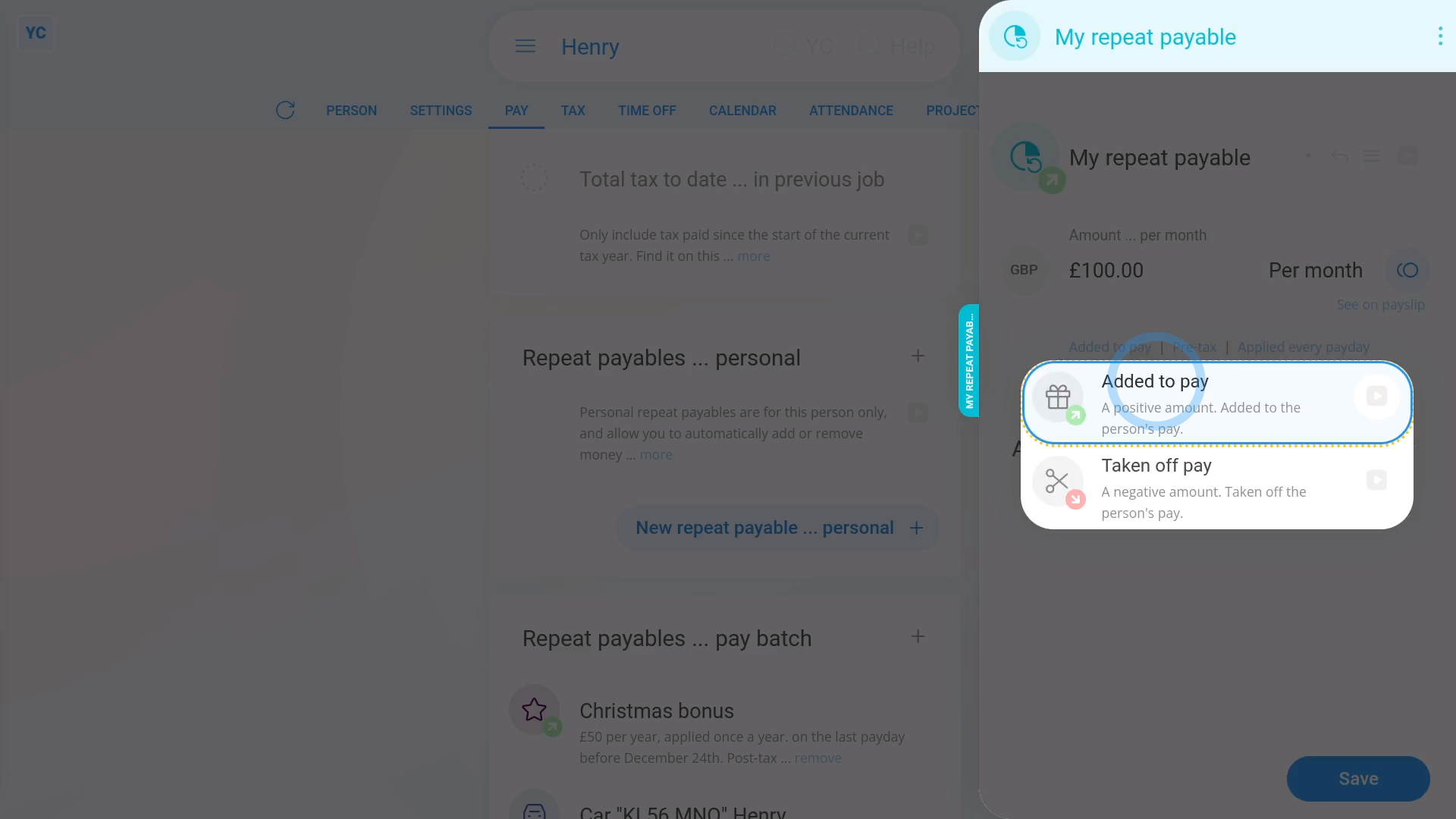

The repeat payable's "added" vs "taken off" options let you control how much a person gets paid every payday, on top of their salary.

To see a repeat payable's "added" vs "taken off" options:

- First, open: "Menu", then "People"

- And then go to: "Pay", then "Pay settings"

- And scroll down to the "Repeat payables ... personal" heading.

- Then tap: New repeat payable

- And select the type.

- And give the repeat payable a name and an amount.

- Then tap the blue "Added to pay" link.

- Now you can select between "Added to pay" vs: "Taken off pay"

- If you select "Added to pay" an amount is added to the person's pay.

- Select "Added to pay" if you're setting up a repeating bonus, or a regularly scheduled payment.

- Once selected, you'll notice a green up arrow (at the top) to remind you that you're adding to their pay.

- If you select "Taken off pay" an amount is deducted from the person's pay.

- Select "Taken off pay" if you're removing an amount every payday, perhaps for paying back an advance.

- And finally, once selected, you'll notice a red down arrow (at the top) to remind you that you're taking money off their pay.

And that's it! That's everything you need to know about a repeat payable's "added" vs "taken off" options!

Repeat payable. 5. How do I set when it's added to a person's payRepeat payable. How's a Christmas bonus or other yearly repeat set