Expense claims. 4. How do I set it to be paid on a specific date?

2:13

"Expense claims. 4. How do I set it to be paid on a specific date?"

To have an expense claim paid on a specific date, you'll need to add it to a specific payslip of the person.

To add an expense claim to a payslip that's paid on a specific date:

- First, open the person who you'd like to pay the expense claim to, on: "Menu", then "People"

- Then go to the person's: Calendar

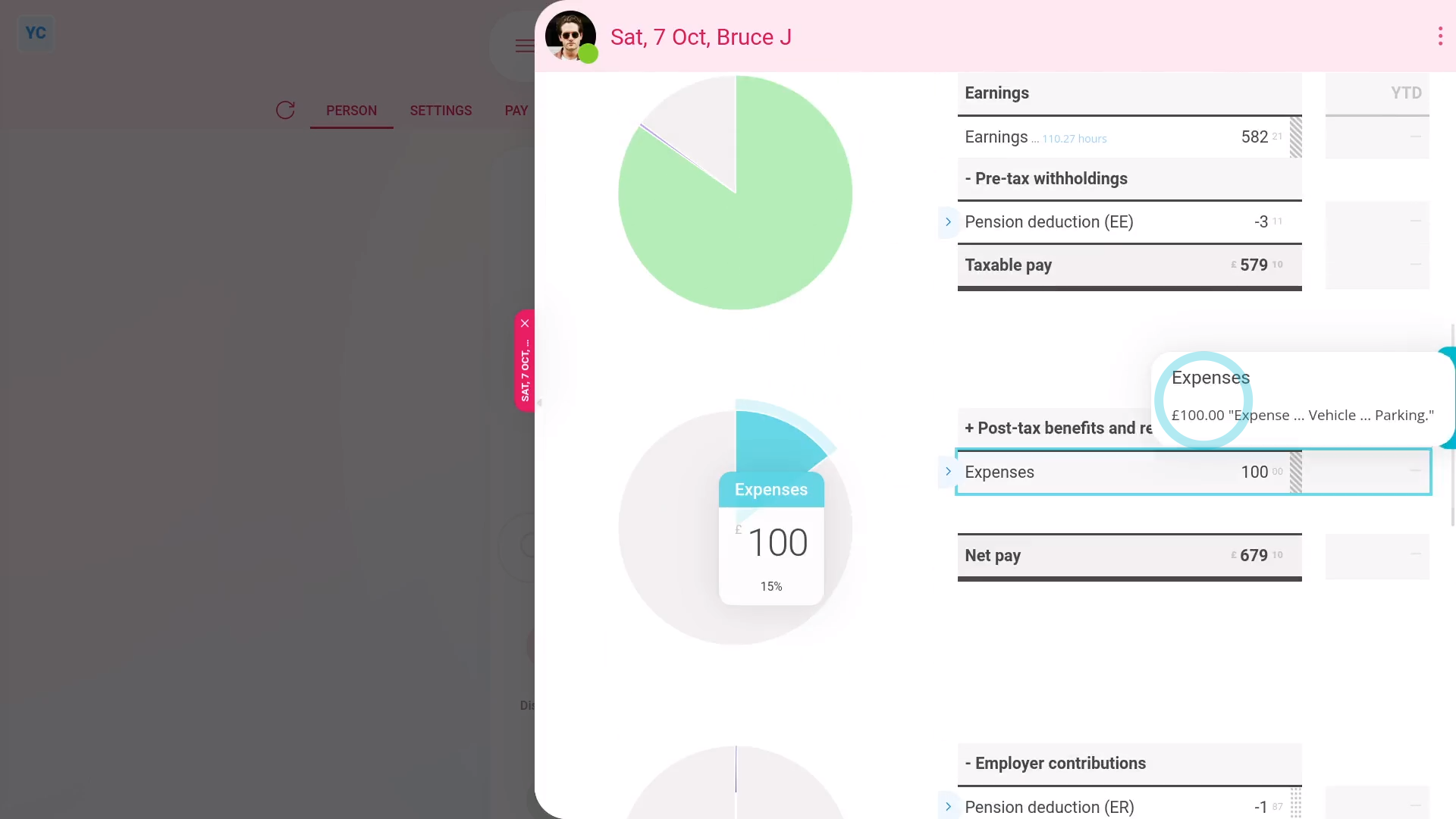

- Tap back through the months and look for the blue circle that matches the payday date. Which is the payslip that you'd like to pay the expense claim on.

- Once you find the payslip you're looking for, tap the blue circle, and then tap: Payslip

- Now that you're on the payslip you want it paid with, tap Expense claim, and select: Expense

- Enter the expense details, like attaching an image, setting the amount, and adding a description.

- And because it's a payroll admin who's entering it, the expense is automatically approved.

- When you tap back to the payslip, and hover your mouse over the "Expenses" amount, you'll see the details.

- And finally, when you scroll to the top of the payslip, you'll see the date that the payslip's expected to be paid.

Keep in mind that:

- Expense claims, by default, are always attached to the next payslip that's due to be filed.

- Which means that expense claims are generally paid relatively quickly.

- Also, any person can attach an expense claim to a specific payslip. No special permissions are required to attach to a specific date.

- However, only payroll admins can approve expense claims.

You may notice:

- If a payslip's already been filed, the payslip's locked and you can't attach your expense claim.

- If it's locked, look for the next un-filed payslip to attach it to instead.

And that's it! That's everything you need to know about adding expense claims on a specific date!