Repeat payable. How do I set up a CCJ to be paid out every month?

5:12

"Repeat payable. How do I set up a CCJ to be paid out every month?"

Monthly repeat payables, or CCJs, are a deduction that's automatically taken off a person's pay every month, and then marked for onward payment.

To set up a monthly repeat payable, or CCJ:

- First, select the person who's getting the monthly repeat payable, or CCJ on: "Menu", then "People"

- And then go to: "Pay", then "Pay settings"

- And scroll down to the "Repeat payables ... personal" heading.

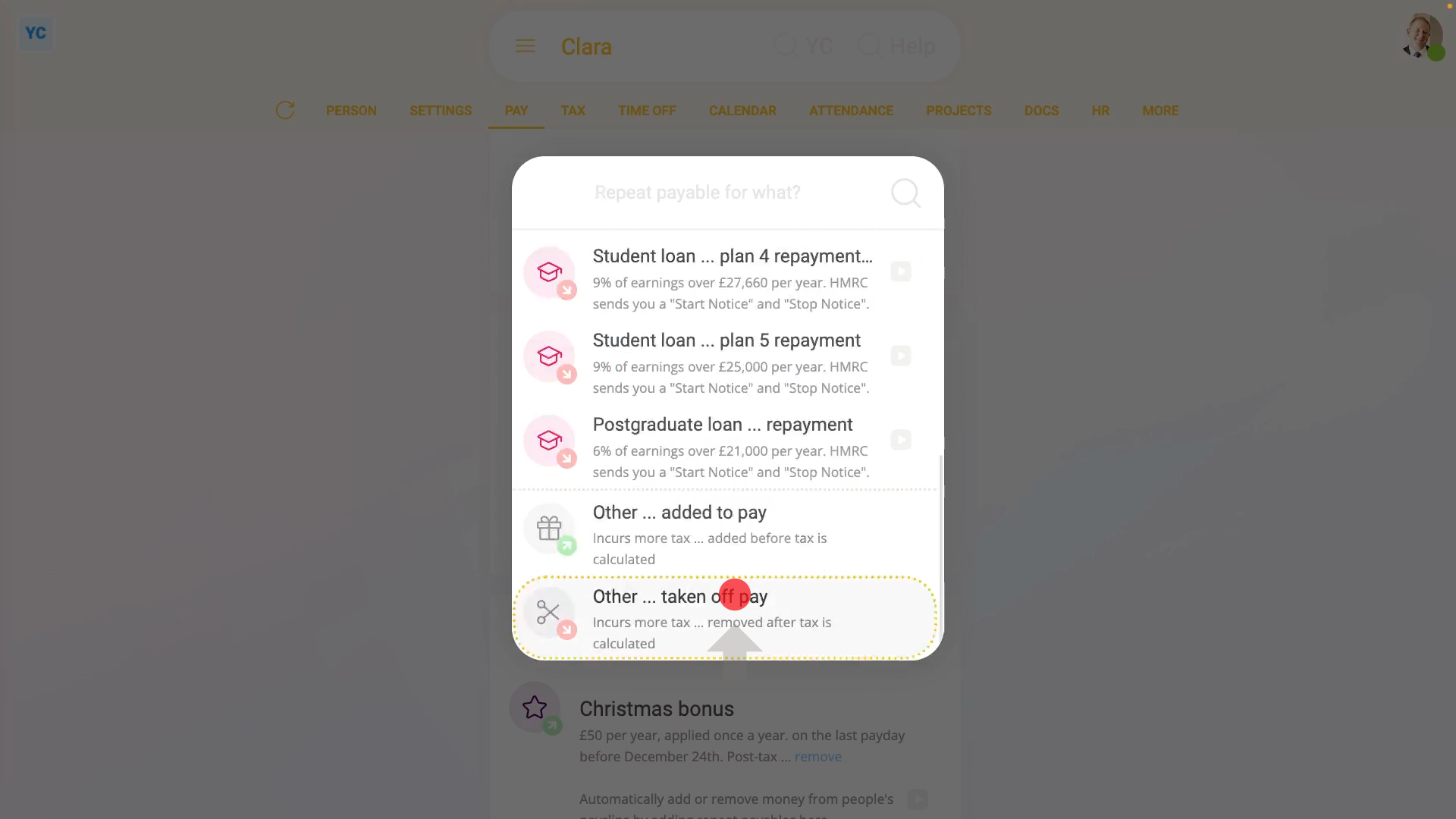

- Then tap: New repeat payable

- And select: Other ... taken off pay

- Next, give the new repeat payable a name.

- And enter the monthly amount payable.

- By default, when calculating the amount, it's set to: "Per month"

- To change it, tap Per month and select your preferred amount time frame.

- Keep in mind that the time frame setting doesn't set how often it's paid, rather it sets over what time frame the amount's calculated.

- For example, if you set the amount to a larger "per year" amount and then set how often it's deducted to "every month ... last payday". It'd then deduct 1/12th of the yearly amount every month.

- Once you've set the amount, you're then free to decide how often it's to be deducted from their pay.

- Now, to see the monthly deduction, tap the "See on payslip" button:

- However, it's recommended to deduct "Every payday" so that the deductions get spread evenly over the person's pay.

- For people that're paid weekly, it now cuts the monthly amount to something close to a 1/4 sized weekly amount. Tap the "See on payslip" button again to see it.

- Now that the deduction amount and frequency are set, tap Advanced to set the remaining options.

- In the description, you can enter notes that are shared with the person.

- Setting "starts on" and "ends on" dates gives you more control over when deductions start and stop.

- In most cases, leave "starts on" as empty, as it automatically starts from today. Then set "ends on" to the date the deduction is to stop.

- In some cases, the Court judgement document may give you a bank account to pay the deduction to. If so, enter those details as a new: "Payee"

- Also be sure to tap Advanced and type in the "Bank reference" from the Court judgement document.

- And also change the "Account type" to "Business", and then tap: Save

- And now the payee for the deduction's all set.

- Now, when you close it, you'll see a summary of the monthly repeat payable, or CCJ, including the description that you entered.

- And finally, to see it on the payslip one last time, tap the "See on payslip" button:

Keep in mind that:

- If a person's paid monthly, you won't see "Per month" listed as an amount time frame, so instead select the "Per payslip" option.

- Also watch out for when a person's paid weekly, but you set it to only deduct from the last payslip of each month. In which case, you may need to tap through a few payslips before you see the deduction.

- In some cases, the CCJ may not supply bank details, or for any other reason, you didn't set the payee. In that case, the amount's still deducted from the person's pay and remains in the company's bank account.

- It's now up to you, as the employer, to make sure the onward payment is made, using whatever payment details the CCJ gave you.

Also remember that:

- A CCJ, or County Court judgement, is where you, as the employer, are issued with a legal notice to deduct pay from a person.

- The deduction is then required to be onward paid to the county court or some other debt collection agency.

- A CCJ enables the court system to collect fines or debt repayments directly from an employee's salary, at source.

- The payment collection is enforced by the law, and can't be refused.

To learn more:

- To learn about a deleting a repeat payable, watch the video on: Deleting a repeat payable

And that's it! That's all you need to do to set up a repeat payable, or CCJ, to be paid out from a person's salary every month!