Repeat payable. How do I set a bank to pay it to, and payroll giving?

2:45

"Repeat payable. How do I set a bank to pay it to, and payroll giving?"

Adding a payee to a repeat payable allows the deducted amount to be onward paid into a bank account.

To create a new repeat payable, and set a new payee to receive any amount taken off:

- First, select the person or pay batch that you're setting the payee for, on: "Menu", then "People"

- Next, go to: "Pay", then "Pay settings"

- And scroll down to the "Repeat payables ... personal" heading.

- Then tap: New repeat payable

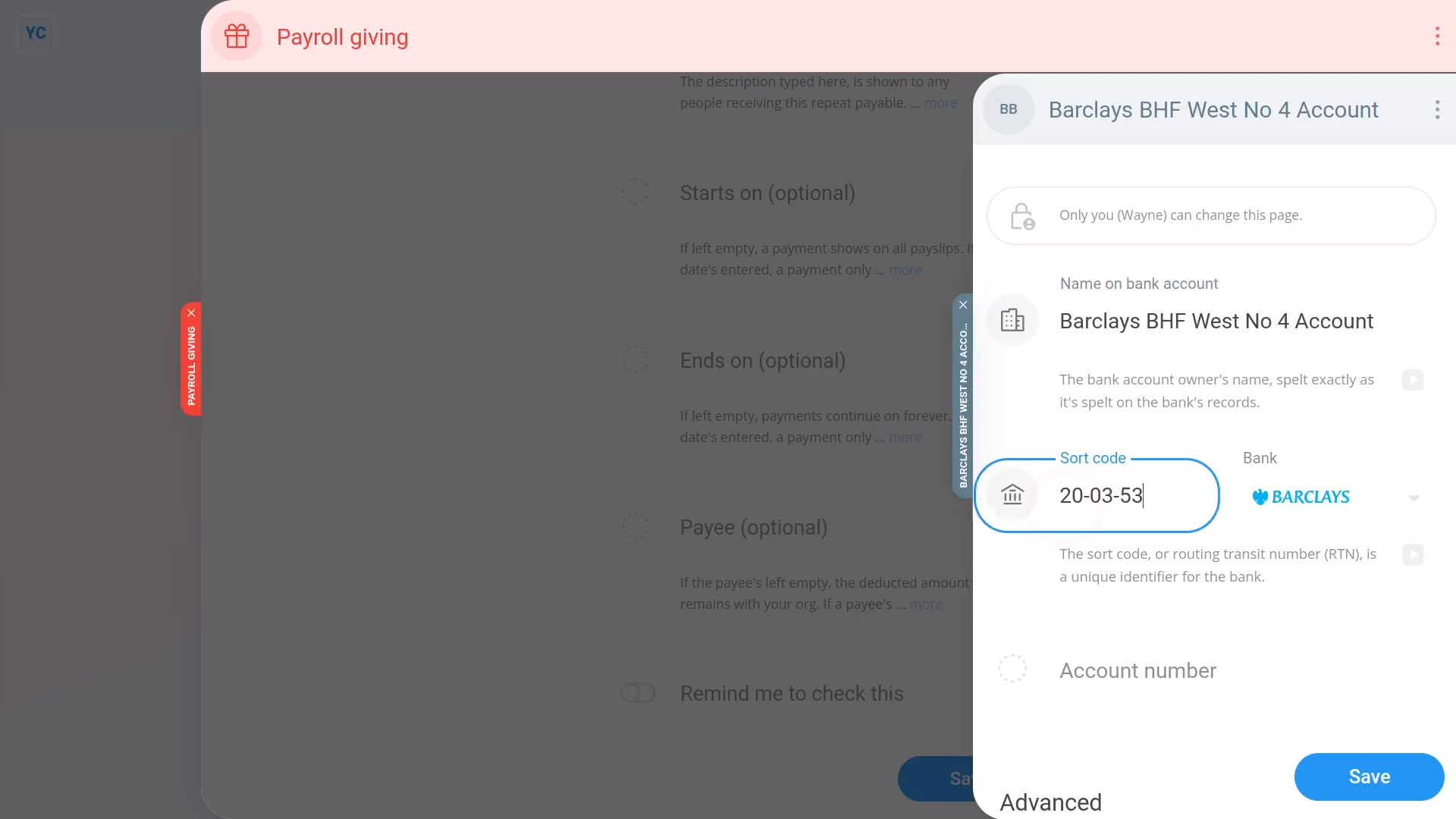

- Next, select either Payroll giving or: Other ... taken off pay

- Type in the amount to be taken off each payday.

- Then tap the "Advanced" heading, and scroll down to: "Payee"

- If the payee that you're looking for isn't in the list, tap New to make a new one.

- Next, type in all the payee's details, including their bank account details.

- Then tap: Save

- And the payee's all set up.

- Now, to see how it shows up on the person's payslip, hover your mouse over the repeat payable, and tap the "See on payslip" button:

- And finally, if you hover your mouse over the amount, you'll see a breakdown of the calculations.

You may notice:

- If you use "Payroll giving", the amount taken off is "Pre-tax". In other words, the person pays less tax by using: "Payroll giving"

- Also, setting a payee is an option that only shows for repeat payables where you take an agreed amount off a person's payslip.

Keep in mind that:

- The payee option is available for both person and pay batch repeat payables where money is taken off.

- Also, if no payee is set, the money is still taken off the person's payslip, but thereafter it stays in the employer's account.

- And with no payee set, the employer is then responsible to onward pay the money manually.

And that's it! That's everything you need to know about setting a bank account to pay agreed salary deductions to!

Repeat payable. How do I add many people and auto-add new peopleRepeat payable. How do I set up a CCJ to be paid out every month