Benefits-in-kind. 5. How do I deduct the co-pay?

1:52

"Benefits-in-kind. 5. How do I deduct the co-pay?"

As part of receiving a benefit-in-kind, in some cases a person agrees to having a co-pay or an amount taken off their pay.

To add a co-pay deduction to a benefit-in-kind:

- First, select the person who's agreed to a co-pay deduction for a benefit-in-kind, on: "Menu", then "People"

- Next, go to: "Pay", then "Pay settings"

- And scroll down to the "Repeat payables" heading.

- And tap the "Benefit-in-kind" that you'd like to add a co-pay deduction to.

- Once it slides out on the right, tap the "Advanced" heading.

- And enter the co-pay, or amount that the person's agreed can be taken off their pay in: "Employee deducted co-pay"

- Then tap: Save

- And you'll now see, in your listing, that the co-pay deduction has been saved.

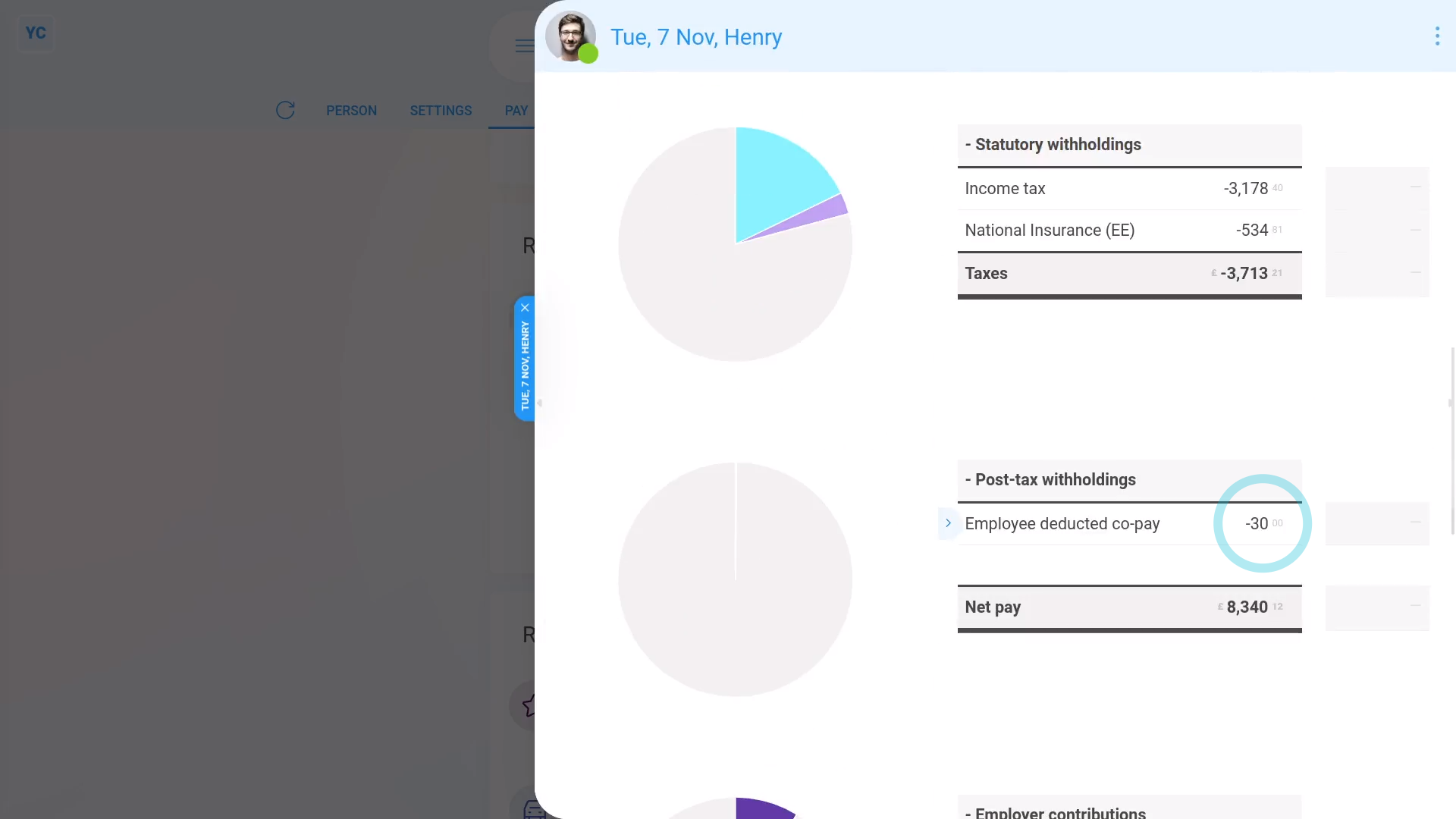

- To see the co-pay deduction on the person's payslip, hover your mouse over the benefit-in-kind, and tap the "See on payslip" button:

- You'll now see the "Employee deducted co-pay" showing under: "Post-tax withholdings"

- And if you hover your mouse over the amount, you'll see a breakdown of the calculation.

- And finally, if you scroll back up to "Benefits-in-kind ... company arranged", you'll also see that the benefit-in-kind has been correctly reduced by the co-pay amount.

Keep in mind that:

- A co-pay deduction can be added to any type of benefit-in-kind.

- Including person or pay batch, and one-time or repeating.

And that's it! That's all you need to do to deduct a co-pay or amount a person's agreed to pay towards a benefit-in-kind!